By

Raphael Santos

February 25, 2022

Updated

September 12, 2023

Source: Frame Stock Footage/Shutterstock

By the end of Q4 2021, venture investors raised $97.7 billion into mobility tech startups, and autonomous vehicles are a crucial part of that funding

- What is mobility tech?

- Why are Autonomous Vehicles the hotspot for VC?

- Top VC-backed companies

- Top VC Investors and deal sizes

- What are the challenges for companies and investors?

- We can help you within the mobility tech sector

The $97.7 billion total is an industry record that deserves a closer look as it represents up 81.9% YoY (Year-over-Year). In 2021, despite the pandemic crisis, investments showed a strong demand for electric vehicles and government initiatives to decarbonise its national fleet.

Now, it's a good time for us to see what is going on between venture capital investors and the mobility tech segment.

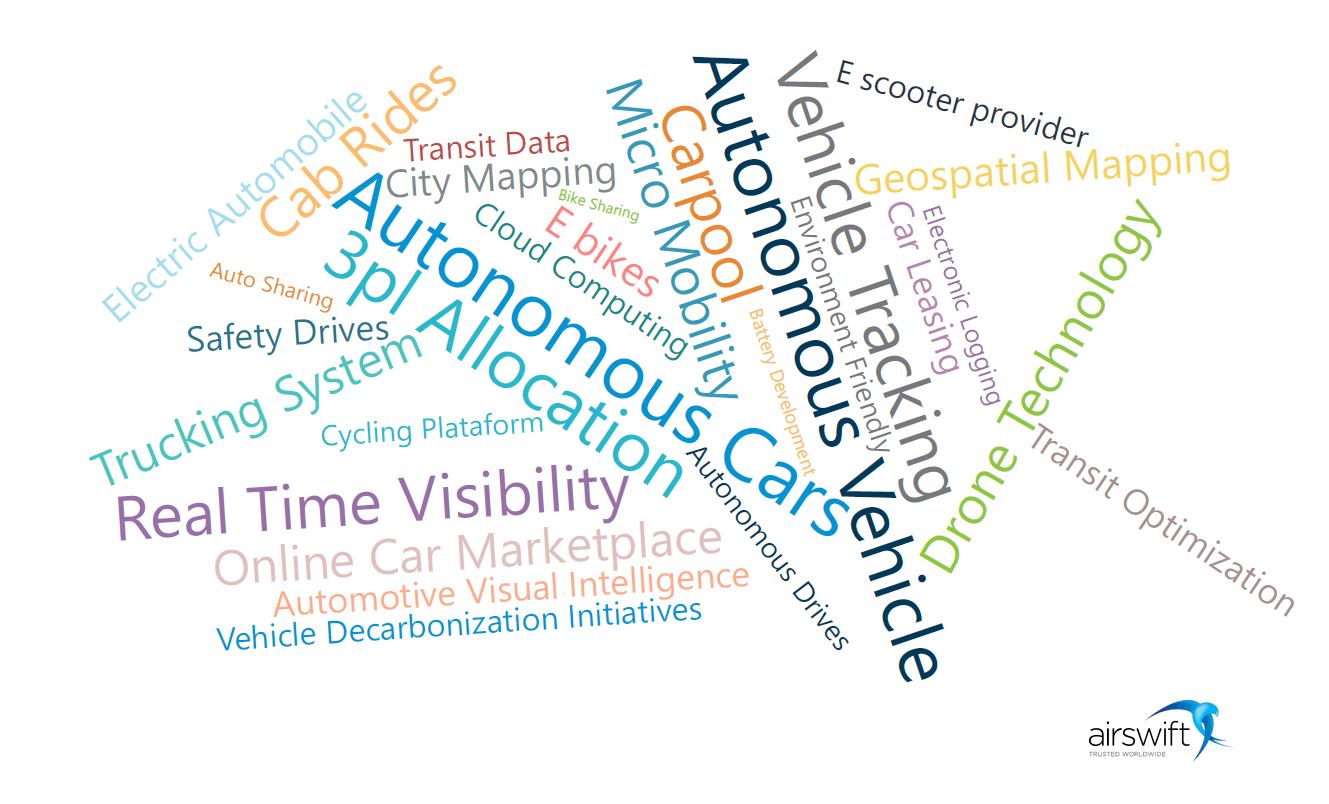

What is mobility tech?

The mobility tech sector is characterized by technological solutions that impact the entire mobility industry — ranging from artificial intelligence to minimize traffic accidents to engineering initiatives that ensure lower environmental impact. Environment-friendly transportation, e-bikes, micro-mobility, vehicle decarbonization initiatives and many more solutions are what you will see in this fascinating sustainable industry.

Why are Autonomous Vehicles the hotspot for VC?

Autonomous vehicles are one of those industry verticals responsible for paving the way in previous quarters to the high investment now offered and then breaking records in 2021.

It is already possible to observe significant advances in fully autonomous driving. An excellent example was what happened with the partnership between Gatik and Walmart.

In August of this year, Gatik launched a fleet of driverless box trucks that Walmart used to transport customer orders multiple times during a route in Arkansas. This is undoubtedly a big step for the supply chain's future.

Gatik's solution brought together full automation and road safety at once. It was the first time we could see this happen on a commercial route and the middle mile. For sure, this brings optimism to upcoming initiatives across the autonomous driving industry.

Goodyear Ventures led Gatik's latest investment. According to Pitchbook, the Venture Capital firm raised $85 million on a Series B (1st July 2021).

And there is more to come yet; the autonomous vehicle sector has a lot to show in that venture capital scenario. Let's delve deep into it!

Top VC-backed companies

Billions

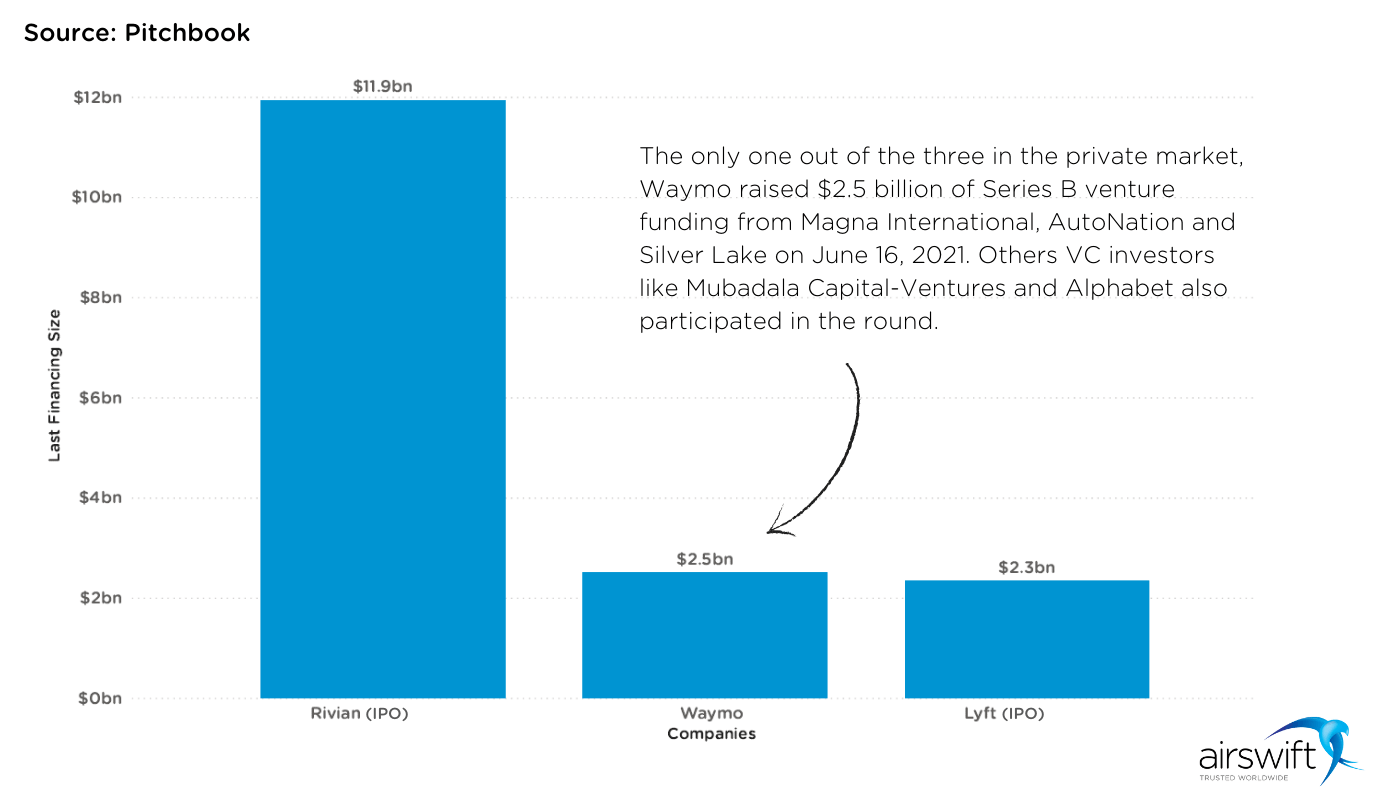

In the last year, we saw the autonomous vehicle sector performing exceptionally well. And all thanks to the optimism of VC investors who shook the market with rounds of investments having very high figures.

Three companies managed to raise more than one billion in investments. Rivian and Lyft, after years of being funded by VC investors, finally made their debuts in the stock market. Waymo, on the other hand, had a very successful Series B venture funding.

Millions

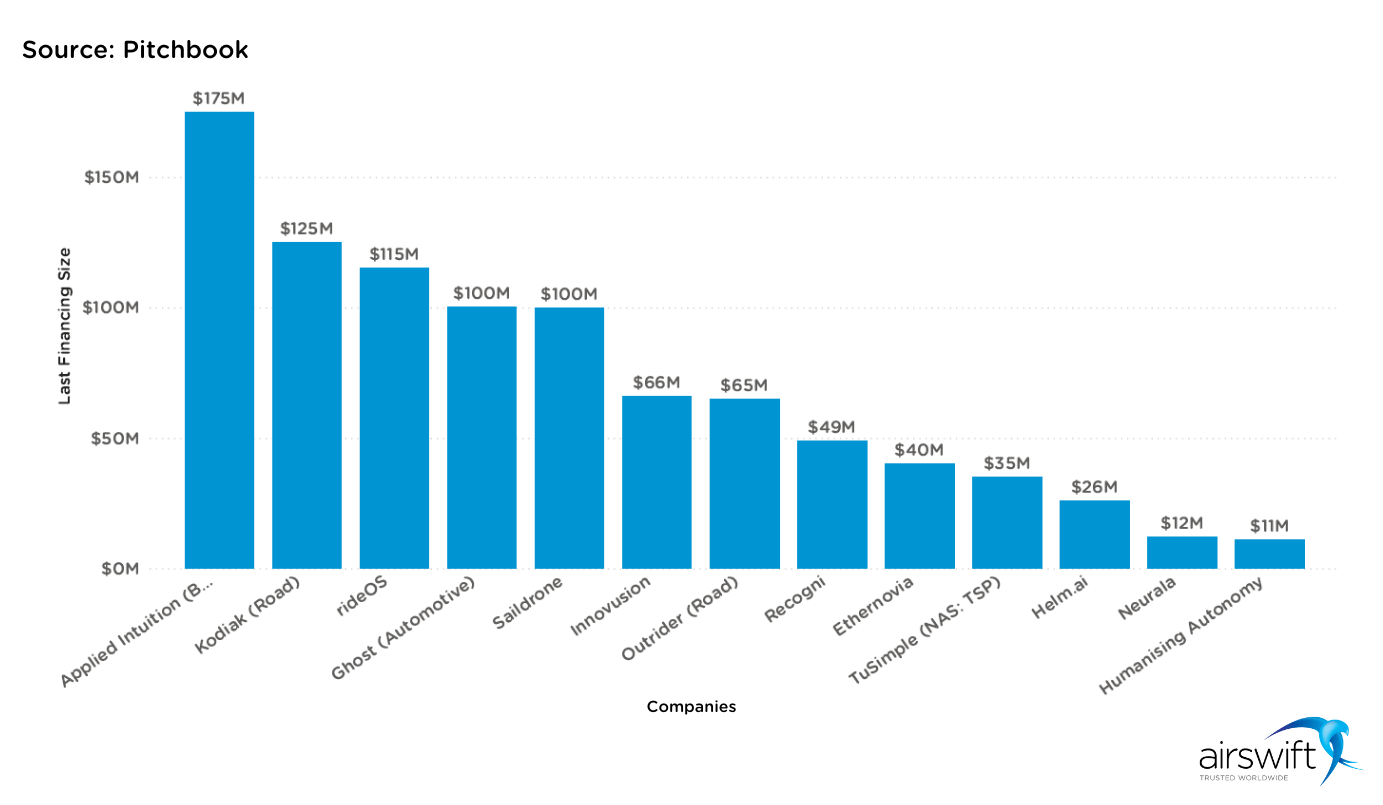

When we say that every market is tech now, this is what reality is showing us. The companies in the chart are part of the automotive sector but stand out for their innovative technological solutions.

Applied Intuition is one of the organisations that promises to revolutionize the entire market with its software products. The systems can put the autonomous driving industry a step ahead in the future and impact different sectors such as agriculture, trucking, construction and many more.

The company raised $175 million (Series D) in a deal with Human Capital as one of the backers. Human Capital is a venture capital firm funding many projects from the autonomous vehicles sector. Ghost was another company backed by the firm.

Applied Intuition has raised $350 million so far. With that, its valuation has reached more than $3 billion.

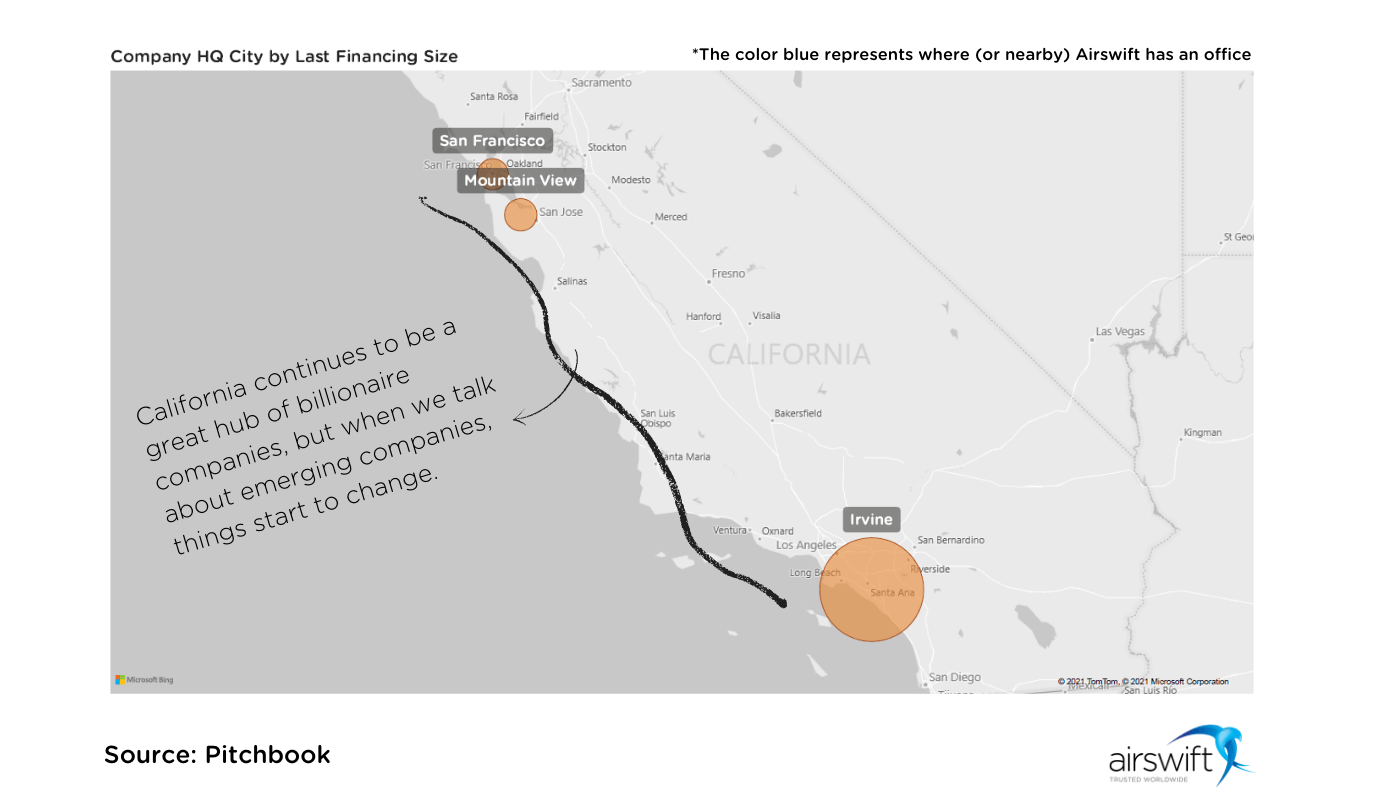

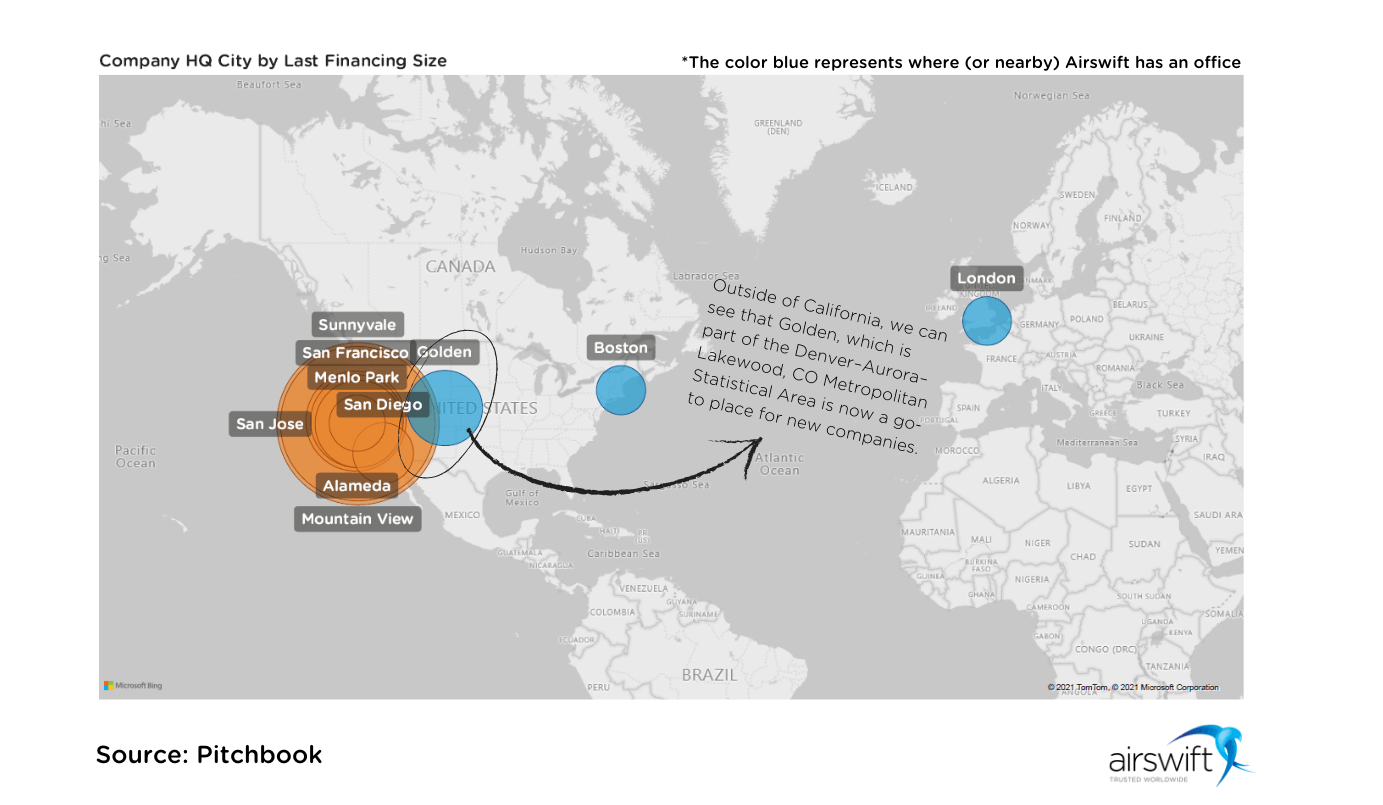

Where are these companies?

We designed a map for you to see where these companies are based and divided it into two colours. The blue ones are for regions outside California, the home of Silicon Valley, while the orange stands for that famous tech hub. It is a way for us to analyse the big picture and see the recent moves on the tech scene. Other regions are drawing attention like the Denver metro area.

The top billion-dollar deals companies are still headquartered in California.

But when we look at the other side of the coin, it shows that emerging companies are starting to look for new places to develop their business. The chart below consists of the top million-dollar companies.

See the example of Outrider, a developer of autonomous yard operations, that has chosen the Denver–Aurora–Lakewood, CO Metropolitan Statistical Area as its perfect place to grow exponentially.

Outrider: a game-changer for the supply chain

Despite being the only company in the chart to receive funding at the end of 2020, we chose to highlight Outride because of its leadership in the vehicular automation field for the supply chain sector.

The company combines its technological capacity in software development and robotics with zero-carbon emissions in electric trucks.

Source: Frame Stock Footage/Shutterstock

Source: Frame Stock Footage/Shutterstock

The company works with a level 4 solution, which consists of high automation, making human override just an option. Koch Disruptive Technologies led the $65 million Series B venture funding. The other backers were New Enterprise Associates, GOOSE Capital, Henry Crown and Company, Evolv Ventures, 8VC and Prologis Ventures. Today, Outrider is worth more than $250 million.

The Silicon Mountain: Denver Metropolitan Area

Denver metro area is a conurbation in which the counties of Adams, Arapahoe, Broomfield, Denver, Douglas, and Jefferson (Golden City) are located to form a growing developed industry area.

The region is becoming known as the "new Silicon Valley" because of its tech hub and expansive labour force and consumer market. The interconnected cities make a united prominent place for finding new job opportunities.

The primary reason for a Bay Area exodus is the cost of living in those cities. So, since the start of the pandemic, there has been a lot of talk about new places that companies could start. The Denver metro area is in the spotlight right now, and we can't forget how remote work will speed up this change from Silicon Valley to Silicon Mountain.

Top VC Investors and deal sizes

So, now that we’ve covered the top companies creating buzz within the autonomous vehicles sector, let's turn our attention to a different perspective and see what Pitchbook's records gave us from the top venture capital firms that invested in the autonomous cars sector recently.

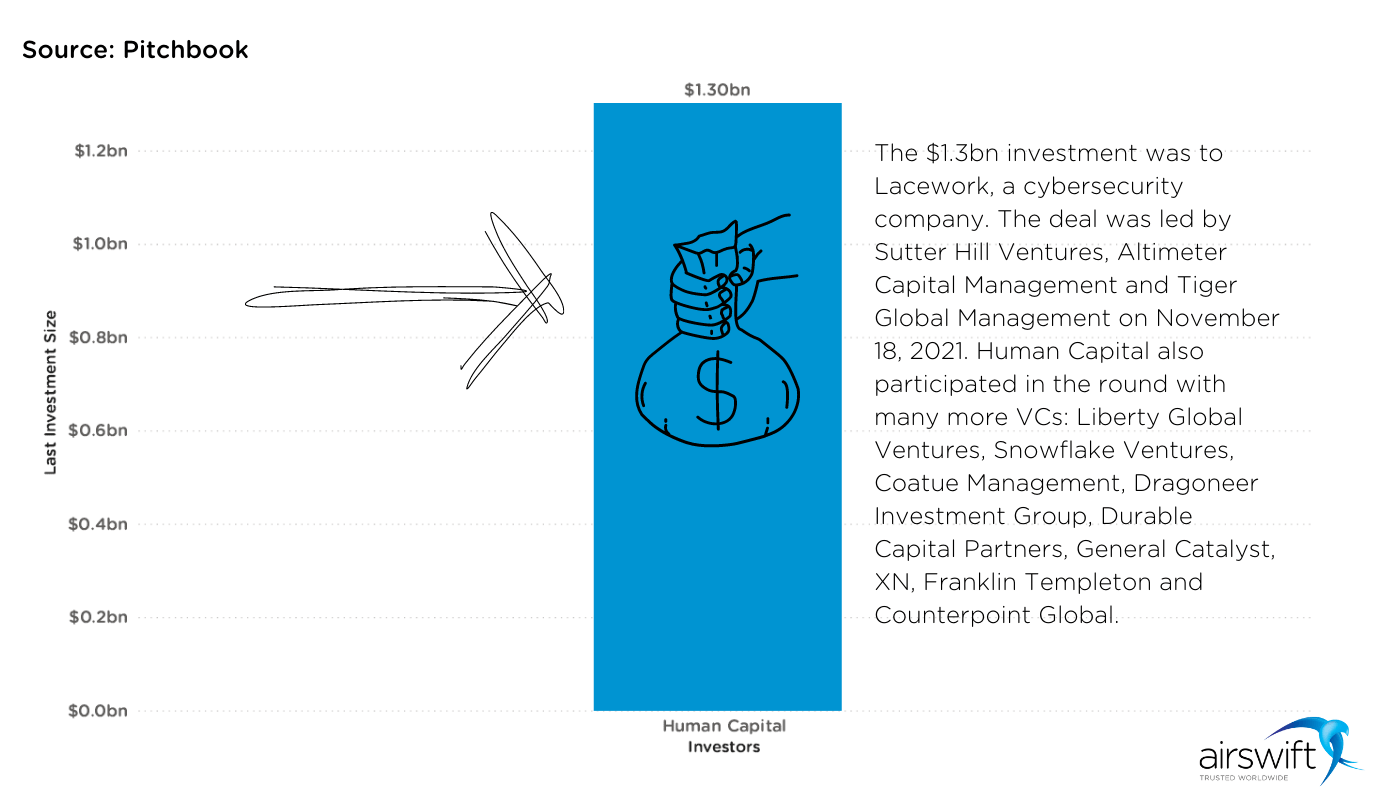

Human Capital

As mentioned above, Human Capital is a familiar presence in the autonomous vehicle market. We analyzed its last deal and were not disappointed. The total raised along with other backers was over $1 billion.

Lacework was the lucky beneficiary for this round. The cybersecurity cloud platform developed a patent that can help with preventing solutions more accurately.

Remember we said that every market is tech now? It's just a matter of time before we see Lacework's solutions becoming popular in the automotive market.

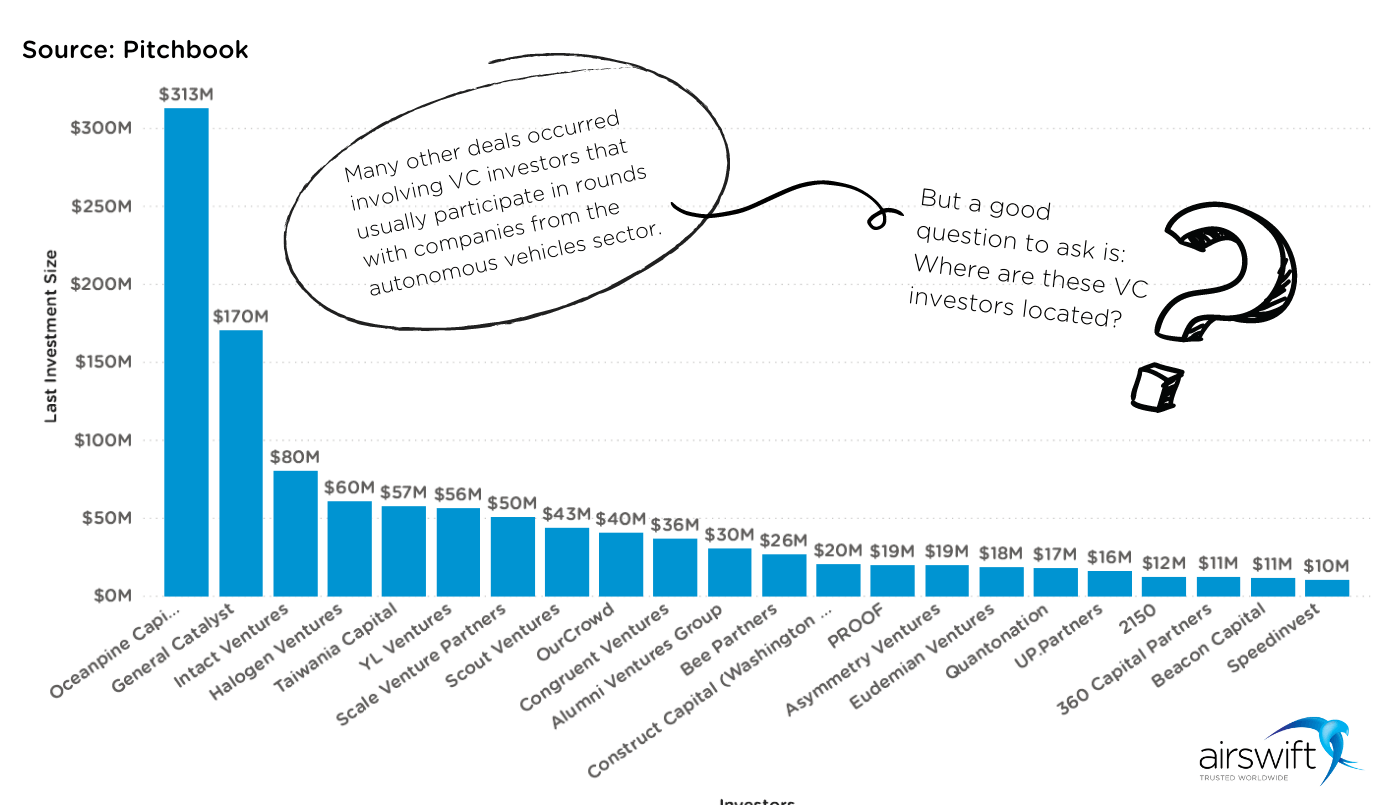

The other backers

The analysis gets even more interesting when we bring together more investors familiar with the autonomous driving industry and see the size of the deals they've recently been a part of.

Where are these investors?

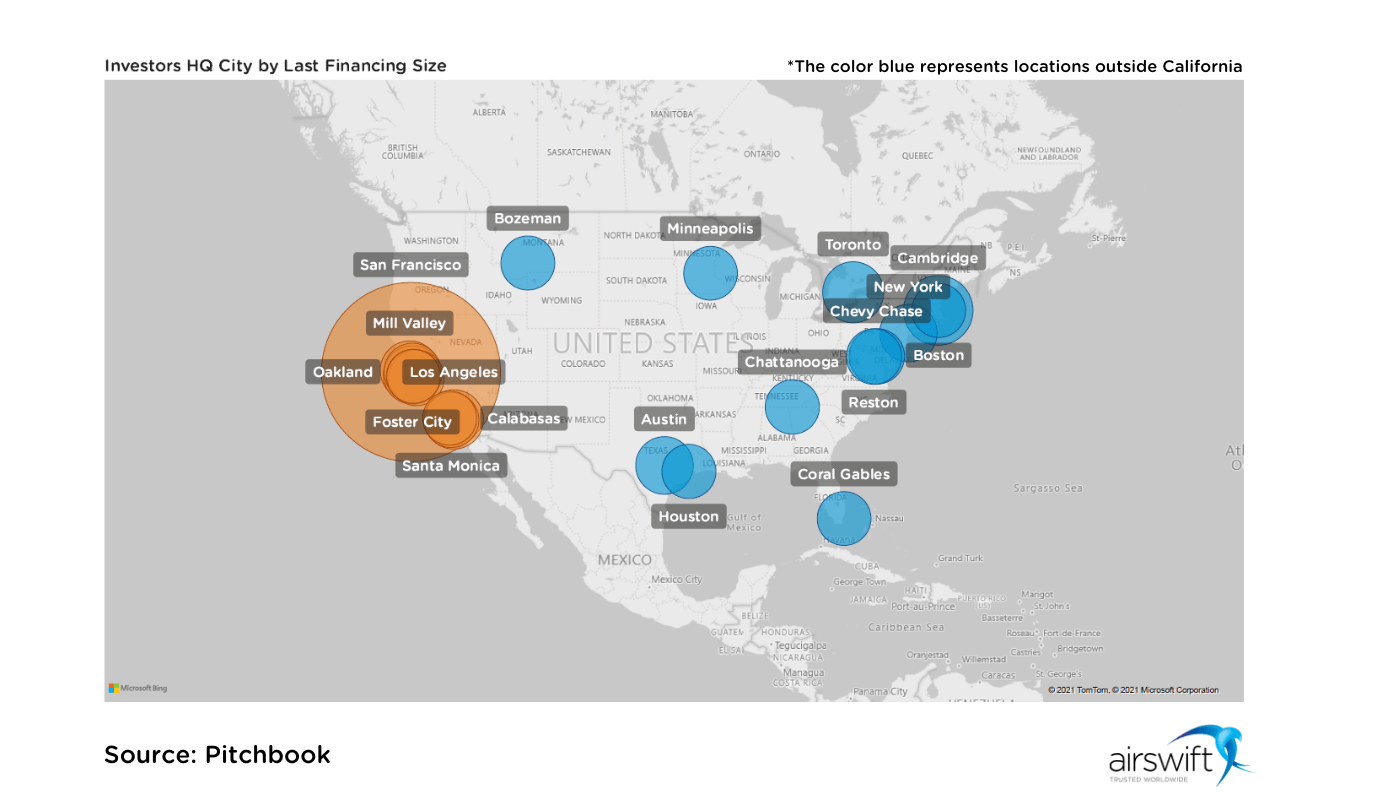

So let's dig deeper and see where are those venture capitalists in the United States and Canada:

The VC firm based in Houston is Energy Transition Ventures, while the one in Toronto is Intact Ventures.

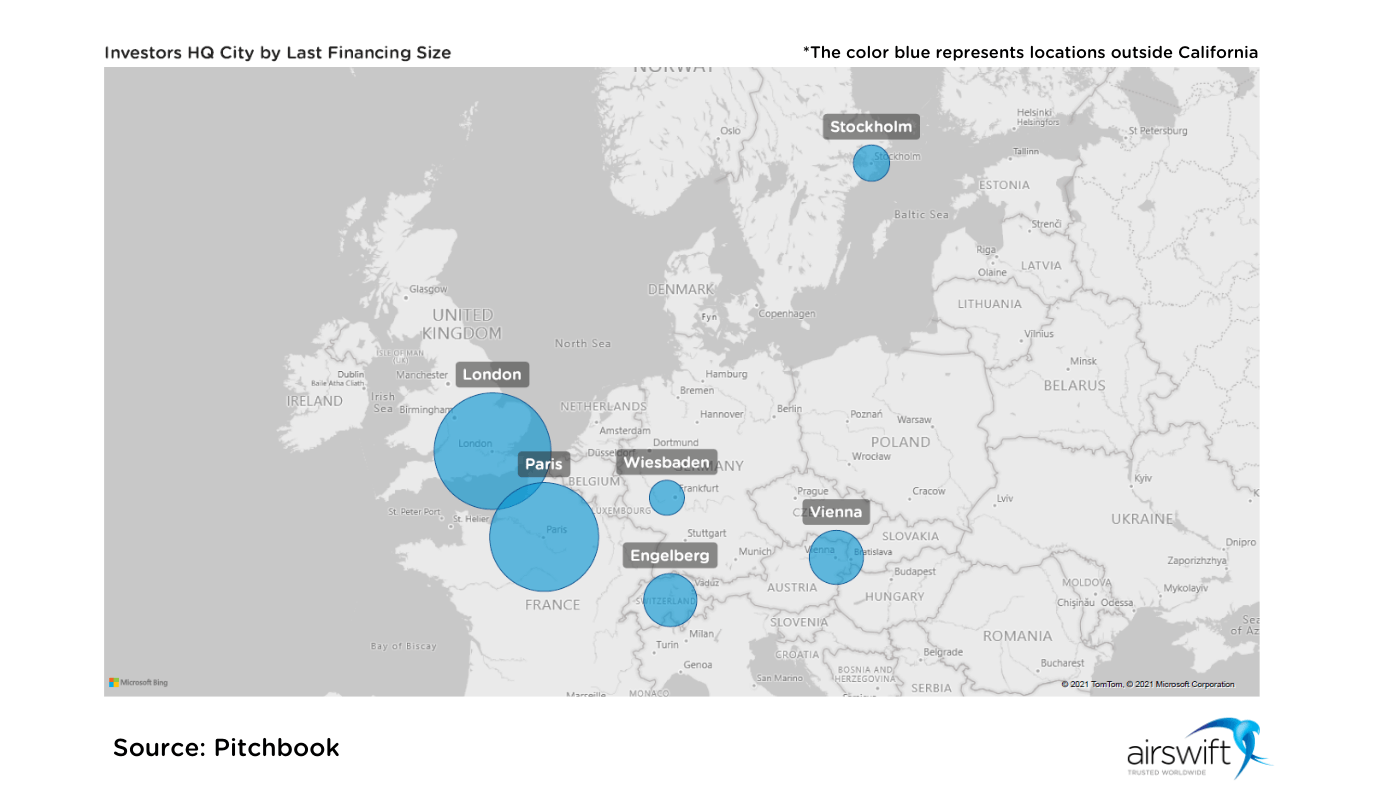

Now, let's see where these investors are located in Europe.

Last Companies Invested

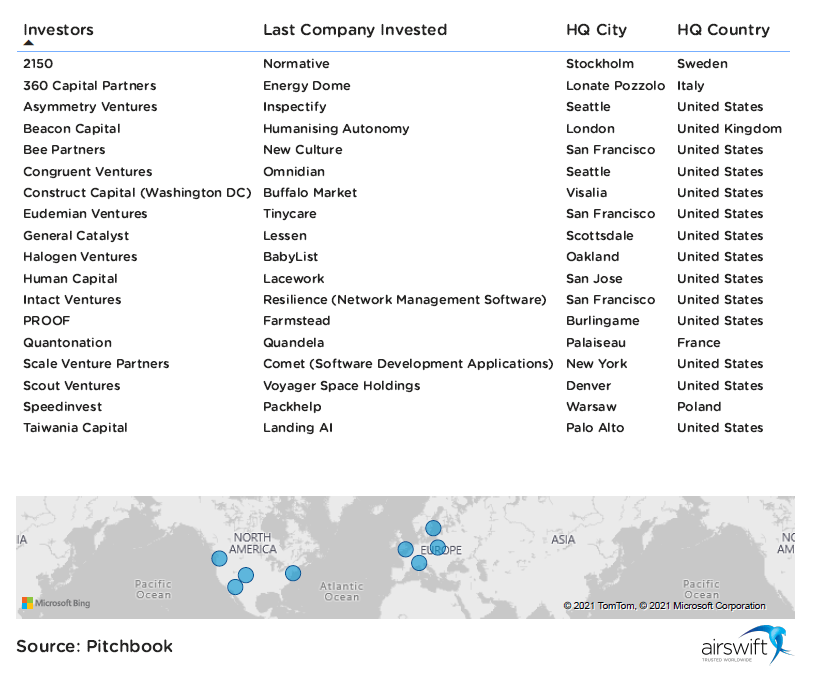

Following the same context, we can now open the data and look at some recent companies invested in by the mentioned investors.

The companies in the above list are from different industries. Because they are linked to technology (A.I., ML...), many can indirectly influence the autonomous vehicle industry. Other companies like Humanising Autonomy (see also the second chart), Flytrex and Yassir will act directly in the tech mobility ecosystem.

What are the challenges for companies and investors?

The cost of starting and maintaining a business has been an ongoing challenge in Silicon Valley. Prices have risen dramatically over the past few years. So, it is clear that we are seeing companies (smalls, mids and bigs) moving to cheaper locations. That consequently also attracts talent in search of new opportunities.

The big question then for those companies is how to surf this new wave and settle in an emerging tech hub. And also how to acquire the best talents and retain them for growth against the competition.

The clock is ticking, but there is still time to be part of a new generation that will bring together venture investors and startups.

We can help you within the mobility tech sector

We at Airswift can help you expand your business within the mobility tech sector. Our company has more than 9,000 contractors and more than 60 offices worldwide.

The best way to grow in a sustainable, agile and scaled way is by partnering with someone capable of providing the best workforce solutions.

Don't fall behind in the competition, partner with us and grow your business!