By

Leanna Seah

September 20, 2024

Updated

October 29, 2024

Overview

Denmark is a small, northern European country with a population of approximately 5.8 million people. Known for its high standard of living, advanced welfare state, and innovative business climate, Denmark is a desirable destination for companies and individuals seeking to tap into its talented workforce.

The country has a highly educated talent pool, with over 80% of the population having completed some form of post-secondary education. Denmark has strong employment laws prioritising worker protections, such as a minimum wage, a maximum workweek of 37 hours, and generous parental leave.

The Danish business culture is also attractive, with a low corporate tax rate, easy access to capital, and a high degree of government support for entrepreneurship. The top industries in Denmark include information technology, life sciences, renewable energy, and food and agriculture. Denmark offers many opportunities for businesses and individuals with its skilled workforce, supportive business environment, and high quality of life.

| Capital |

Copenhagen |

| Languages spoken |

Official language: Danish Business language: English (widely used in international business settings) National minority languages: German, Greenlandic, Faroese |

| Population size |

5.85 million as of March 2023 |

| Payroll frequency |

Monthly |

| Currency |

Krone (Kr., Øre) |

| VAT |

0-25% |

Payroll and taxes

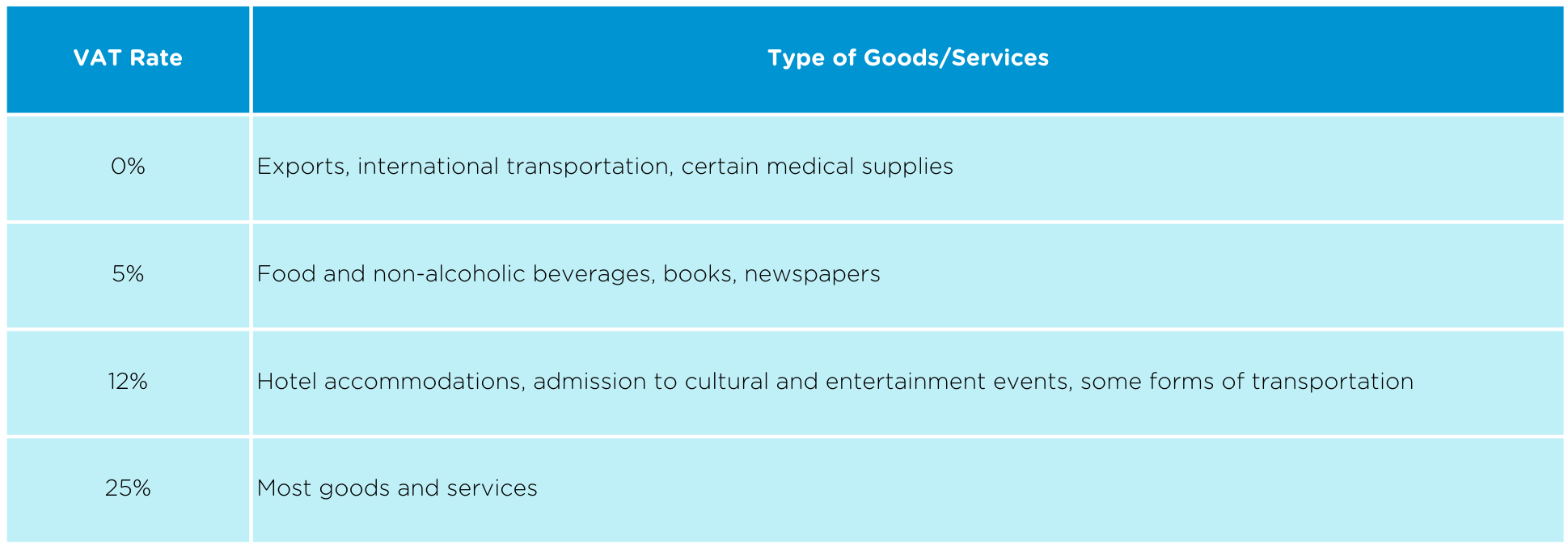

VAT rates

Value-added tax (VAT) is an important source of revenue for the Danish government, contributing to funding public services and infrastructure. The VAT system in Denmark is fairly complex, with different rates and exemptions for various goods and services as follows:

Table 1: VAT rates based on goods/type of service

Employer contributions

In Denmark, employers must contribute to social security and other government programs for their employees. These contributions are typically calculated as a percentage of the employee's salary and are paid monthly.

The main contributions that employers are responsible for, according to Danish employment law, are as follows:

Labour Market Contribution (Arbejdsmarkedsbidrag)

This contribution funds unemployment benefits and other labour market initiatives. The current rate for 2023 is 8% of the employee's gross salary, and the employer is responsible for paying this contribution.

ATP

This is a mandatory pension scheme for all employees in Denmark. The contribution rate is currently 10% of the employee's gross salary, of which the employer pays 2/3 (6.7%).

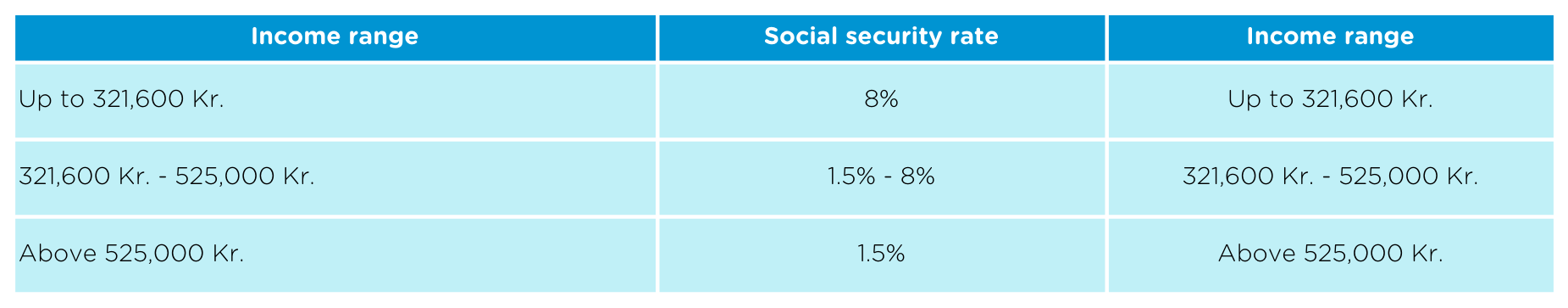

Social Security (Arbejdsgiverbidrag til social sikring)

This contribution funds various social security programs, including healthcare, parental leave, and sick pay. The rate varies depending on the employee's income and other factors but typically ranges from 1.5% to 8%.

Table 2: Social security rates based on income range

Note: The rates may vary depending on the specific social security program being funded.

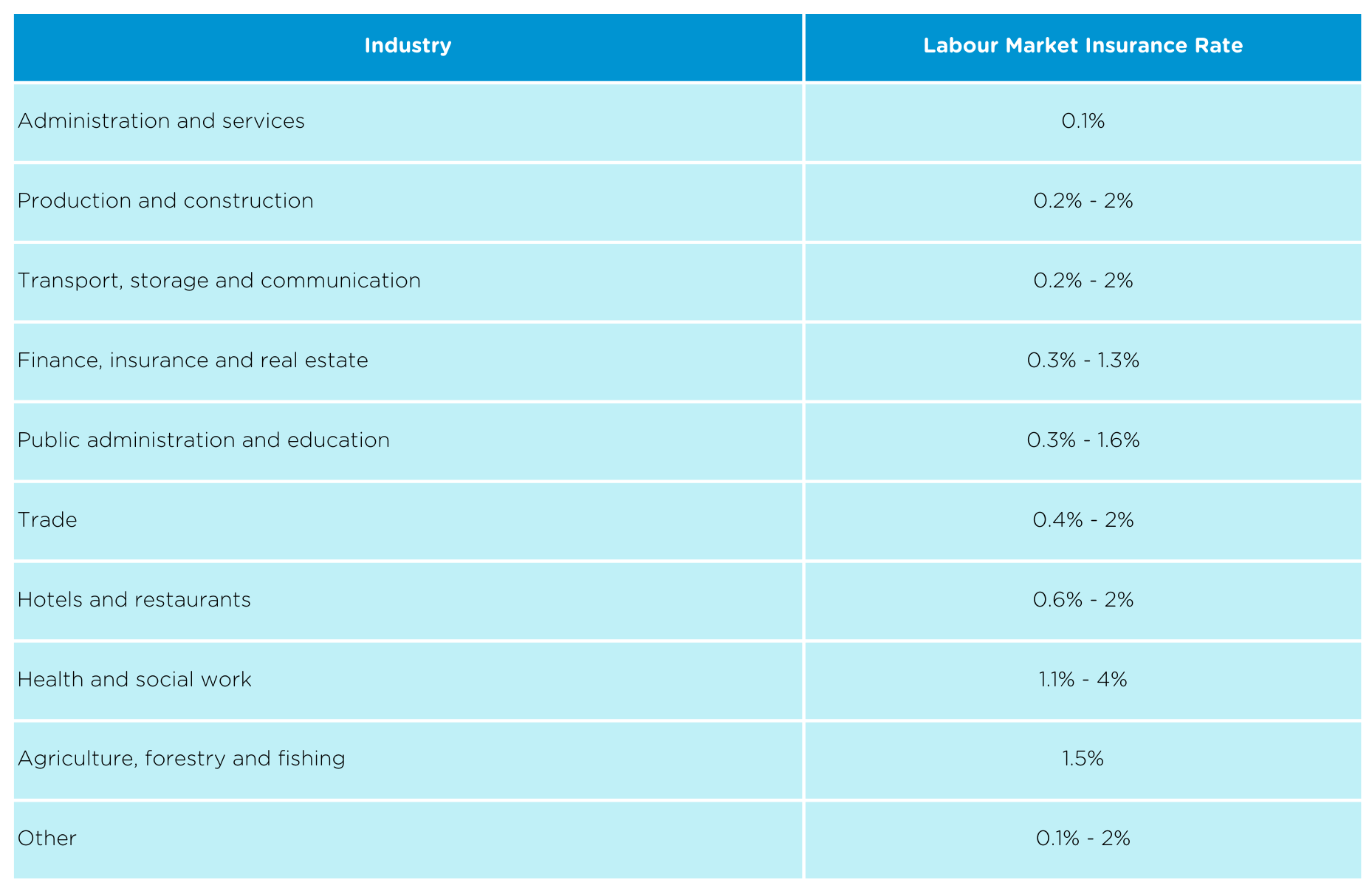

Labour Market Insurance (Arbejdsgiverens betaling til arbejdsmarkedets erhvervssygdomssikring)

This contribution funds workplace injury and illness insurance. The rate varies depending on the industry and the risk associated with the work, but it typically ranges from 0.1% to 4%.

Table 3: Labour market insurance rate based on industry

Note: These rates are subject to change and may vary based on specific circumstances.

Holiday Pay (Feriepenge)

Employers must set aside a certain percentage of their employees' salaries as holiday pay. The rate is 12.5% of the employee's gross salary, and the employer is responsible for paying this contribution.

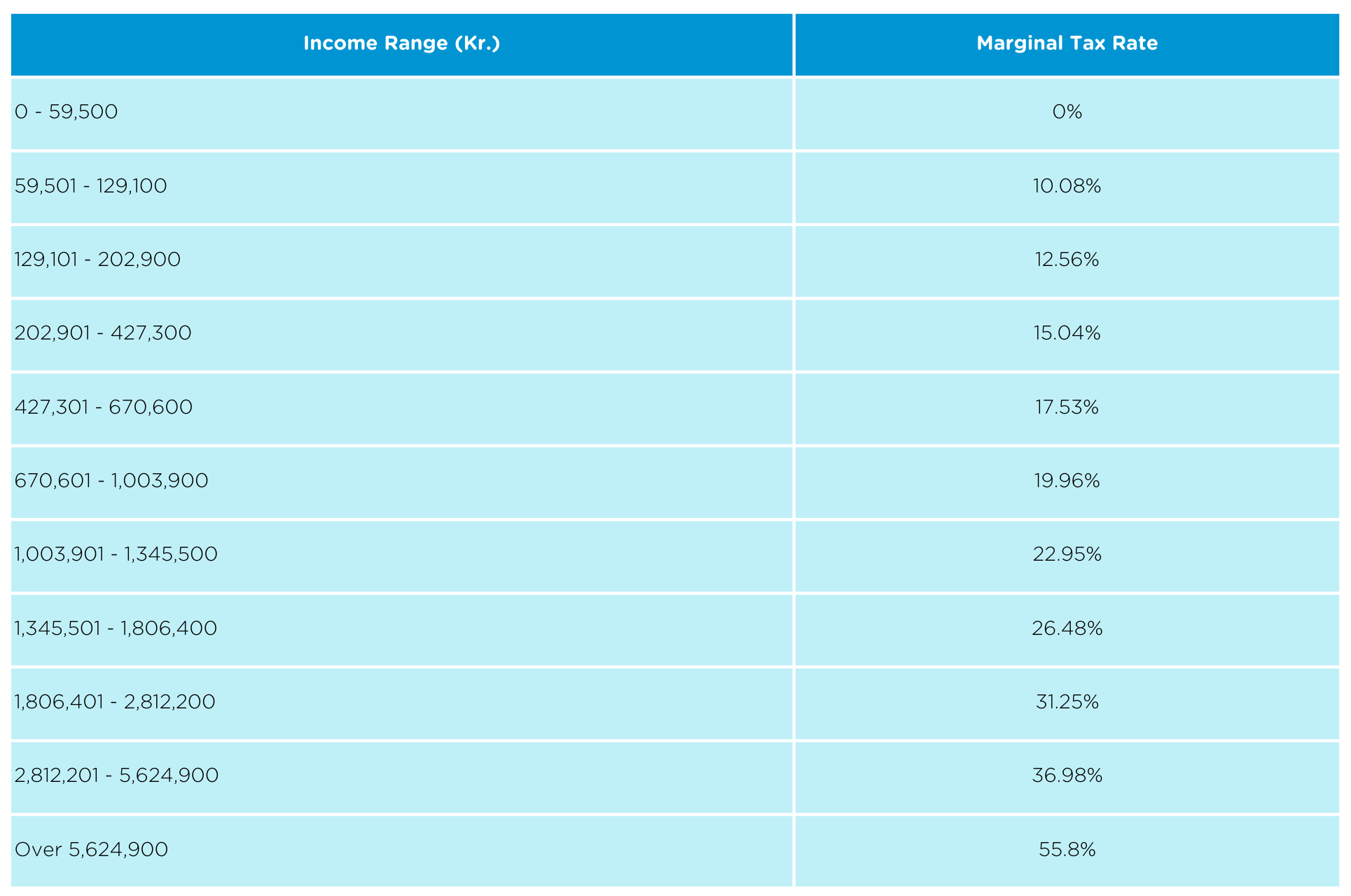

Taxes

In addition to these contributions, employers are also responsible for withholding income tax and other taxes from their employees' salaries and regularly remitting them to the government. The income tax rate in Denmark is progressive, with rates ranging from 0% to 55.8% depending on the employee's income level.

Note that this is the marginal tax rate, meaning that the tax rate only applies to the portion of income within each income range. A personal allowance of 46,000 Kr. (in 2023) is also deductible from taxable income.

Overall, employers in Denmark must be prepared to make significant contributions towards social security benefits, pension, and other programs on behalf of their employees. Understanding and factoring these obligations into your payroll calculations and budgeting are important.

Employee contributions

In Denmark, employees are required to contribute to social security, pensions, and unemployment insurance. The employee contribution rates vary depending on the program and the employee's income level.

Social Security (Arbejdeersbidrag til social sikring)

Employees must contribute to social security to fund various social welfare programs, including healthcare, parental leave, and sick pay. The rate varies depending on the employee's income and other factors but typically ranges from 1.5% to 8%. The employer is responsible for withholding the employee's share of social security contributions and paying them to the authorities.

ATP (Arbejdsmarkedets Tillægspension)

ATP is a mandatory pension scheme for all employees in Denmark. The contribution rate is 10% of the employee's gross salary, of which the employee pays 1/3 (3.3%).

Unemployment Insurance (Arbejdsløshedsforsikring)

Employees must contribute to unemployment insurance, financially supporting individuals who lose their jobs. The contribution rate is currently 1.5% of the employee's gross salary, of which the employer pays 0.5%, and the employee pays 1%.

Labour Market Insurance (Arbejdsmarkedets Erhvervssygdomssikring)

This contribution funds workplace injury and illness insurance. The rate varies depending on the industry and the risk associated with the work, but it typically ranges from 0.1% to 4%.

Income tax

The income tax rate in Denmark is progressive, with rates ranging from 0% to 55.8% depending on the employee's income level. Employees are responsible for paying their income tax to the authorities through monthly withholdings. The employer is responsible for withholding the correct amount of tax from the employee's pay and paying it to the authorities on the employee's behalf.

Table 4: Marginal tax rate based on income range

Minimum wage

Denmark has no statutory minimum wage, as wage levels are typically determined through collective bargaining agreements between employers and labour unions.

Instead of a minimum wage, Denmark has a system of industry-specific minimum wages, which are negotiated through collective bargaining between the employers' organisations and the unions. These minimum wage agreements cover most workers in Denmark and are legally binding.

The minimum wage rates vary by industry and occupation and are typically set higher than the average wage for that industry. Sometimes, the minimum wage may include additional benefits, such as pension contributions, paid time off, or health insurance.

Typically, the minimum monthly salary is around 19,382 Kr. After taxes of around 52%, it results in a minimum take-home salary of around 9691 Kr. The average salary in Denmark is around 23,148 Kr., a solid wage that allows a person to live a good life in Denmark, though salaries and cost of living vary across regions.

It's worth noting that while Denmark does not have a statutory minimum wage, the country does have a comprehensive social security scheme with a high level of social benefits and a strong social safety net, which helps to ensure that all workers receive a decent standard of living. This includes access to free public healthcare, education, childcare, generous parental leave policies, and unemployment benefits for both local and international employees.

Employee benefits

Mandatory benefits

Health Insurance: All employees in Denmark are entitled to free health insurance, which includes medical treatment and hospitalisation expenses.

Pension: Employers must provide a pension scheme to their employees, including both a state pension and a workplace pension.

Parental Leave: New parents in Denmark are entitled to parental leave, which can be shared between parents. During this period, the employee is entitled to a parental allowance from the government.

Sick Leave: Employees who fall ill are entitled to receive sick pay from their employer for the first 30 days of their absence. After that, they can receive sick pay from the Danish government.

Supplementary/optional benefits

Life Insurance: Employers may offer life insurance as a supplementary benefit to their employees, which provides financial protection to the employee's family in case of death.

Disability Insurance: Disability insurance provides financial protection to employees who cannot work due to a disability.

Company Car: Some employers in Denmark provide their employees with a company car for personal and professional use.

Fitness Memberships: Many Danish employers offer their employees discounted or free fitness memberships to encourage healthy lifestyles.

Childcare: Some employers may offer their employees subsidised childcare, allowing parents to work without worrying about the cost of childcare.

Vacation Time: While vacation time is not a mandatory benefit in Denmark, many employers offer their employees between 25 and 30 days of paid vacation per year.

Source: Shutterstock

Working hours

In Denmark, the standard working hours are 37 per week, typically over five days. However, many companies offer flexible working hours or part-time work arrangements, depending on the needs of the employee and the employer.

In addition, Danish labour law specifies that employees have entitled to a minimum of 11 consecutive hours of rest every 24 hours and a minimum of 24 consecutive hours of rest every seven days. This means employers must provide their employees with adequate rest breaks and time off to ensure their health and well-being.

Overtime work in Denmark is also regulated by law. Employees who work more than 37 hours per week are generally entitled to overtime pay or time off in lieu of payment. The specific overtime rates and requirements may vary depending on the employment contract, the industry, and the employee's specific circumstances.

It's worth noting that working hours and overtime regulations may vary depending on the industry and the collective bargaining agreements in place. Employers and employees are responsible for complying with Danish labour laws and regulations.

Types of leave available

Annual leave

Danish employees have an annual leave entitlement of five weeks, earning 2.08 days of vacation per month. Out of the 25 days, three can be taken consecutively between May 1 and September 30. Employees can use their vacation days in the same holiday year or by December 30 of the following year.

All employees can take up to 5 weeks or 25 days of holiday per year, irrespective of how many paid vacation days they have accrued. Most employees can also avail themselves of an extra week's paid vacation through the Additional Sixth Week Agreement.

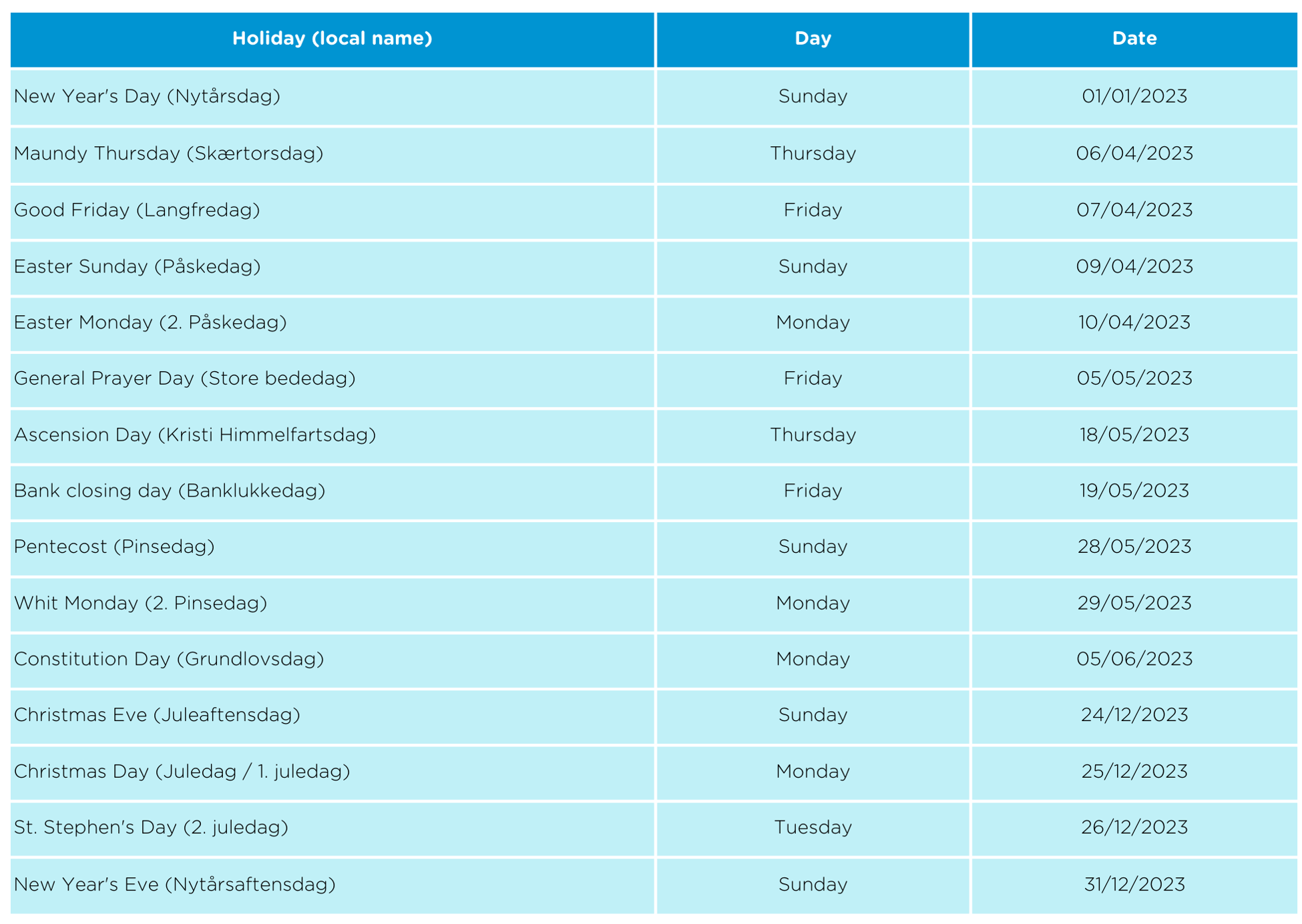

Public holidays

Table 5: Public holidays in Denmark

Sick leave

In Denmark, employees are entitled to sick leave if they cannot work due to illness or injury. The length of the sick leave and the amount of sickness benefits an employee receives depends on the individual's employment contract and the collective agreement that applies to their workplace.

In general, most employees are entitled to up to 30 days of fully paid sick leave per year, which can be extended to 52 weeks in certain circumstances. During the first 30 days of sick leave, the employer pays the employee their full salary, and after 30 days, the municipality takes over and pays the sick pay. The amount of sick pay from the municipality is around 90% of the employee's salary.

It's worth noting that some collective agreements may offer additional sick leave benefits, such as increased sick pay or longer periods of fully paid sick leave. Additionally, employees may be entitled to special sick leave if they cannot work due to a serious illness or need to care for a sick family member.

Maternity/paternity leave

In Denmark, both maternity and paternity leave are available to new parents. Maternity benefits are quite generous in Denmark. Pregnant employees are entitled to four weeks of maternity leave before giving birth and 14 weeks of maternity leave after giving birth, which means 18 weeks of maternity leave. During maternity leave, the employee receives full payment from the employer.

Fathers are entitled to two weeks of paternity leave after the birth of their child, during which they also receive full pay. In addition to paternity leave, fathers can also take two additional weeks of leave, known as 'Dad's quota', which is paid by the state.

After the maternity leave period, the parents can take parental leave for up to 32 weeks, which can be split between the two parents. During parental leave, parents receive a parental leave allowance from the state, calculated based on their income and can range from 50% to 100% of their salary, up to a maximum of 21,717 Kr. per month (as of 2023).

Background checks

Background checks in Denmark are not mandatory, but employers can conduct them in certain circumstances. The Danish Data Protection Act regulates the collection and processing of personal data, including during background checks.

Danish companies must have a legitimate reason for conducting a background check and obtain the candidate's consent before doing so. The candidate also has the right to access the information collected and to have any inaccuracies corrected.

Source: Shutterstock

Attracting talent

Denmark is known for its highly educated workforce and intense competition for top talent. Thus, companies must go above and beyond to attract and retain the best talent in the market. To achieve this, companies must provide an environment fostering employee engagement, well-being, and personal and professional growth.

Employee engagement is a significant factor that companies need to consider when hiring talent in Denmark. Companies prioritising employee engagement have seen benefits such as increased productivity, reduced turnover rates, and improved customer satisfaction. Therefore, companies must create a work environment where employees feel valued and engaged.

Offering competitive compensation and benefits packages is also essential in attracting top talent in Denmark. In addition to providing attractive salaries, companies should also consider offering benefits such as health insurance, retirement plans, and flexible working arrangements. Many employees in Denmark value work-life balance; thus, providing remote work options and other flexible working arrangements can be highly attractive to job seekers.

Another way to attract and retain top talent is to provide personal and professional growth opportunities. Companies can offer training and development programs to employees to help them enhance their skills and advance their careers. Providing such opportunities can help attract talent seeking a long-term career with growth prospects.

When sourcing talent, companies can use online job portals and social media platforms like LinkedIn to post job openings and reach a wider pool of candidates. Networking events and job fairs can also effectively connect with potential candidates. However, companies should ensure that their hiring practices are fair and unbiased. Denmark has strict anti-discrimination laws, and thus, companies must implement diversity and inclusion initiatives to attract and retain a diverse workforce.

In conclusion, to attract and retain top talent in Denmark, companies must prioritise employee engagement, offer competitive compensation and benefits packages, provide flexible working arrangements, and prioritise diversity and inclusion. Doing so can help companies build a talented and engaged workforce, significantly impacting their overall success.

Termination of employment

In Denmark, termination of employment is governed by the Danish Employment Act, which outlines the rules and requirements surrounding employee termination.

Severance pay

Severance pay is not mandatory in Denmark but can be negotiated between the employer and the employee. In some cases, collective bargaining agreements or individual employment contracts may include provisions for severance pay. The Danish Employers' Confederation recommends that severance pay be equivalent to one month's salary for every year worked, up to 12 months' salary.

Probationary period

When an employee is hired, the employer may establish a probationary period, which can last up to three months. During this period, the employer or the employee can terminate the employment without notice. Employees terminated during their probationary period are not entitled to severance pay unless otherwise stated in their employment contract. However, they are entitled to receive payment for any work performed up to the termination date.

Notice period

After the probationary period, the employer must provide written notice to the employee if they wish to terminate the employment. The notice period is based on the employee's length of service and can range from one to six months. Similarly, an employee must provide written notice to their employer if they wish to terminate their employment, and the notice period is usually one month.

Redundancy

If an employer terminates an employee due to redundancy, the employer must follow a specific process outlined in the Collective Redundancy Act*. This process includes informing the relevant trade union and giving the employees notice of termination. Sometimes, employers may be required to offer alternative employment or provide severance pay.

* The Collective Redundancy Act (Sammenlægningsloven) regulates the procedures employers must follow when making large-scale redundancies in Denmark. The act defines a collective redundancy as a termination of employment of 10 or more employees within 30 days or 20 or more employees within 90 days due to the employer's economic, technical, or organisational circumstances.

An employer considering a collective redundancy must inform and consult with the affected employees and their representatives. The employer must provide written notice to the employees and their representatives, explaining the reasons for the redundancy, the number of employees affected, the period of the redundancies, and the criteria used to select the affected employees. The employer must also provide information about any social plans or measures taken to mitigate the impact of the redundancies.

The consultation process must occur at least 30 days before the redundancies take effect, and the employer must consider any suggestions or alternatives proposed by the employees or their representatives. If an agreement cannot be reached, the employer must provide a written explanation for their decision.

If a collective redundancy is implemented, affected employees may be entitled to compensation. The amount of compensation is based on the employee's length of service and is calculated in accordance with the Collective Redundancy Act. The employer may also be required to provide outplacement services or other support to help affected employees find new employment.

Unfair dismissal

Unfair dismissal occurs when an employer terminates an employee without a valid reason or without following the correct process. Employees who believe they have been unfairly dismissed can file a complaint with the Danish Labour Court within six months of the termination.

Source: Shutterstock

What are my options for hiring?

For businesses seeking to attract talent in Denmark, there are a variety of solutions provided by Airswift to ease your hiring process within compliance with local laws.

Our long-standing expertise and knowledge minimise the risks of hiring and onboarding the cream of the crop Denmark offers. Let us bear the administrative tasks while you concentrate on your growing business.

Talent acquisition

When growing a business, there are always risks involved. That is why having talents with appropriate knowledge and expertise is vital. In Airswift, you get a local talent acquisition professional to source high-quality employees in a competitive market.

We also offer contract hiring for short-term projects and flexible staffing solutions – you will never have to compromise quality for urgent contract hiring. Our database of highly qualified contractors ensures you have the best for your organisation.

If you seek a more permanent staffing solution, our professional recruitment services can connect you with the best talents from Denmark who meet your requirements.

Employer of record

If you are looking for ways to hire people remotely but do not want to set up a physical office, an employer of record (EOR) might be just what you need.

A third-party employer of record (EOR) allows you to avoid the hassle of setting up a local office and focusing on running your business instead. They handle tasks like paying employees' wages and providing them with statuary benefits.

*Although the information provided has been produced from sources believed to be reliable, no warranty, express or implied, is made regarding the accuracy, adequacy, completeness, legality or reliability of any information. For the latest information and specific queries regarding particular cases, please contact our team.