Data Science in Energy: Your Blueprint for a Robust Talent Plan

January 27, 2021

- Home

- Blog

Source: Blue Planet Studio/Shutterstock

Is data the new oil?

Big data has been a major talking point for several years. In 2017, The Economist claimed that data was the new oil and would define industry throughout the 21st century.

We produce over 2.5 quintillion bytes of data each day. This brings an increasing demand to hire data scientists.

More and more companies are looking for talented analysts to process and interpret the data they produce. But what does data science mean in the energy sector? Safety, economy, and connectivity for a start!

Data analytics and machine learning can help the energy industry to:

- Increase safety and prevent accidents.

- Reduce operational costs.

- Optimise production processes.

That is the reason why companies are seeking a more connected workplace.

Technology can be used to predict the maintenance requirements for field equipment, for example. This proactive action enabled by data science reduces downtime and saves money. In terms of safety, many disasters are prevented through better information every year.

Most companies in the energy sector have invested in digital transformation to help them grow their businesses. And there is no way back. Data science, artificial intelligence, and automation are here to stay.

Do you have the data talent in place to stay competitive?

- How is data science transforming energy?

- What data science skills are in demand?

- What is the average salary for a data scientist?

- Recruiting data scientists for your projects

How is data science transforming energy?

All the sectors in the energy and utilities industry benefit from technologies and big data.

Many management advances are in generating novel decision-making insights. For example:

- Utility companies can use data analytics to identify energy consumption and energy saving to manage power outages, figure out peak times and to set energy pricing.

- Oil & Gas firms can use data science to help drive refinery, distribution processes, and adjust to market demands in real time.

- Clean energy companies can use data for smart grid management and regulation. Machine learning algorithms can also be used for weather prediction and maximising efficiency of renewable energy sources such as wind and solar power.

In order to advance their digital transformation, companies must continue investing in talent beyond just technology-related roles, as the demand for skills in data and machine learning is expected to rise.

The Global Energy Talent Index (GETI) report of 2023 recommends that companies offer more flexibility in order to attract a talented workforce.

"With growing skills synergies with outside industries such as technology, the industry can recruit fresh talent but will need to offer more flexible working and support for families and living costs to encourage relocation of existing employees.

What data science skills are in demand?

Data science is a multidisciplinary field that uses scientific methods, processes, algorithms, and systems to extract insights from structured and unstructured data.

Data scientists are skilled in math and statistics, databases and programming languages. Premium data scientists have domain knowledge and understand how businesses work enough to create solutions for it.

They are not just analytical - they can explain the story behind the numbers

Job descriptions for a data scientist often look for experience with:

- Algorithms and data structures.

- Programming languages (e.g. Python, R, SQL).

- Machine learning libraries (e.g. SciKitLearn).

- Data visualisation (using a tool like Tableau/PowerBI or a Python library like MatPlotLib).

- Communication (both written and verbal - to share data findings).

- Domain knowledge (in the energy sector you may see reservoir engineers or geologists transition into data science).

Want more insight into talent trends in the technology industry? Click the link below to download our latest whitepaper.

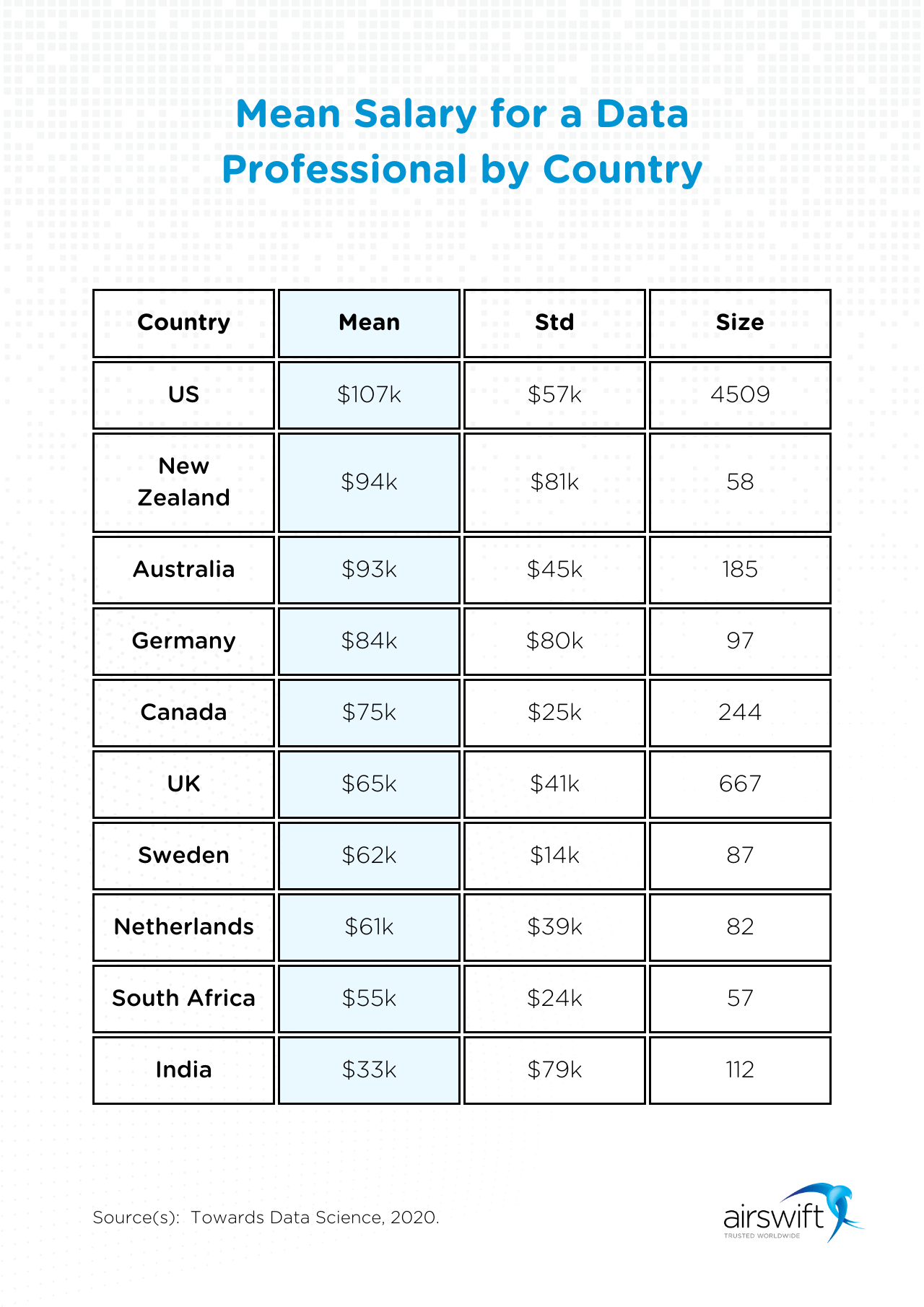

What is the average salary for a data scientist?

Data scientists are in high demand around the world. If you don’t want to be tied down to one country, working as a data scientist can offer you the freedom and flexibility that you are looking for.

According to the U.S. Bureau of Labor Statistics, the average data scientist salary is $100,560 in the USA. But it depends on several factors:

- Experience

- Job title

- Industry

- Company size

- Region

- Education

In their research, Towards Data Science found a wide variation by region and by job roles - with architects and managers paid more than analysts. Possessing a PhD could also lead to 10-20% higher pay.

In the digital sphere, employers and employees are "on the same page" in how they should be adapting to technological change.

The growth of smart grids is causing talent to shift between the power and technology industries. The GETI report of 2023 shows that 24% of respondents are considering leaving the energy industry, with 37% choosing the technology industry as their top alternative.

Outside industries are also seeking professionals from the power workforce. The main reason for leaving is the desire for career progression, with 38% of respondents stating this as their motivation. ESG considerations have dropped to third place, with only 11% citing them as a factor.

Recruiting data scientists for your projects

Digital transformation is now so important that there aren’t enough experts to go around.

The need for data science specialists has grown fast in such a short space of time. It’s becoming exponentially harder to fill roles, train new staff and build a workforce that both understands digital and the unique demands of the energy industry.

“The rise of innovations means many power workers now have the skills to work in industries as diverse as data analytics and finance.”

John L. France, CEO & Managing Partner at Bear

Peak Power

If you are looking for data scientists, Airswift can help you.

We already have access to those networks and will source the best data specialist for your team. With over 60 offices worldwide, 1,000 employees, and 9,000 contractors, Airswift is the agency of choice for world-leading energy businesses. Grow your workforce with us!

This post was written by:

You may also be interested in…

-

Navigating the energy sector: Insights from the 2024 GETI report

-

Brazil is a world leader in renewable energy job creation

-

Why the workforce is pivotal to the energy transition

-

The next Silicon Valley? Emerging US tech hubs disrupting the industry

-

Transferrable skills within the energy sector: challenges and opportunities

-

Building a better grid: The role of tech talent in power reliability

-

Innovative hiring: The benefits of recruiting from outside your sector

-

AI Adoption: 9 industries that are setting the gold standard

-

How can power firms improve their environmental image problem?

-

GETI 2023 webinar: power & nuclear energy sectors