By

Leanna Seah

September 20, 2024

Updated

October 17, 2024

Overview

The Ghanaian workforce is highly educated and motivated, making it an ideal place to find employees. This Sub-Saharan African nation's business climate is generally stable and welcoming to foreign investment. There is a wide range of talent in Ghana, with over 17 million people living in the country; Many of whom are young adults who attended university and have either found employment or are still looking for employment opportunities. These are good conditions for start-up companies to set up base if they are willing to train staff on the job or hire less experienced employees for role-specific requirements.

The education system here is strong, with over 40% of the population having some degree of post-secondary education. There are also many vocational schools that provide training for specific jobs within different industries like agriculture or construction work.

The employment laws in Ghana are favourable to employees; however, there are some restrictions on working hours and conditions that must be followed by all businesses. In general, the business climate in Ghana is friendly towards foreign businesses and investors.

The top industries in which it's easiest to find employees include tourism (hotels/resorts), oil/gas exploration/drilling companies (including offshore drilling platforms), manufacturing companies such as textile mills or furniture manufacturers), and construction companies (commercial buildings). There are also many up-and-coming industries in the services, economics and agricultural sectors.

| Capital | Accra |

| Languages spoken | The official language is English; however, national languages such as Dagaare, Dagbanli, Dangme, Ewe, Frafra, Ga, Gonja, Nzema, Twi, Fante and Ghanaian Sign Language are all widely spoken. |

| Population size | 32.7 million |

| Payroll frequency | Monthly/Fortnightly |

| Currency | Ghanaian Cedi (GH¢, GH₵, GHS) |

| VAT | Standard: 12.5% National Health Insurance Levy (NHIL) 2.5%. Ghana Education Trust Fund (GETFund) 2.5%. COVID-19 Health Recovery Levy (COVID-19 HRL) 1% Wholesaler/retailer of goods: 3% |

Source: Shutterstock

Source: Shutterstock

Payroll and taxes

Employer contributions

Employers contribute 13% towards an employee’s social security and pension funds.

Employee contributions

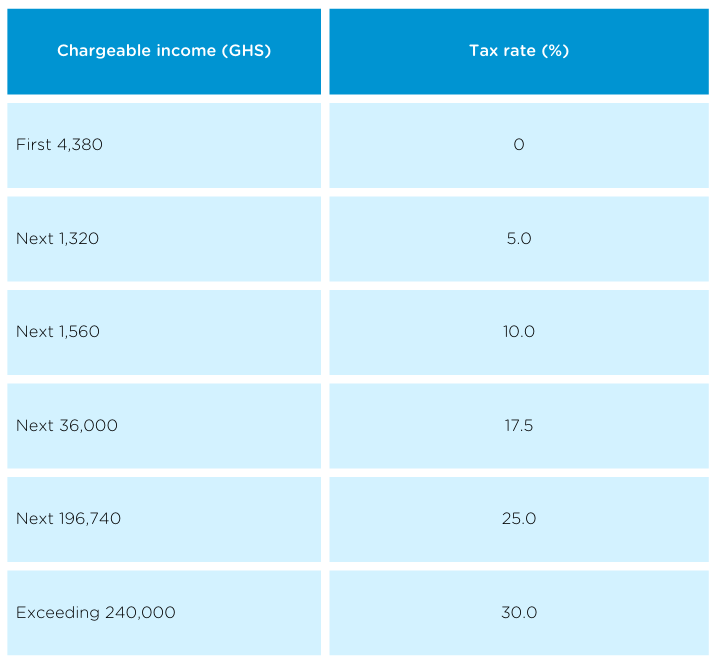

Employees contribute 5.5% towards their social security and pension funds. Employees also contribute to personal income tax with a “Pay as You Earn (PAYE)” concept – whereby 0% to 30% of an employee’s income is deducted by the employer and filed for tax. Income is deducted for Ghanaian residents on a graduated scale as follows:

Table 1: Ghanaian income tax rates on a graduated scale

Table 1: Ghanaian income tax rates on a graduated scale

Non-residents pay a flat rate of 25% as income tax.

Tax deductions

The following are deducted from the income before the PAYE is calculated for tax:

- Social security (5.5%)

- Interest on the mortgage on one residential premise of an employee

- Provident fund contribution (by the employer or employee) of up to 16.5% of the employee’s basic salary

- Charitable donations/contributions

Allowances/bonus

Some allowances given to employees in Ghana will be added to the salary before calculating PAYE, including:

- Transport

- Rent/accommodation

- Night shift

- Child education

- Domestic help

- Night shift

For bonus payments, employers must pay taxes on any bonuses paid to employees throughout the fiscal year, which range from 5% to 15% of the employee's yearly basic income. If the bonus payment exceeds 15%, the excess is added to the employee's earnings and taxed at graduated rates.

Working hours

Under employment compliance laws, a worker's working hours are restricted to eight hours per day or forty hours per week. If shorter work hours are set on certain days, the hours of labour on other days of the week may be proportionately longer than eight hours, but not more than nine hours per day or forty hours per week.

In the case of seasonal jobs where long hours of work are needed, the average number of hours of work throughout a year should not exceed eight hours a day, except that the hours of work which may be determined under labour law which shall not exceed 10 hours a day.

Source: Shutterstock

Minimum wage

Starting January 2023, the daily minimum wage in Ghana will be 14.88 GHS. Employers who fail to pay the minimum requirement will be subject to punishment.

For overtime hours, employees are paid 150% of their hourly salaries.

Employee benefits

Mandatory benefits

Employers in Ghana, whether in the public sector or private sector, are required to provide the following benefits for employees:

- Pension and social security contributions

- Annual paid leave

- Public holidays off

- Paid childbirth leave

Supplementary/optional benefits

In addition to mandatory benefits as laid out by Ghana's labour laws, employees may add the following benefits to the employment contract:

- Health insurance

- Housing allowance

- Holiday bonuses

- Free meals

- Private pension plans

- Flexible working

- Emigration benefit

Types of leave available

The Ghanaian law has provisions for:

Annual leave

Full-time regular employees are entitled to 15 working days of paid leave per year after one year of service.

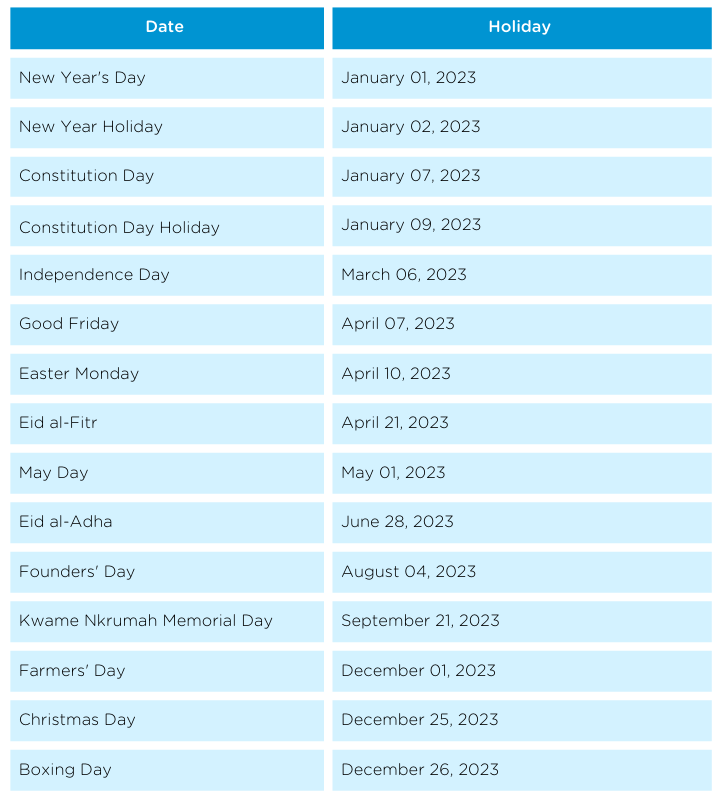

Public holidays

Table 2: Public holidays in Ghana

Table 2: Public holidays in Ghana

Sick leave

In Ghana, there is no formal legal necessity for paid sick leave.

Maternity/paternity leave

Pregnant employees are eligible for 12 weeks of paid maternity leave (14 weeks for multiple or difficult births) at 100% of their regular pay rate. When the birthing parent returns from maternity leave, they are entitled to one hour of unpaid time off during the workday to nurse their child until the child is one.

There are no legal requirements for paternity leave.

Source: Shutterstock

Background checks

There are no clear regulations or prohibitions on background checks on candidates. An employer may use a third party to do background checks on applicants as long as the behaviour does not infringe on the applicant's privacy based on the Data Protection Act 2012.

Attracting talent

The demand for talent in Ghana has increased significantly over the past few years. Companies in Ghana need to ensure that the talent they bring on board can deliver results and drive business success. Finding candidates with leadership characteristics can be challenging for employers, but personalising career development opportunities can positively impact employee engagement. It's important to know what candidates want and what motivates them so that you can attract the right people – not just those who are currently looking for jobs but also those who are happy where they are but may consider changing jobs down the line if presented with strong benefits and incentives.

Finding and keeping the right people with a holistic approach

In today's competitive labour market, finding and keeping the right people is a top priority for companies in Ghana. The challenge is that although many organisations have built up their talent management functions to include recruitment and retention, only some are equipped to handle this effectively. Achieving a balance between attracting new talent through recruitment efforts while also retaining existing employees is critical to success as it leads to higher retention rates and lower turnover costs. Organisations that can successfully execute a holistic approach to talent management will enjoy significant benefits such as increased productivity, better customer service, and improved employee engagement.

Personalised career development opportunities drive engagement and productive employment

Training is essential to any employee's development, and the benefits are just as important for team leaders as for entry-level employees. Training can take many forms, including in-person seminars, online courses, and self-paced training modules.

The goal of training should be to provide employees with information that is relevant to their roles and current job description. This means employees should be able to choose which skills they want to learn more about based on what they need to do the best work possible—and it also means that managers need to ensure that those choices align with long-term career goals so that everyone stays motivated and engaged over time.

Personalised career development opportunities can have a positive impact on employee engagement. Employees are looking for opportunities to grow and learn, not just a paycheck. They want to be challenged and gain new skills, but they also want recognition for their accomplishments.

Employees want more than just an office environment where they can work on projects; they crave greater collaboration with colleagues, leaders and clients so that every interaction is an opportunity to learn from one another in order to improve the company’s services or products as well as their own performance.

Recommendations for employers on hiring and retaining top talent

- Be aware of the current labour market.

- Hire the right people.

- Provide employees with opportunities and training to develop their skills and grow in their careers.

- Provide a competitive salary and benefits package that meets the needs of your employees.

- Provide a proper work/life balance.

- Communicate clearly about expectations for performance and behaviour.

- Provide coaching for role-specific requirements.

- Support your employees by providing them with a safe and fair work environment.

- Make access to mental health services easy for employees.

- Offer opportunities for employee engagement, including a voice in decisions that affect their jobs.

- Practise non-discrimination; persons with disabilities, underprivileged people, and other minorities need to be given a fair chance.

Ghanaian workers are increasingly seeking out jobs that offer a better work-life balance and more opportunities for personal growth. Employers who are aware of these trends can ensure that they attract top talent by offering these job perks to attract and retain top talent.

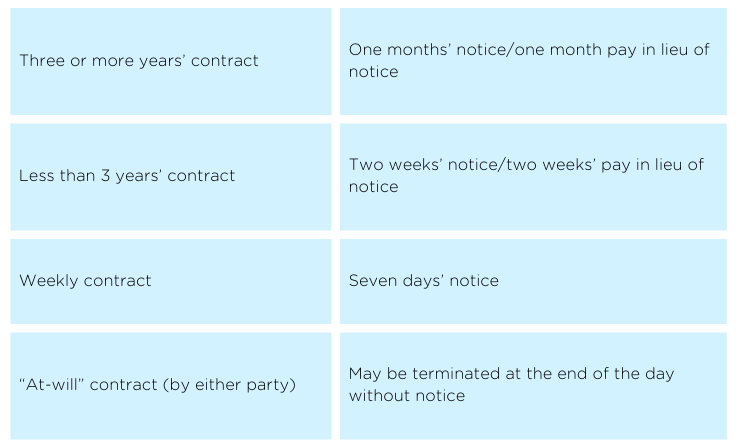

Termination of employment

The termination procedure varies based on the kind of contract, the grounds for termination, and the employment agreement or collective bargaining agreement. Either the employee or the employer can end the employment contract at any time with written notice. Employees can challenge the termination in the labour court if the termination is found to be unfair.

However, if the employment contract states an “at-will” clause, then either the employer or the employee may terminate the employment without cause at the conclusion of the day. If the absence of an “at will” clause, paying the employee in lieu of notice is acceptable.

Severance pay

In the case of individual terminations, it is not required to be compensated. However, if the termination is due to redundancy, the is the possibility for the employer and employee to discuss fair compensation. Wrongful terminations can be taken up to the labour court – if it is found that the employee has been unfairly discharged, the employer may be required by law to reinstate the employee or pay for compensation and damages.

Probationary period

The period of probation is often included in the employment agreement or collective bargaining agreement in Ghana.

Notice period

In Ghana, the notice period is as follows:

Table 3: Notice periods in Ghana

Table 3: Notice periods in Ghana

Source: Shutterstock

What are my options for hiring?

For organisations looking to attract talent in Ghana, Airswift offers options to make the hiring process easier while remaining compliant with local rules.

Our extensive experience and skills reduce the risks associated with hiring and onboarding Ghana's best talents. Allow us to handle the administrative responsibilities so you can focus on building your business.

Talent acquisition

There are always risks when starting a business. That is why having people with the necessary knowledge and abilities is vital. Airswift assigns a local talent acquisition expert to assist you in finding high-quality candidates in a competitive market.

We also provide contract hiring for short-term projects as well as flexible employment choices, so you'll never have to trade quality for urgent contract hires. Our network of highly qualified contractors guarantees that your company will have the best.

If you are searching for a more permanent solution, our professional recruitment services can connect you with the best talent in Ghana to fit your needs.

Employer of record

If you want to recruit individuals remotely but don't want to have a physical office, an employer of record (EOR) in Ghana may be the solution.

A third-party employer of record (EOR) allows you to bypass the headache of establishing a local office and instead concentrate on running your business. They are in charge of activities such as paying employees' salaries and providing them with statutory benefits.

*Although the information provided has been produced from sources believed to be reliable, no warranty, express or implied, is made regarding the accuracy, adequacy, completeness, legality or reliability of any information. For the latest information and specific queries regarding particular cases, please contact our team.