By

Leanna Seah

July 11, 2023

Updated

September 18, 2024

With its rich cultural landscape and international population, Indonesia has become a prominent location for expats seeking new opportunities.

However, due to the unfamiliarity of Indonesian law and its regulations, an ongoing cause for confusion is the tax obligations for non-locals.

If you plan to relocate or are an expatriate new to Indonesian tax regulations, this is for you!

From the types of taxable income to the different tax brackets, this article aims to help readers navigate the Indonesian Tax System.

Here is the list of topics covered in this guide:

- Tax residency criteria

- Taxation rates in the Indonesian tax system

- Taxable income in Indonesia

- The taxpayer registration process

- The tax identification number (NPWP)

- Planning to leave Indonesia? Remember to de-register

- Get support from Airswift

Tax residency criteria

In December 2011, the Indonesian Directorate General of Taxes (DGT) established updated criteria to determine tax residency.

Based on this, tax obligations can be imposed on two separate groups: Individual Taxpayers and Companies. Let’s take a look at the criteria for each of them below:

Individual Taxpayers

- The individual is considered a tax resident if they have lived in Indonesia for over 183 days within 12 months.

- Or has been present in Indonesia for under 183 days within a fiscal year but intends to continue staying there.

- The intention can be displayed when the individual obtains a working visa, work and stay permit or an employment contract that extends beyond 183 days.

Companies

- A company is considered registered in Indonesia if its establishment is based on Indonesian laws or if it is set up in Indonesia.

- A company is considered domiciled in Indonesia if its head office is based in Indonesia, has an administrative or financial headquarter in Indonesia or if members of its management reside in or are domiciled in Indonesia.

If you'd like to learn more about corporate income tax rates, our helpful guide on corporate tax will have everything you need to know. This article will focus on the tax regulations for individual expats in Indonesia.

Taxation rates in the Indonesian tax system

In Indonesia, personal income tax is calculated through what is known as a self-assessment system. This means that resident taxpayers must file their tax returns.

There are plenty of legitimate registered local tax advisors that expats can use to help them navigate the Indonesian taxation system. This guide is a great way to get a head start on understanding the basics surrounding the regulations you may encounter.

Keep in mind that all tax residents are subjected to a Withholding Progressive Tax, a form of income tax that is contributed to the government by the employee of the income recipient.

The progressive rates mean that the higher your income, the bigger the percentage of tax imposed. Tax rates range from five to 35 per cent, depending on the individual's income bracket.

These rates currently fall into four applicable tax bands:

| Tax Band | Annual Income (IDR) | Rate |

| I | Up to 60,000,000 | 5% |

| II | 60,000,000 to 250,000,000 | 15% |

| III | 250,000,000 to 500,000,000 | 25% |

| IV | 500,000,000 to 5,000,000,000 | 30% |

| V | Above 5,000,000,000 | 35% |

Updated October 2023

Taxable income in Indonesia

Practically all forms of income generated by tax residents in Indonesia are considered taxable, and according to Article 4, Chapter 3 of the Personal Income Tax Law, these include:

- Employment income

- Income from the exercise of an independent profession or business

- Passive Income (dividends, royalties, interest and insurance gains)

- Capital gains (from the sale or transfer of property)

- Rent collection and any other income incurred from the use of the property

Conversely, non-residents are subject to a flat rate of 20 per cent withholding tax on their gross income. There are, however, instances in which this rate can be reduced via applicable tax treaty provisions or exempt services that may qualify as business profits.

Additionally, non-residents are only liable to pay personal income tax (PIT) for Indonesian-sourced income, unlike their tax-resident counterparts who are taxed on the income they earn in Indonesia and abroad; Unless there is a Double Taxation Avoidance Agreement between the individual’s country of residence and the Indonesian government.

In such cases, the non-resident taxpayer may not be required to pay any tax in Indonesia or a reduced amount.

Deductions

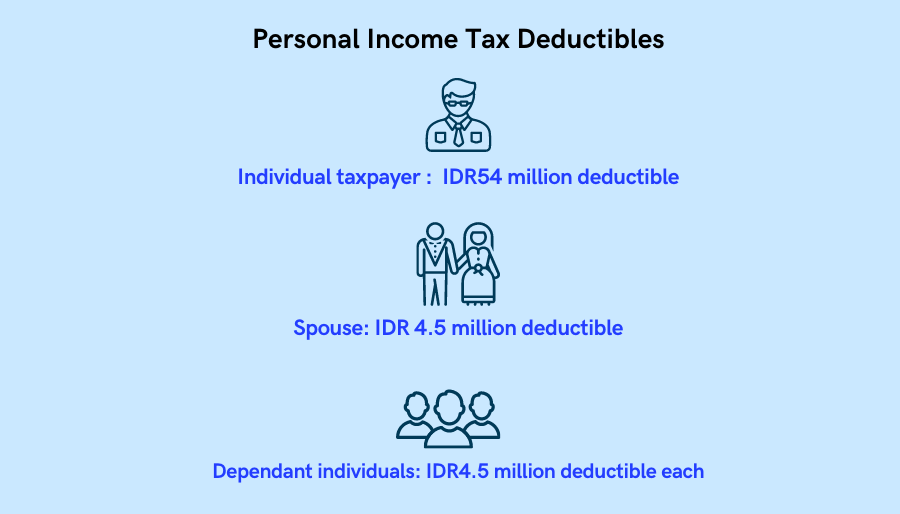

Under some circumstances, individuals may qualify for certain deductibles. The most common ones include individual taxpayers (IDR 54m), spouses and/or dependant individuals (IDR 4.5m).

The taxpayer registration process

Where do I register?

Before you file your taxes, you must register at the Tax Service Office in your city of residence to get your tax identification number (NPWP). For Jakarta expats, you must register at the Tax Office for Foreign Bodies and Expatriates (KPP BADORA).

Taxpayers can employ a representative (such as an accountant) to assist them in registration, but this step is entirely up to you. If you decide to appoint a representative, remember that you will be held legally accountable for any unsettled taxes, so give this responsibility to a reliable and trustworthy source.

What should I have with me?

As part of the registration process, these are the documents you will need to have with you:

- The completed tax registration form

- A copy of all pages of your passport

- A copy of your work permit

- A certificate of domicile for you and your employer

- A copy of your employers NPWP

- Letter of Authorization (only if you send a representative to complete your registration process)

What are my tax obligations in Indonesia?

For residents in Indonesia, there are currently two types of tax returns that they must file:

- Monthly Individual Income Tax

- Annual Individual Income Tax

For individual taxpayers, the monthly tax payment deadline is usually by the 15th of the following month. Monthly submission of all necessary reports should be no later than the 20th of the following month. For annual filing, the deadline is at the end of the 4th month after the tax year ends.

Keep track of important tax payment dates in Indonesia, as late payments may incur interest penalties starting at 2 per cent monthly and can go up to 48 per cent.

The tax identification number (NPWP)

One of the most important things you must do before you file your taxes is to obtain your NPWP* or tax identification number.

All resident individuals in Indonesia are required to have this; the same rule applies to expat residents.

Once you’ve received your NPWP from the tax office, you can pay your monthly income taxes, file annual tax returns, and more. Some other activities that require an NPWP in Indonesia include:

- Obtaining a driver’s license

- Opening a bank account

- Applying for a credit card with a local bank

- Purchasing a vehicle

- Building a house

- Renewing the registration of a vehicle that is above a certain value

- Transferring money from an Indonesian bank account to a foreign account

Penalties for failing to secure your NPWP can be harsh, so remember to do this as quickly as possible, or you may risk imprisonment of up to six years and a maximum fine of up to four times more than the total amount of tax due.

*As of )October 29, 2020, the Government of Indonesia put into effect the Harmonised Tax Law ("Law 7/2021"), which states that the NPWP is replaced with the National Identity Number (NIK) as the new individual Tax ID number

Updates to Taxation Laws (Law No. 7/2021)

- On October 29, 2021, the Government of Indonesia officially promulgated Law No. 7 of 2021 on Harmonization of Tax Regulations ("Law 7/2021").

- The law introduced significant changes to Indonesian tax regulations, including the use of the National Identity Number (NIK) as the new individual Tax ID number, replacing the Tax Identification Number (NPWP).

- Law 7/2021 also brought back the Voluntary Disclosure Program (VDP) for individuals, providing different final income tax rates based on asset declarations and repatriation choices.

- The law updated income tax thresholds, provided relief for micro, small, and medium enterprises (MSMEs), cancelled the planned corporate income tax rate reduction, introduced a gradual VAT rate increment, and included provisions for carbon tax related to carbon trading.

*Information is to date as of October 2023

Planning to leave Indonesia? Remember to de-register

For expatriates who are making plans to leave Indonesia permanently, do remember to cancel your tax registration.

All you need to do is submit an application to the local tax office in your city of residence to schedule an audit of your tax returns history and the supporting documents. Once this is done, your application to de-register should be approved.

Do note that this process can be lengthy and may take up to three years for the audit to complete. You can leave Indonesia during this time, but the government may hold on to several personal documents while they complete the tax audit.

Get support from Airswift

Relocation can be daunting, especially when dealing with the rules and regulations that come with the new surroundings.

This is why working with an Employer of Record service like Airswift is a great way to find support from experts in the field who can help you simplify the process so you can focus on the things that matter.

Contact us today to learn more about what we do and how we can help.