By

Diyaa Mani

March 21, 2023

Updated

September 18, 2024

Misclassification matters: Legal risks and repercussions

The COVID-19 pandemic has significantly impacted businesses and the economy, leading many companies to implement cost-cutting measures to stay afloat. While this is necessary in some cases, it is important for companies to do so responsibly and lawfully. One area where companies should exercise caution is in the misclassification of employees.

Some employers may be tempted to misclassify employees as independent contractors to reduce labour costs intentionally. However, this practice is illegal and can have serious consequences for the employer, including fines, legal penalties, and damage to the company's reputation.

In a post-COVID-19 world, companies should prioritise compliance with labour laws and ethical practices, even as they work to reduce costs and secure their financial future. Misclassifying employees as independent contractors may offer short-term savings, but it is not a fair or sustainable business model.

What is employee misclassification?

It is when an employer or a business entity misclassifies a worker as an independent contractor instead of an employee to avoid responsibilities and obligations to the worker, such as paying payroll taxes, providing benefits, and complying with labour laws.

This misclassification is often done to reduce labour costs and avoid paying employee benefits and protections legally required. However, this puts the worker at a disadvantage because they are not entitled to the same rights and protections as employees, such as minimum wage, overtime pay, workers' compensation, and unemployment insurance.

The worker is also not eligible for job-protected leave and may not receive protection under labour and employment laws, such as anti-discrimination laws, family and medical leave laws, and health and safety regulations.

Sometimes, the worker may not be aware that they have been misclassified and believe they are working as independent contractors. However, it is the employer’s responsibility to classify workers accurately; if a worker is misclassified, they may be able to take legal action to correct the situation.

What is an independent contractor?

An independent contractor is an independent worker or a company that provides services to another person or company, usually on a project basis. These independent professionals are in business for themselves and are not employees of the company they provide services to.

Independent contractors, like gig workers/freelancers, are typically engaged to perform specific tasks or projects and usually work on their terms and conditions without the direction and control of the company they provide services to. They are usually paid for their services on a fee basis and are responsible for their taxes, insurance, and other business-related expenses.

What is an employee?

An employee is a person who works for another person or a company and is employed by that person or company. Employees are under the direction and control of the company they work for and receive a salary or an hourly wage in exchange for their services.

Employees are entitled to rights and protections under the law, such as minimum wage, overtime pay, workers' compensation, unemployment insurance, and the right to a safe and healthy work environment. They may also be eligible for benefits such as health insurance, paid time off, and retirement benefits, depending on the terms of their employment.

Employees are considered "at-will" or "for cause", depending on the terms of their employment agreement. "At-will" employees can be terminated at any time by the employer, while "for-cause" employees can only be terminated for specific reasons outlined in their employment agreement.

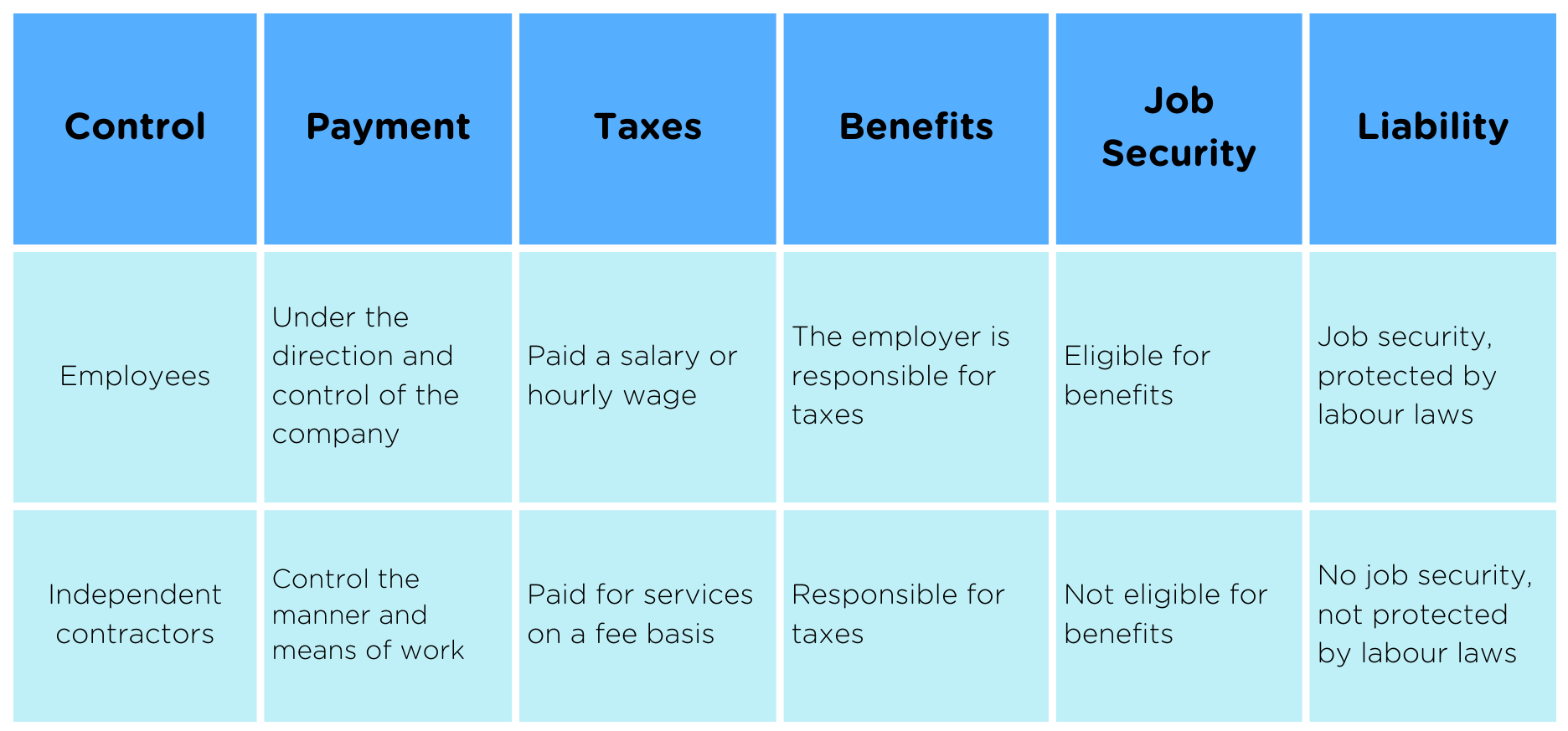

***It is important to note that there is a distinction between employees and independent contractors, which can have significant legal implications, especially concerning taxes, benefits, and liability. Employers must accurately classify workers as either employees or independent contractors, and failure to do so can result in legal consequences.

What is the difference between an employee and an independent contractor?

The difference between an employee and an independent contractor lies in the nature of the employment relationship between the worker and the company they provide services to. The following are some of the key differences between employees and independent contractors:

What are the legal repercussions of misclassification?

Employee misclassification can have serious legal repercussions at a federal level for the employer and the worker. Some of the most common legal consequences of employee misclassification include the following:

- Tax implications: When an employee is misclassified as an independent contractor, the employer may not withhold and pay the employer's portion of taxes, such as Social Security taxes, and the worker may not be paying their income taxes - which can lead to criminal penalties like tax fraud. This can result in tax liability for both the employer and the worker. Rampant cases like these can cause a country to lose out on tax revenue - leading to a recession, in which case, everyone loses out.

- Labour law violations: When an employee is misclassified, they may not be protected by labour and employment laws establishing a minimum wage and overtime pay standards and the Occupational Safety and Health Act (OSHA), which requires employers to provide a safe and healthy work environment.

- Benefits violations: Employees who are misclassified may not be eligible for legal protections and benefits such as health insurance, paid time off, compensation coverage, and retirement benefits, typically provided to employees.

- Unemployment insurance violations: Employers may not contribute to unemployment benefits for employees misclassified as independent contractors.

- Litigation: Employees who have been misclassified may file a class action lawsuit against their employer for violating labour and employment laws. The employer may face significant financial penalties and legal fees.

If there are legal repercussions, why do some employers still misclassify workers?

Despite the legal repercussions, some unscrupulous employers still conduct deliberate misclassification of full-time employees as independent contractors for several reasons, including:

- Lack of awareness: Some employers may not be aware of the laws and regulations surrounding employee classification and may inadvertently misclassify workers.

- Cost savings: Misclassifying employees as independent contractors can help companies reduce labour costs, as they are not responsible for paying certain benefits and taxes.

- Convenience: Hiring independent contractors can be more flexible and convenient for employers, as they do not have to provide benefits or comply with certain labour laws.

- Ignorance of the consequences: Some employers may not fully understand the consequences of misclassifying employees and may believe they can get away with it.

Employers must understand that the risks and consequences of misclassifying employees far outweigh any potential cost savings. Misclassifying employees can lead to legal disputes, fines, and damage to the company's reputation, putting the business at risk. This makes it important for employers to classify their workers accurately and fairly.

What actions can misclassified workers take?

If you believe that your employer has misclassified you as an independent contractor instead of an employee, there are several steps you can take to address the situation:

- Review your employment contract and other relevant documents: Review any written agreements or contracts you have signed with your employer to determine if they accurately reflect your working relationship and clearly state the definition of employment terms for your job.

- Gather evidence: Document your work schedule, responsibilities, and your employer’s level of control over your work. This information will help you demonstrate your employment status as an employee, not an independent contractor.

- Contact a labour law attorney: An experienced employment attorney can advise you on your rights and options and help you determine the best action to take.

- File a complaint with the local Department of Labour: You can file a complaint if you believe your employer has misclassified you and violated federal labour laws. The department or other relevant government agencies will investigate your complaint and take enforcement action if necessary.

- Consider a private lawsuit: If you have been misclassified, you may be entitled to back pay, overtime pay, benefits, and other damages. You may file a private civil action lawsuit against your employer to recover these damages.

Acting quickly if you believe you have been misclassified is important, as there may be strict time limits for taking legal action. An experienced labour law attorney can advise you on the best course of action to take based on the specific facts of your situation. Millions of workers have been in such situations - but worker advocates are familiar with cases of worker misclassification and are the best source of legal advice.

How do I avoid employee misclassification?

To avoid the risk of misclassification, employers should consider the following steps:

Review the worker's job duties and responsibilities: Determine the level of control the employer has over the worker’s duties, hours, and how the work is performed. If the employer has high control over these factors, the worker is likely an employee, not an independent contractor.

Consider the economic realities test: The economic realities test is a multi-factor test used to determine whether a worker is a full-time employee or an independent contractor. Factors considered in this test include the degree of control the employer has over the worker, the worker's opportunity for profit or loss, and the permanency of the relationship.

Use a written agreement: A written agreement can help clarify the working relationship between the employer and the worker and provide evidence in case of a legal dispute.

Check state and federal laws: Different states and federal agencies have different tests for determining whether a worker is an employee or an independent contractor. Employers should check both state and federal laws to ensure compliance.

Consult with an attorney: An experienced employment law attorney can provide guidance on classifying workers correctly and help the employer avoid potential legal problems.

It is important for employers to accurately classify workers as employees or independent contractors, as misclassification can have serious legal and financial consequences. Employers should take proactive steps to avoid misclassification and seek legal advice if they are unsure about the classification of a worker.

How can an Employer of Record help my company avoid employee misclassification

An Employer of Record (EOR) is a third-party service that acts as the official employer for a company's workers, taking on the responsibilities of payroll, taxes, and benefits. An EOR can help a company avoid employee misclassification by providing the following services:

- Classifying workers correctly: An EOR is experienced in the laws and regulations surrounding worker classification and can help a company accurately classify its workers as employees or independent contractors.

- Handling payroll and taxes: An EOR will handle the payroll and tax responsibilities for the company, ensuring that all required taxes are withheld and paid, reducing the risk of employee misclassification.

- Providing benefits: An EOR can offer benefits such as health insurance, paid time off, and retirement benefits to the company's workers, helping to ensure that workers are classified as employees and not independent contractors.

- Minimising legal and financial risks: An EOR takes on legal and financial responsibilities for the company's workers, reducing the risk of legal action and financial liability for the company.

By using an EOR, companies can minimise the risk of employee misclassification, freeing them up to focus on their core business activities.

Get in touch with us to learn more about how an Employer of Record can benefit your organisation.