By

Raphael Santos

March 22, 2022

Updated

September 25, 2024

Source: Frame Stock Footage/Shutterstock

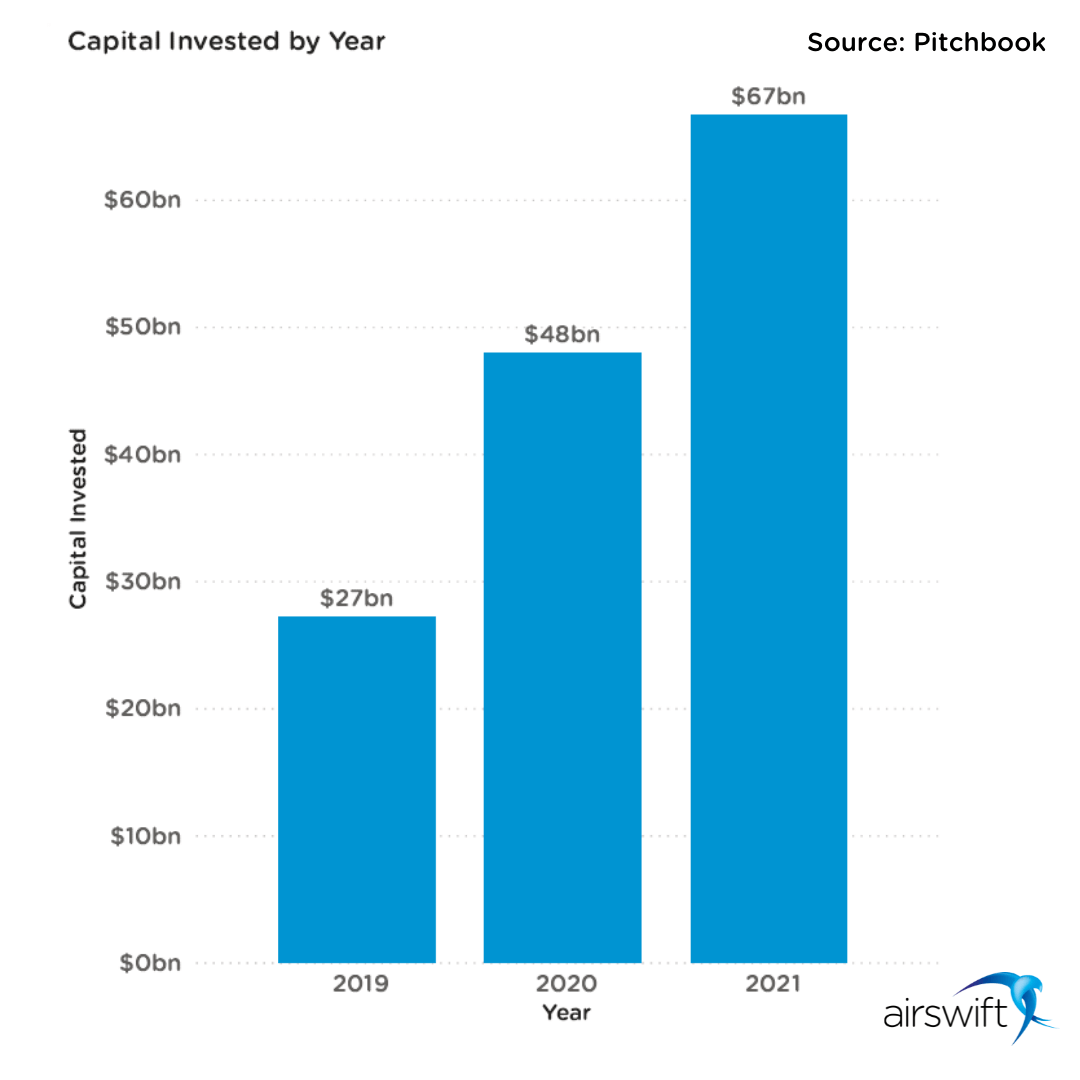

With a Year-over-Year (2020-2021) increase in funding by 39.6%, the biotech market is growing with some trending companies leading the way

The biotechnology market has caused great expectations among investors, workers and consumers. This is partly related to the COVID-19 pandemic, which motivated the acceleration in investments in the sector so commonly characterized by its long-term results.

Biotech industry trends have revolved around diversifying the production of patents and investing a lot of capital early in the life of many companies without expecting short and mid-term results — a typical script regarding the sector that could hold on investors and raise scepticism.

But the fundraising has skyrocketed in the past three years and achieved its momentum in 2021 with a Year-over-Year of 39.6% according to Pitchbook’s records.

The Biotech industry numbers

The last three years showed the ascension of the biotech industry and brings optimism for the maturation of the market that we are seeing today.

Historically, as the sector is closely linked to the R&D model, incomes will be a thing for the future. Something that does not necessarily excite investors. But at the same time, it is an excellent opportunity for those who can wait as it will directly impact the development of society.

In the triennium period, the accumulated increase in investments was 148%. An excellent result that cast aside the shadow in biotech companies and brought them immense visibility.

Many pharmaceutical companies and personalized medicine treatments are no longer unknown to the greater public. Many solo investors and venture capital firms are allocating their resources in this field. It seems that the trend is going to continue more quality and larger investments.

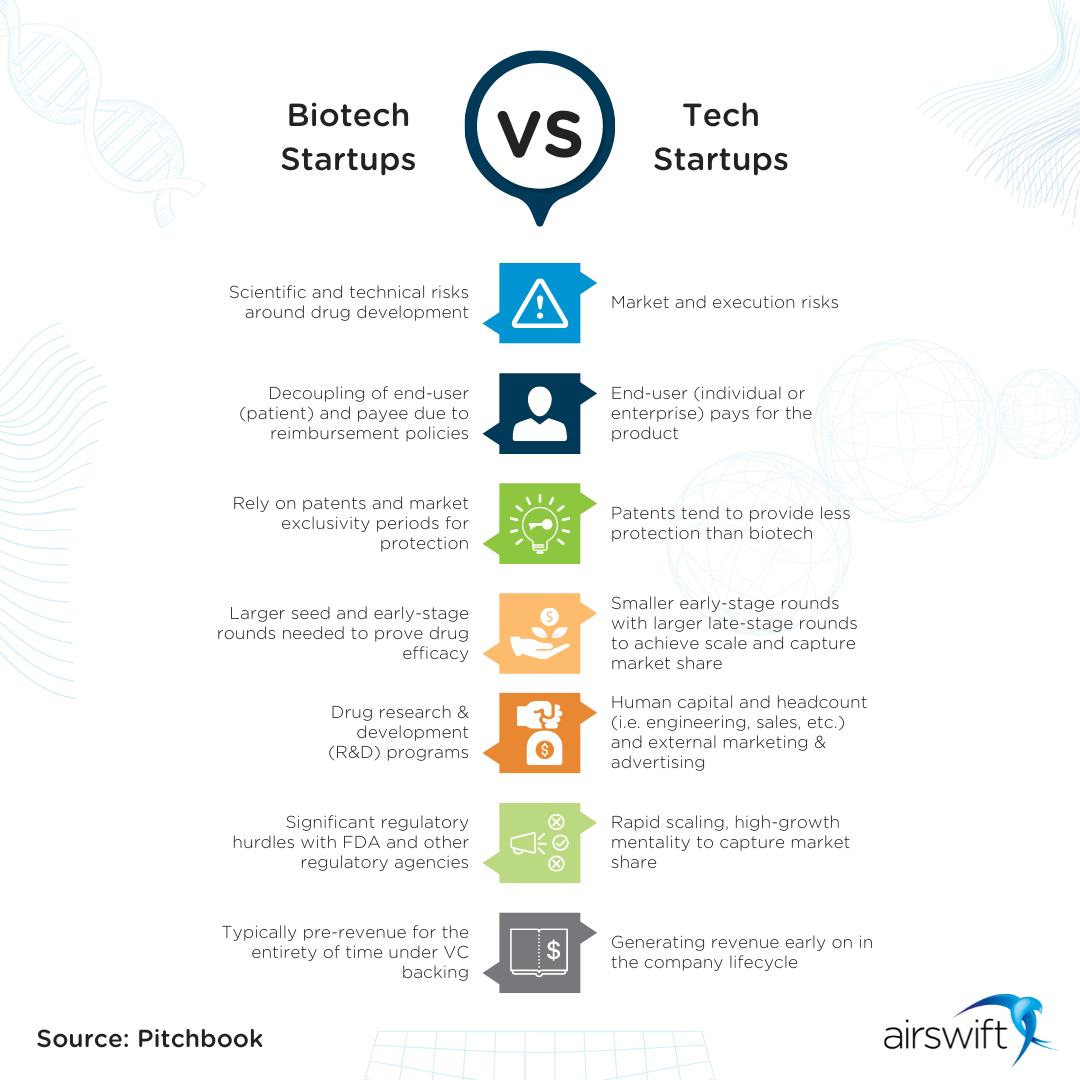

With that in mind, it's crucial to define the limits and understand how the biotech universe differs from the tech universe. And how both markets can learn from each other.

Startup ecosystem: Biotech versus Tech

A singular aspect of biotech that collides with the usual startup methodology is the impossibility of producing a Minimum Viable Product (MVP) in the short-term.

Biotech companies are born with great challenges when seeking large sums of investments. The risks involved are not negligible.

Pharmaceutical companies, for example, need - after researching and developing the drug in question - to organize and fund clinical trials. They must also pass the regulatory approvals of federal agencies such as the US Food & Drug Administration (FDA), in the case of the US.

All of this considerably increases the amount of time it takes for a product to reach the market and start generating revenue.

The graph above provides us with a clear overview of how the differences between biotechnology and technology startups can be distinguished.

Now, it is interesting to note how the characteristics of newly created biotechnology companies attract venture capital investment. This is because the VC investors are the ones who most identify with the proposals of these science startups: they see an incredible capital return opportunity with a moonshot.

Medical Biotech Industry

The biotechnology market more related to the medical area -which has been the most significant part of all investments in the sector- can be divided into two business models.

Drug-centric approach

The drug-centric approach starts from the premise of focusing on a product and developing it. So the patented drug serves as a reference for researching possible diseases that may be treated by it.

Disease-centric approach

The disease-centric approach is the opposite of the method mentioned above. The company starts with the surroundings of a disease and then searches for possible candidate drugs to serve as a treatment.

Many companies even follow a hybrid model that encompasses both methods.

Biotech industry trends

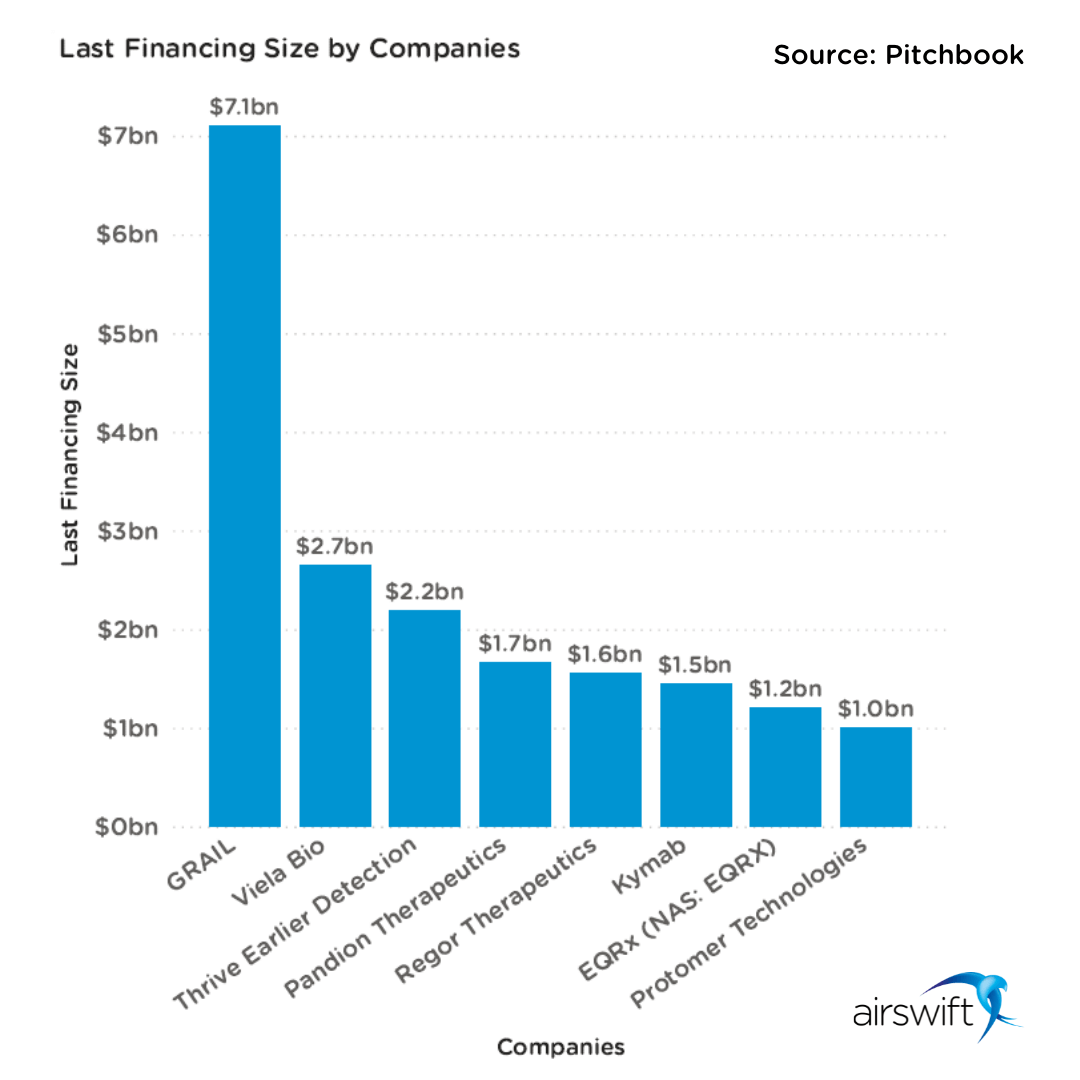

In 2021, the main biotechnology companies that received billions in funding point out the industry's trends.

Diseases treatment and state of the art data science

Usually called digital health companies, these biotech organizations use real-world data analysis and machine learning to diagnose diseases early.

Muti-Cancer Early Detection (MCED)

The Muti-Cancer Early Detection (MCED) blood test method has been developed and used by the company Thrive Earlier Detection as a way to identify different types of cancer in the early stages, including those with no screening methods. Then, the patient could anticipate his cancer treatment.

Thrive Earlier Detection was acquired by Exact Sciences last year for over 2 billion dollars. This certainly sets new goals for the company and its blood-based multi-layer cancer screening test. Thrive's pioneering cancer test, CancerSEEK, is now combined with the entire infrastructure and scalable power of Exact Sciences, making the company virtually the leader in the field of that sort of screening.

Computer-aided drug design

A modern method that has been gaining prominence among academics and major industry players for its cost-effectiveness and agility.

Through patented drug design discovery platforms, companies such as Protomer Technologies and Pandion Therapeutics have attracted the attention of investors and led many paths for the industry's future.

Pandion Therapeutics has TALON (Therapeutic Autoimmune reguLatOry proteiN), while Regor Therapeutics has CARD (Computer Accelerated Rational Discovery).

Padion was acquired by Merck & Co. in a 1.7 billion-dollar deal, which will allow the company to aim for a broader range of autoimmune diseases. On the other side, Regor received 1.6 billion dollars from Eli Lilly; the funding will be used on research and to expand its product pipeline development.

And speaking of Eli Lilly, the drug firm also made another move and acquired Protomer Technologies for 1 billion dollars. Promoter developed a protein-engineering platform to help with the treatment of metabolic diseases.

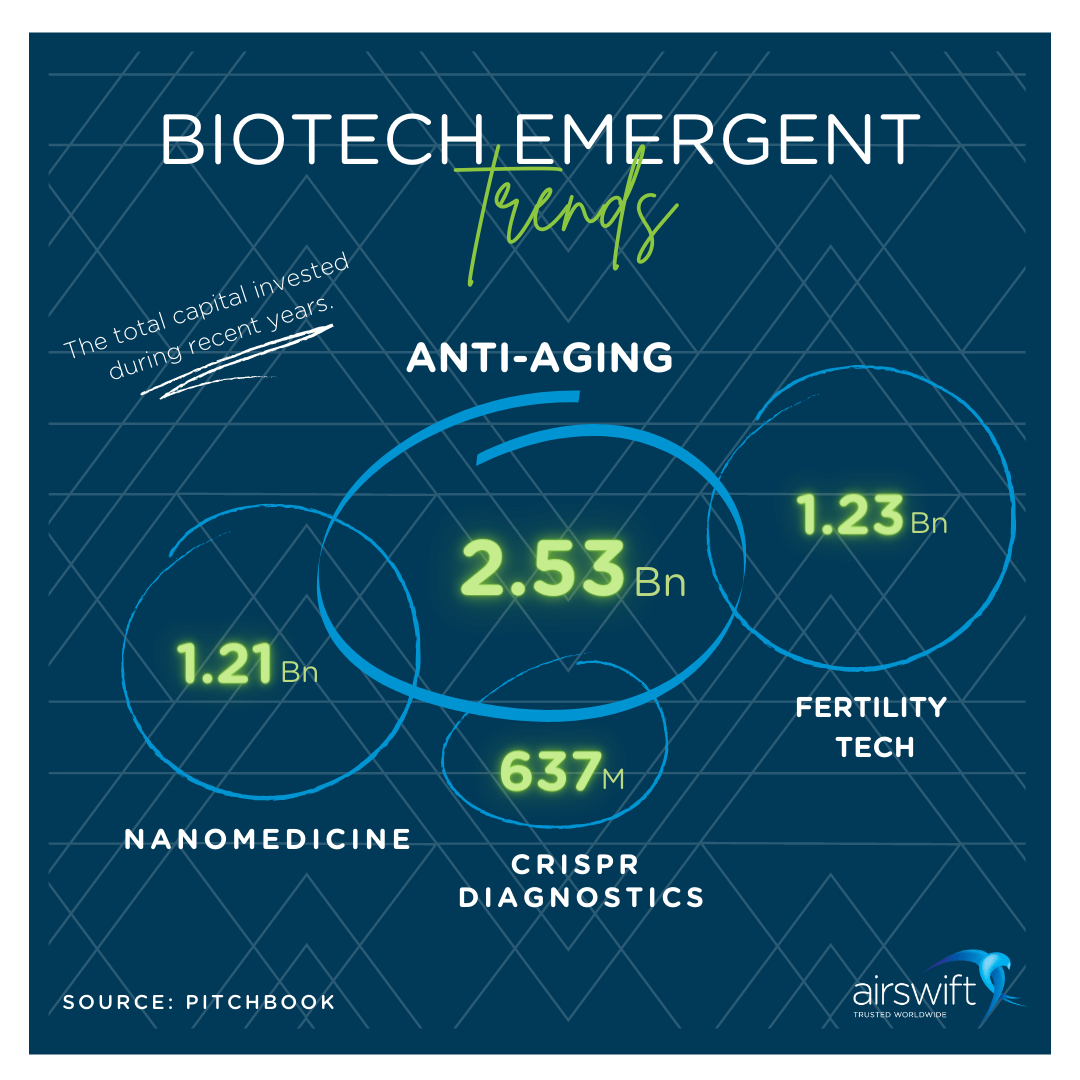

Biotech emerging trends

In addition to the trends that are already well present in today's market, many others are coming strong with impactful investment signs.

Anti-Aging

We saw a preview of the potential of this technology in the field of human augmentation. Even, Jeff Bezos is betting his chips on new technology.

Those Life Science companies are researching medicines to treat the effects of aging on the body. Insilico Medicine is one of the companies that has been attracting attention due to its deep learning technology. The organization uses AI solutions to discover drugs capable of increasing lifespan.

Nanomedicine

As the name implies, nanomedicine is an area of the medical biotech industry known for using nanotechnology to combat numerous diseases. Its innovation is capable of allowing the detection of many disorders in their early stages, in addition to enabling the next level of drugs, such as new vaccines.

CRISPR Diagnostics

A gene editing tool (CRISPR) that comes with the expectation of making diagnostic results faster and more affordable. As an alternative to those on the market today, this new technique can allow tests to be performed efficiently in the patient's own home, including the detection of COVID-19.

We can elect two trending companies in this area: Mammoth Biosciences (2017) and Sherlock Biosciences (2019), both recently founded and already raising the hype around healthtechs with their molecular diagnostics platforms.

Fertility Tech

Source: Frame Stock Footage/Shutterstock

Source: Frame Stock Footage/Shutterstock

According to the Centers for Disease Control and Prevention, women who have fertility problems represent only 10% in the US. With this in mind, we see that fertility techs usually meet the demand of another type of situation: couples who decide to postpone the generation of children.

Global fertility services include data to monitor hormones and thus provide truly dense clinical information that will help in more effective treatments.

The main challenge: talent

One thing that has been risking the rise of new biotech industry trends is the lack of talent. We're talking about an industry characterized by hard-science developments, many of which require critical, visionary knowledge and proven experience.

The common theme in the market is how unpredictable biotechnology technologies are. This generates a greater capacity for demands on workers in anticipating solutions and working with innovative ones. It isn't easy to predict what skills will be in-demand in the industry; the industry itself does not yet know, it can only based on educated guesses. This is perhaps what makes biotechnology most unique.

Source: Frame Stock Footage/Shutterstock

Source: Frame Stock Footage/Shutterstock

To forecast science is not that simple, which is a big challenge. It is one of the reasons why numerous partnerships are made between biotech companies and universities; and how development programs have been very successful among healthtech teams.

It is not uncommon to see life sciences companies using simulators to design an environment for action planning and critical analysis, as is familiar to see in companies such as NASA with its pilot training.

Outsourcing is the way to grow

With the talent shortage, now a reality that can suppress many biotech industry trends, new solutions are been discussed.

Many clusters are experiencing fierce competition regionally. There are more job postings than candidates prepared to fill them, so workers are shifting between companies in the same hub, making retention a challenge.

The answer lies in the flexibility allowed by remote work to escape this problem. Consequently, this still leads to the big question involving hiring these remote talents in other markets. But with outsourcing, the obstacles no longer remain an issue to acquiring talent abroad.

That's why you need to partner with a workforce solutions organization. And here, at Airswift, we got the solution you need. With over 60 offices and 9,000 contractors, our company has the best Global Employment and Mobility team to customise solutions based on your needs demand and help you expand your operations with the world's best talent.

The practice of outsourcing in industries such as biotech is the best cost-benefit for your organization.

Want more insight into talent trends in the technology industry? Click the link below to download our latest whitepaper.