By

Leanna Seah

May 12, 2021

Updated

October 29, 2024

What is an Employer of Record?

An Employer of Record (EOR) is a third-party organisation that helps businesses legally employ workers in other countries. The EOR becomes legally responsible for managing all aspects related to the employment of a worker, including payroll, benefits, taxes and labour law compliance.

An Employer of Record can be used by businesses to hire international workers and access a wider talent pool without bringing them onto their payroll. This is especially useful for businesses that want to expand into foreign locations or want to quickly grow their workforce without the administrative burden of hiring and managing their employees directly.

By partnering with an EOR, the organisation has the freedom to focus on the core aspects of its business growth while the EOR handles all of its administrative responsibilities.

Think about the jobs you’ve been hired for in the past.

After the initial excitement of accepting the offer, it’s time to get down to business...

- You begin completing the necessary employment paperwork and processes.

- You will need to get paid.

- Applicable taxes will need to be deducted.

- You will likely need employee benefits, such as health insurance

- All necessary work permits must be verified and recorded by the employer.

Human Resources typically manage this piece of the employee onboarding process. However, in many cases, companies choose to outsource this function to an Employer of Record.

Why or when would a company use Employer of Record services?

An EOR is often used for global expansion when a company plans to conduct business activity in a new country without a physical entity.

The process of registering a local business entity can be expensive and arduous. The company may need to move swiftly in order to meet the needs of a project or new business venture. Or they only require a short-term solution.

Thus, a global Employer of Record can be an efficient way to hire workers in that country. The EOR will have a legal entity to manage local payroll, employment tasks and immigration. The EOR will also appear as the legal employer for your remote employees in the host country.

What are the benefits?

An EOR is attractive when expanding overseas without an existing footprint. The EOR will have a legal responsibility to manage your payroll processing, tax and immigration in the host country. An Employer of Record can also help you hire international talent, perform background checks, oversee benefits administration and perform various administrative tasks.

Here are some of the main benefits of an EOR:

Speed up your market penetration strategy

Companies can ramp up operations faster than incorporating a foreign entity in the country without running any compliance risks. An Employer of Record can get you up and running in a new location in as little as 48 hours by appearing as the legal employer of your international hire. This allows organisations to hire the best global talent and leverage new market opportunities as soon as they surface.

Increased convenience

Airswift’s Employer of Record solutions provide companies with flexibility. Businesses can test new markets or engage in short-term projects without setting up a physical foreign entity. This is especially helpful for smaller companies that don’t have the corporate infrastructure required to handle local payroll, immigration, and tax requirements.

An EOR provides a company with a legal entity that can handle all these commitments. They also have the expertise needed to ensure the company is fully compliant with any international employment laws and regulations of their host country.

Cost-effective

An Employer of Record allows companies to bypass the overhead costs that often come with setting up and maintaining an entity in a foreign location. From sourcing international talent keeping compliant employment contracts, an Employer of Record lets businesses restructure their cash flow and allocate these resources towards escalating their growth plans.

Using an EOR is also a convenient and cost-effective option for smaller companies, especially firms without the corporate infrastructure to manage local payroll, payroll taxes and immigration.

Minimise risk

An Employer of Record helps to assume responsibility for the liabilities that come with hiring and operating internationally. Human resources issues relating to employee benefits, payroll and taxation, administrative operations and legal compliance are taken on by the EOR.

Protecting companies from the risks involved in mishandling these matters. Working with competent and experienced EOR service providers gives clients peace of mind that these responsibilities are being properly managed.

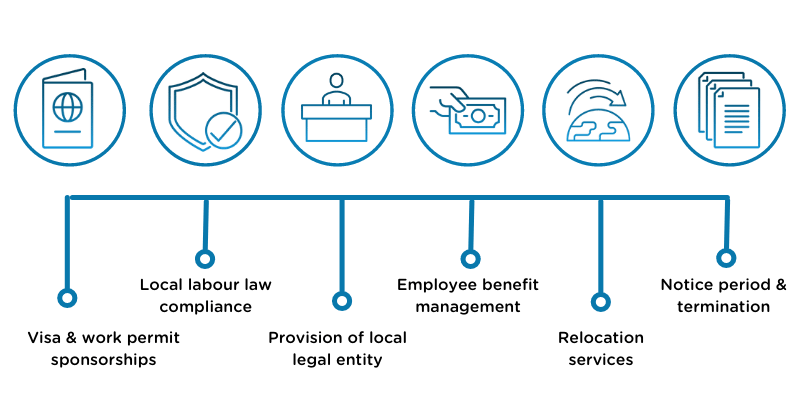

Some of the core formal employment tasks an EoR shoulders on behalf of a company include:

- Sponsoring correct visas and work permits

- Ensuring all international expansion and hiring plans are compliant with local regulations

- Providing a local legal entity within the host country

- Employee compensation and benefit management

- Employee relocation services

- Employee notice period and contract termination procedures

What are the limitations of working with an Employer of Record company?

The legal employment relationship will exist between the employee and the EOR. But the EOR has no dealings with the employee around daily work responsibilities. This direction comes from the original employer. Thus, the lines of responsibility can become somewhat “blurred” when using an EOR.

Additionally, as the employment relationship is technically between the employee and the EOR, the original employer essentially gives up control over the payroll process.

This might cause confusion if the company pays employees bi-weekly and the host country dictates monthly payments.

In this instance, the international employee is paid through the EOR according to the host country’s laws and NOT the company’s payroll process.

What are the alternatives?

Should I use a PEO or EOR?

One alternative would be to use a Professional Employer Organisation or a PEO. The key difference is that a PEO does not hold the employment relationship and associated risk as an EOR would.

Instead, a PEO provides guidance on payroll service, registration and compliance needs. This may include connecting a company with an Employer of Record. This would involve the company managing relationships with both the PEO and the EOR.

Contractors or EOR?

Another alternative would be to hire contractors to carry out in-country operations. Although, for long-term assignments, this might not be the best alternative. Contractors, by the very nature of the work they’ve chosen, may be more likely to change jobs frequently.

Employer of Record or a staffing agency?

There is some crossover in the services provided by an employer of record and a staffing agency. Both will manage the temporary deployment of personnel for a client company.

However, many staffing agencies do not have the specialist in-house expertise to manage global employment contracts, laws and regulations.

Is it easier to register an entity in-country?

A company can always opt to register an entity in-country. This process is a viable situation if funding and timescales allow. It is also an effective approach if you are planning a long-term, permanent base in-country.

If you need a temporary solution while registering an entity, an EOR can be valuable. In countries with long registration periods, the EOR could temporarily assume responsibility for international employment. This can be an effective way to save time and money.

They would then transition back to the client company once an entity is established.

How do I choose service providers?

Most Employer of Record companies offer similar services, but it's important to work with a partner you feel the most comfortable with. Don't rush into the selection process, and make sure to ask these questions below before making a decision.

- Do they have operations in the destination country? Not every Employer of Record has experience working in every country. The ideal scenario is for the EOR to have substantial experience working in-country with local expertise.

- Are they internationally compliant with local employment law? The major upside to using an EOR is mitigating the risk of violating local payroll, tax and immigration laws. In-depth knowledge of such legislation is critical when selecting a provider.

- Do they have experience with similar business owners in your industry? If they understand the business, they can tailor a solution to fit the needs of the company.

- Will you be assigned a single point of contact or an online portal? When managing people, you don’t want to be treated as a number with little human interaction.

- Is the Employer of Record service part of their core business? If the EOR is an ancillary part of their business, it will not be a core focus. This can impact performance and employee morale.

-

What is the paperwork involved in enlisting an Employer of Record? The documentation involved often varies and is highly dependent on the clients needs, country regulations and the types of engagement required from the service provider. The best way to find out more about this process is to reach out to Airswift. Our team are ready to equip you with all the information that you need.

-

How much does the Employer of Record service cost? The price of EOR services is typically tailored to the client's needs. At Airswift, we work with our clients to curate custom solutions that are best suited to their needs.

Our article on comparing Employer of Record companies provides you with a helpful framework on how to find the best EOR service provider for your business needs.

Simplify your global business expansion with Airswift's Employer of Record

Our EOR services are available in over 60 locations. Airswift helps to employ and manage an international workforce on behalf of our clients. Ensuring all procedures are handled by dedicated teams in-house without having to rely on third-party providers.

Immigration support

Immigration support

Understanding the laws that govern immigration processes is a daunting aspect of international hiring. Airswift works with international employees to help get the correct visas and permits for their new work location.

Location-specific employee support

We live in the countries we work in. This means that we have a designated team of Airswift staff who can regularly check-in with a client’s new hire. Our local service teams are available to answer all queries that may arise from clients and workers.

Accurate payroll management

Payroll procedures vary according to country. Airswift provides payroll services that abide by local regulations. We assist clients in managing all aspects of payroll processing, from setting up a local bank account to tax payments and worker compensation.

De-mobilisation services

When a worker’s employment contract ends or if either party decides to terminate the employment. Airswift can support tax clearance, immigration cancellation and end-of-lease arrangements. We also help with bank account closure and organise return travel.

If you are expanding your business operations internationally, Airswift can help. Our Employer of Record services cover a wide range of essentials that can be customised to your needs. Some of our core services include outsourcing payroll management, ensuring compliance with labour laws, tax filing and work visa sponsorships.

We are a truly global business with a local approach to innovative employee solutions. We don't just work in the countries we operate in - we live there.