Top oil and gas employment trends to look out for in 2024

January 2, 2024

- Home

- Blog

The impact of AI in the oil and gas sector: Insights from the 2024 GETI report

Launched in 2017, the Global Energy Talent Index (GETI) Report charts emerging trends across the world’s energy workforce. Since its inception, GETI has gathered insights from thousands of energy professionals to create a comprehensive map of the energy landscape, providing organisations with the tools to refresh their skills base and retain talent.

This year’s GETI report explores the rise of artificial intelligence (AI) and how it’s reshaping the energy industry, from job roles to skills in demand.

In this article, we’ll explore how the industry approaches AI adoption and focus on oil and gas employment trends related to salaries, global mobility, and skills demand.

The article is divided into the following sections:

- Pay optimism remains high for the oil and gas sector

- Opportunity is a barrier to global mobility

- Oil and gas skills are in high demand

- The oil and gas workforce is technologically conservative

- Download the GETI report

Pay optimism remains high for the oil and gas sector

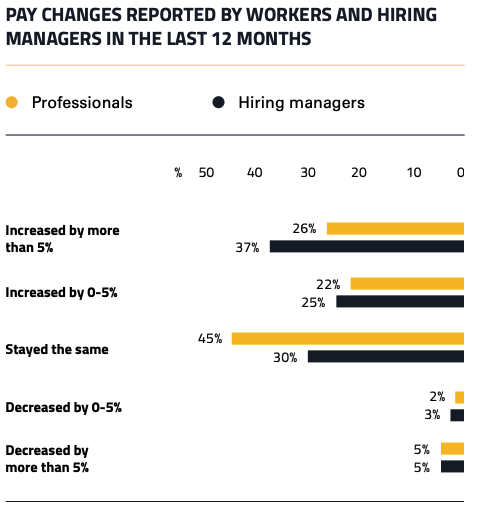

The oil and gas industry has seen rapid salary growth across the sector. However, this year’s GETI report reveals that this has begun to flatten amidst falling fuel prices.

Hiring managers had a more positive outlook than professionals, with 62% reporting a pay increase over the last year, compared to 54% in the previous year.

However, pay optimism is higher than last year, with 69% of professionals expecting a raise over the next 12 months (up from 66% last year). Hiring managers are also optimistic about salary expectations over the next year, with 72% anticipating a pay increase.

Oil and gas firms should conduct regular market salary assessments to ensure competitive compensation packages. It’s also important to implement performance-based incentives and bonuses to help motivate your workforce, meet their salary expectations and retain top talent.

Opportunity is a significant barrier to global mobility

Known for being globally mobile, the oil and gas industry’s workforce is used to moving to different areas to work on global projects.

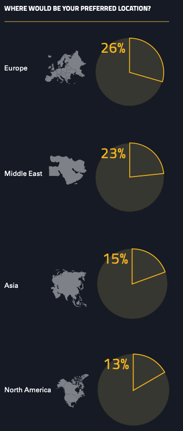

Therefore, it’s no surprise that 83% of professionals would consider relocating, compared to 81% last year. Moreover, 61% of companies now offer overseas transfers, up 4% from last year.

Europe is the most desirable destination for relocation, although the number of those willing to relocate there has fallen from 29 to 26% since last year. This is followed by the Middle East (23%) and Asia (15%). North America dropped out of the top three this year, with 13% stating it as their chosen destination for relocation.

Career progression remains the biggest driver for overseas relocation. This is followed by lifestyle, cost of living and remuneration.

On the flipside, the biggest barrier to relocation is proximity to family. 34% of professionals cite this as the reason why they wouldn’t move for work. 20% said that their employer doesn’t offer opportunities for relocation, suggesting that mobility levels might be impacted by opportunity.

Oil and gas skills are in high demand

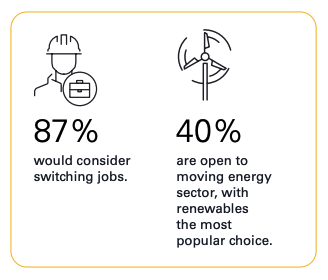

Despite 87% of workers considering a job switch over the next twelve months, the majority (61%) said they would stay in oil and gas.

Of the 40% that said they would change industries completely, 50% would move to the renewables sector. This is unsurprising considering that ESG (environmental, social and governance) were the third biggest driver for those considering moving careers.

Career progression opportunities and interest in the wider industry motivate those looking to switch jobs. Engineers in particular, are driven by flexible working models and technology.

The importance of career progression paths

In order to attract staff who are keen to progress in their careers, energy companies must offer career progression paths and regular reviews with their employees. You should initiate programs that encourage your workforce to develop new skills and promote a culture of lifelong learning in the working environment.

It is also valuable to recognise and reward employees for their achievements on projects and allow these achievements to form the basis for promotions where possible. This will lead to a more satisfied and motivated workforce.

Companies should also consider investing in new technologies to keep their employees excited in their roles. Offering your workforce the chance to work with newer technologies and training them on using them could keep them engaged and less inclined to move to a different industry.

If your employees feel stuck in a rut, it might be time to review your organisational structure and how work is assigned. Encouraging employees to take on new challenges, learn new skills and work across different teams can help keep them engaged.

How to retain oil and gas employees who are interested in the wider industry

Another big motivator for employees interested in a career change was interest in other sectors within the energy industry.

A way to appeal to employees expressing an interest in the wider field is to provide opportunities to learn about and experience different aspects of the business.

This could be done through job shadowing, cross-training, mentorship programs or even opportunities to work on special projects outside their normal day-to-day responsibilities.

Another way is to keep employees informed about what's happening in the industry and the company. This could be done through regular updates from senior leaders, industry news sources or even social media channels.

Finally, energy companies can create a culture of innovation and creativity that allows employees to experiment and try new things. This could be done through innovation labs or other initiatives that encourage out-of-the-box thinking.

What can oil and gas companies do to retain talent during the energy transition?

Regarding talent retention, employers should be aware that oil and gas skills are in demand, not just within the sector but across the wider industry. 81% of workers reported being headhunted for another job, and 12% have been approached more than 16 times since last year. 9% of engineers reported being approached more than 21 times by employers looking to hire them.

A quarter of those surveyed said that all approaches came from outside of the oil and gas sector, but it’s worth noting that only 19% considered joining another industry. Of those respondents, 26% said they would move to the technology industry, the second lowest proportion of any sector.

These findings indicate that the oil and gas industry primarily desires individuals with oil and gas skills. However, there is a rising interest in renewable energy among this workforce, which is mobile, ambitious, and environmentally conscious. Employers must consider providing opportunities for their employees to lead more sustainable innovations if they want to retain their talent.

There are several things oil and gas companies can do to address climate change concerns and retain talent, including:

Make sustainability a core value

When climate change is at the heart of a company’s values, it shows employees that their concerns are taken seriously. This can help engage and motivate oil and gas workers who want to make a difference.

Increase communication about climate change goals

Oil and gas companies must clearly communicate their plans to tackle climate change. Employees want to know what their company is doing to address the issue and how they can help meet these goals.

Here are some ideas about how you can communicate your climate change goals with your staff:

- Encourage employees to talk about your organisation's climate change and energy transition goals and suggest any changes they want.

- Create forums or discussion groups where workers can share ideas and ask questions about your organisation’s plans.

- Make it easy for employees to reduce their carbon footprint at work. This could involve providing energy-efficient equipment or offering incentives for public transport or car-sharing.

- Encourage employees to get involved in energy efficiency and renewable energy projects. This could involve anything from energy audits to solar panel installations.

- Ensure your managers are trained to have conversations about climate change with their teams. This will help to get everyone on the same page and working towards the same goal.

By taking these steps, oil and gas companies can show their employees they are serious about tackling climate change and making the energy transition. This will help to retain staff and attract new talent to your company.

Encourage employees to get involved in sustainability initiatives

There are many things employees can do to help your company build a more sustainable future. Making these methods known to your workers and encouraging them to get involved will help show that you’re committed to taking action on climate change.

There are several ways you can do this, including:

- Promote energy conservation practices within the company, such as carpooling where possible

- Set up recycling programs for waste and used equipment

- Invest in projects and programs that offset carbon emissions by tapping into natural carbon sinks such as plants, oceans, soil and forests. This helps to remove GHGs from the atmosphere, reducing their concentration in the air

- Support employee involvement in local environmental initiatives, such as tree-planting days

Prioritise clean energy transition training

With career development playing a crucial role in employee retention, consider providing energy transition training for your staff. This will help ensure that they have the skills they need to progress in their career as the energy landscape continues to change.

It’s important to develop skills for employees at all qualification levels. Upskilling your staff could open doorways for them to progress into new roles within your organisation as the energy transition continues.

Encourage career progression in line with your company's energy transition

The GETI report revealed that career progression is one of the biggest drivers in motivating employees to switch to a new sector. Energy workers are looking for companies where they can see a future for themselves, so it’s important to show that there will be opportunities for growth as your company transitions.

Here are some ideas for how you can help your employees to progress in their careers within your organisation:

- Introduce job shadowing and mentoring programs

- Promote energy literacy initiatives

- Encourage cross-functional team collaboration

- Support employee energy transition training

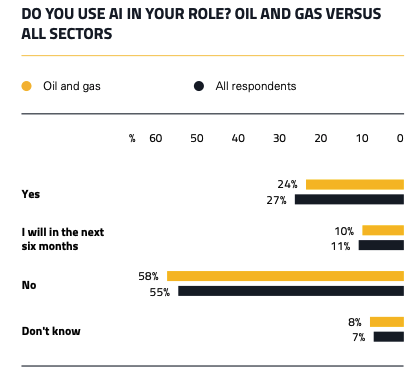

The oil and gas workforce is technologically conservative

The GETI report revealed that one-third of oil and gas companies have an AI policy. However, the sector is not very advanced in AI adoption. Only 24% of oil and gas employers use AI in their work. 19% of workers are unsure if their company has an AI policy, the highest percentage in the energy sector.

Oil and gas companies primarily use AI for immediate needs, such as safety, inspection, automated workflow, and collaboration. However, AI tools were the least popular among oil and gas professionals.

Machine learning and generative AI, such as ChatGPT, are commonly used in the sector. Approximately 15% of workers utilise these technologies. Artificial General Intelligence is also utilised, but to a lesser extent, with only 12% of workers using it. However, these percentages are significantly lower compared to other sectors.

This is perhaps unsurprising, as oil and gas is a mature sector with significant skills in traditional technologies. This suggests that AI uptake might be slower compared to newer sectors like renewables. However, AI has many potential functions for oil and gas, such as enabling more carbon-efficient production and helping workers to optimise carbon capture.

The sector’s biggest barrier to AI adoption is a lack of clarity about which tools would best fit the company. This is followed by insufficient investment or employee support. 47% of respondents are optimistic about AI, the second lowest of any sector.

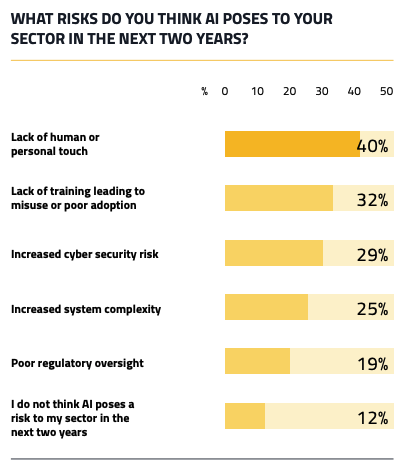

The workforce has several concerns about the potential risks posed by AI. 40% worry about insufficient human contact, 32% fear insufficient training causing misuse, and 28% are concerned about cybersecurity risks.

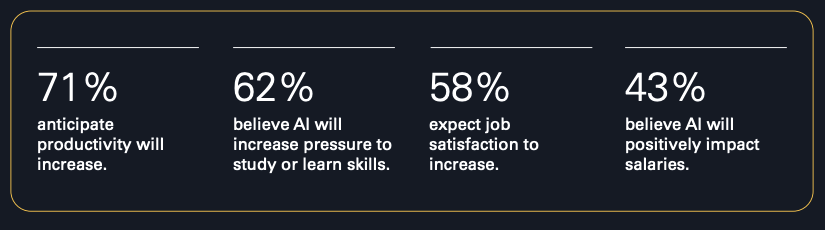

Despite these figures, there is some optimism surrounding AI in the oil and gas workforce. 71% of those surveyed believe that AI adoption will increase productivity, while 62% feel it will increase pressure to learn new skills. 58% expect to experience improved job satisfaction due to AI use, and 43% anticipate salary increases as a result.

How to boost oil and gas firms' competitive edge with automation and technology

Harvard Business Review suggests peak demand for major commodities may occur as soon as 2025. As reserves reduce and the prices fluctuate, it is vital that resource companies manage this uncertainty with agility.

Leveraging big data

Better access to data empowers senior leaders to view entire organisational performance holistically.

Digitally focused companies can stay one step ahead of their competition by leveraging big data to produce more at lower operating costs and track compliance data autonomously.

Better use of data could be leveraged through the “Digital Twin” – virtual versions of physical equipment that provide data to prevent downtime, reduce maintenance costs, and streamline operations.

The Internet of Things (IoT) and wearable technology will create data points throughout the business, as trillions of sensors can generate and share real-time data quickly and effectively.

One use case for this is connected pipelines. IoT sensors provide real-time pipeline integrity monitoring, ensuring safe oil and gas transportation. This results in reduced emissions from operations, operational excellence, and improved safety of the supply chain.

Interrogating and communicating this data will be the factor that creates a competitive advantage. The rapidly growing demand demonstrates this for data scientists and machine learning engineers.

Innovations in oil and gas safety

Digitalisation can increase security and inform safe, efficient and accurate decision-making. Some potential innovations include:

- 3D-printed models of rigs are used to assess locations before building begins.

- Underwater robots to fix gas pipelines off the coast.

- Augmented reality (AR) and drone technology to assess and inspect offshore oil rigs.

As the cost of these innovations reduces, new skill sets are rising to meet them. For instance, drillers will become remote drilling experts anticipating offshore jobs moving to onshore support centres.

Skills in demand for the year ahead

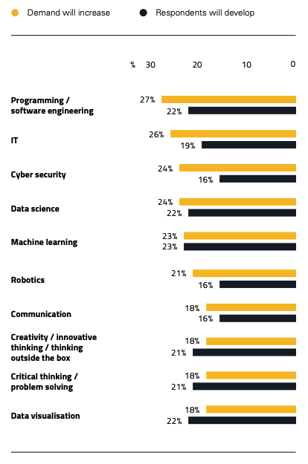

94% of respondents believe AI will increase demand for certain skills, which are also associated with anticipated risks. The top skills people want are programming, software engineering, cybersecurity, and data science.

However, training priorities don’t seem fully aligned with skills needs. Despite being among the top three most sought-after skills, professionals expressed little interest in developing IT and cybersecurity skills. This indicates potential skills shortages in these areas if training isn’t implemented.

Download the full GETI report

Would you like to learn more about oil and gas employment trends expected to shape the sector in 2024? Get all the latest insights and information on trends across the rest of the energy industry in the 2024 GETI report. Download it today.

This post was written by: Callum Donaldson, Vice President of Business Development & Sales

You may also be interested in…

-

What can Oil & Gas companies do to retain talent during the energy transition?

-

Top petrochemicals employment trends to look out for in 2024

-

Nuclear power employment trends to look out for in 2024

-

The secret to employee happiness in renewable energy

-

Key employment trends for the power industry in 2024

-

How to boost O&G firms' competitive edge with automation and hi-tech

-

Has renewable energy promoted inclusion and gender balance?

-

Stay interviews: The future of hiring and retention

-

Renewable energy employment trends to look out for in 2024

-

The post-pandemic energy workforce