Guide to hiring employees in Kazakhstan

Everything you need to know when expanding your workforce in Kazakhstan

Source: Shutterstock

Overview

Energy companies should consider expanding their business to Kazakhstan because the country has significant natural resources, particularly in the energy sector. Kazakhstan is one of the world's largest producers and exporters of oil and gas, and it has abundant reserves of coal and uranium as well.

Moreover, Kazakhstan is strategically located at the crossroads of Europe and Asia, making it an important transit route for oil and gas exports to global markets. The country has a well-developed transportation infrastructure, including pipelines, railways and highways, which facilitates the transportation of energy resources.

Additionally, Kazakhstan has a favourable investment climate, with a stable political system, a competitive tax regime, and a relatively low cost of doing business. The government has implemented a range of policies and incentives to attract foreign investment, including streamlined procedures for obtaining licences and permits, and tax exemptions and holidays for certain types of investments.

Overall, expanding to Kazakhstan presents significant opportunities for energy companies to tap into the country's vast energy resources and benefit from its favourable investment climate and strategic location.

| Capital | Astana |

| Languages spoken | Kazakh and Russian |

| Population size | 19 million |

| Payroll frequency | Monthly |

| Currency | Kazakhstani Tenge (KZT) |

| VAT | 0.25% |

Payroll and taxes in Kazakhstan

VAT rates in Kazakhstan

VAT

Kazakhstani VAT rates are as follows:

Table 1: VAT rates based on goods/type of service

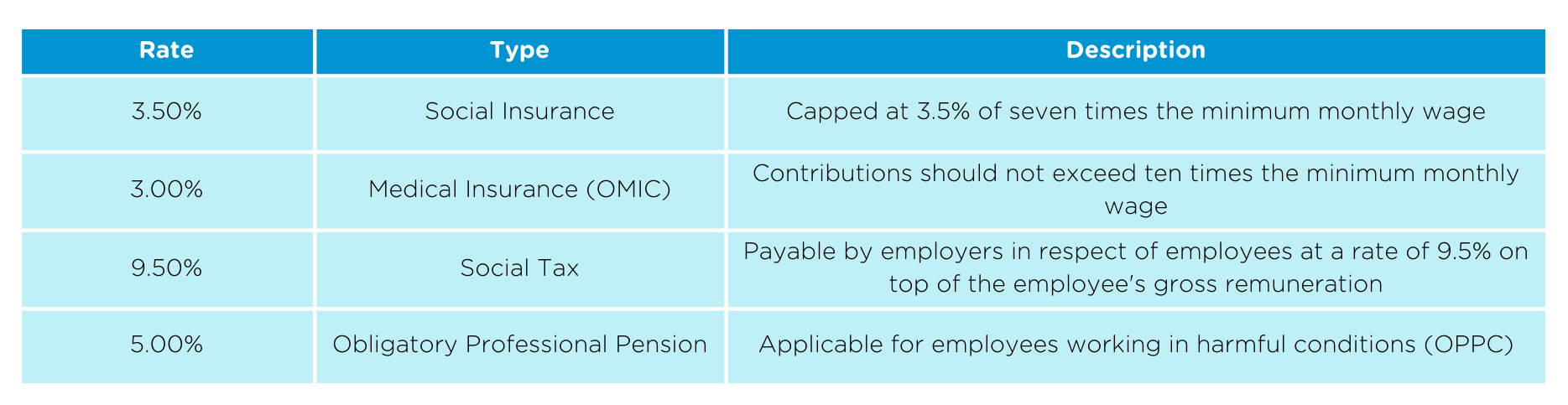

Employer contributions in Kazakhstan

Employers in Kazakhstan are required to make several tax contributions to the government on behalf of their employees, including:

Table 2: Employer contribution rate

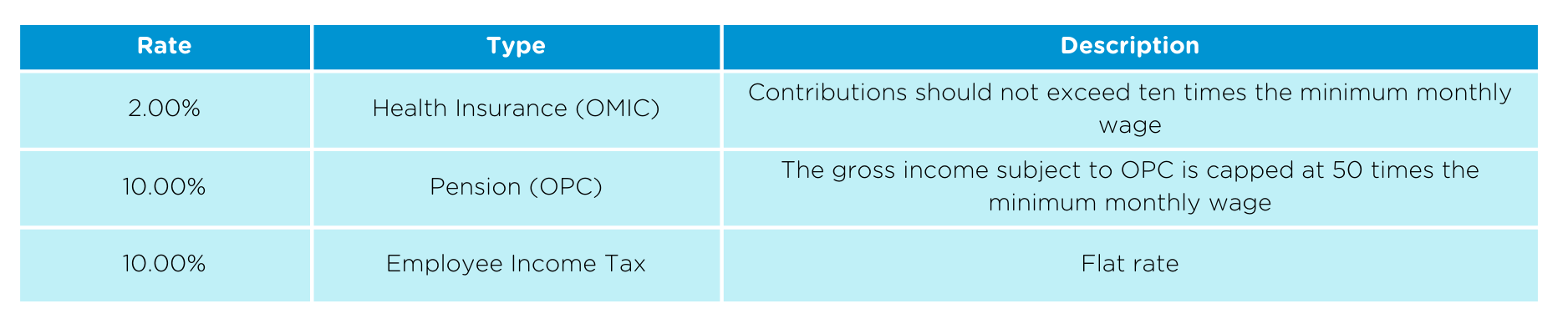

Employee contributions in Kazakhstan

Employees in Kazakhstan are also required to make some tax contributions, including:

Table 3: Employee contribution rate

It's important to note that the tax system in Kazakhstan is complex, and the rates and regulations can change frequently.

Minimum retirement age in Kazakhstan

In Kazakhstan, the retirement age varies depending on the employee’s gender. The minimum retirement age for men is 63, and for women, it is 60.5.

Minimum wage in Kazakhstan

As of January 2023, the minimum wage in Kazakhstan is KZT70,000.

Employee benefits in Kazakhstan

Mandatory Benefits

Employers in Kazakhstan must provide their employees with several mandatory benefits, including:

Pension

Compulsory pension contributions: Employers must contribute 10% of their employee's gross salary to a state pension fund. These contributions are made on the employee's behalf and are intended to provide a retirement benefit.

Disability and survivor pensions: The state pension fund provides disability and survivor pensions to eligible employees or their dependents if the employee becomes disabled or dies while employed. The pension benefit amount depends on the length of the employee's service and salary.

Employees may also voluntarily contribute to the state pension fund to increase their retirement benefits.

Paid time off

Employees in Kazakhstan are also entitled to annual, sick, and maternity leave. We will cover these benefits in more detail later on in the guide.

Social insurance

As highlighted in the tax section, employers are required by law to provide their employees with social insurance, which covers benefits such as healthcare, disability, and pensions.

Supplementary/Optional Benefits

In addition to the mandatory benefits required by law, some employers in Kazakhstan offer supplementary benefits to attract and retain employees. Some common supplementary benefits include:

Health insurance: Employers may provide their employees with health insurance, covering medical expenses and hospitalisation costs.

Life insurance: Employers may also offer life insurance to their employees, which provides a lump sum payment to the employee's beneficiaries in the event of their death.

Retirement benefits: Some employers offer retirement benefits such as a 401(k) plan or a pension plan to help employees save for retirement.

Professional development: Employers may provide opportunities for professional development, such as training programs, workshops, or tuition reimbursement for continuing education.

Flexible work arrangements: Some employers offer flexible working arrangements, such as remote work or flexible hours, to help employees balance work and personal responsibilities.

Source: Shutterstock

Working hours in Kazakhstan

The regular working hours in Kazakhstan are eight hours per day (40 hours per week). Any work carried out beyond this should be considered overtime. Overtime must be at most two hours per day; overtime hours can be up to 12 hours per month and 120 hours per annum.

Types of leave available in Kazakhstan

Annual leave

Employees can take at least 24 calendar days of paid leave every year, two weeks of which must be consecutive. Employees engaged in heavy work are entitled to an additional minimum of six calendar days. This refers to employees who work under harmful or hazardous conditions and those with category 1 and 2 disabilities.

Annual leave can only be carried over to the next year if the employee is temporarily disabled or pregnant. In these instances, employers should grant a part of the paid annual leave during the current or next working year.

As an employer, you must pay your employees for their annual leave before they go on vacation. This payment must be made at least three working days before the vacation starts. If an employee is granted leave at a time not part of their regular vacation schedule, you must also pay them for that time off.

If an employee's annual leave period goes beyond the end date of their employment contract, and the employee is paid for that period, their last day of work will be considered the last day of their paid leave. This means that their employment contract will end on the last day of their paid vacation.

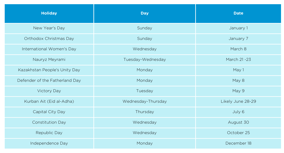

Public holidays

Table 4: Public holidays in Kazakhstan

The calendar above is true for the year 2023. Please note that some holidays have varying dates based on the lunar calendar or specific observances. It's always advisable to check the official sources or local authorities for the most accurate and up-to-date information regarding public holidays in Kazakhstan.

Sick leave

Employers are legally required to provide their employees with paid sick leave if they cannot work due to illness or injury. The length of the sick leave depends on the severity of the illness or injury and is determined by a doctor.

During the sick leave period, the employee is entitled to a percentage of their salary. The amount of the sick leave benefit depends on the length of the employee's service with the employer and the reason for the sick leave.

Some employers in Kazakhstan require their employees to provide a doctor's certificate as proof of their illness or injury before they can take sick leave. A licensed medical practitioner must issue this certificate.

Maternity/Paternity leave

As an employer in Kazakhstan, it's important to know that there are specific maternity and paternity leave guidelines.

Maternity Leave

Pregnant employees are entitled to maternity leave for 126 calendar days, with 42 days to be taken before the expected delivery date. Maternity leave can be extended by 14 calendar days in case of a difficult delivery or in case of multiple births. During this time, the employee is entitled to receive 100% of their average salary based on the six months before taking maternity leave.

Paternity Leave

Employees are entitled to take paternity leave for a period of 14 calendar days within the first two months after the birth of their child. During this time, the employee may receive 100% of their average salary based on the six months before taking paternity leave.

It's important to note that employers legally must grant maternity and paternity leave to eligible employees and cannot terminate their employment during this time.

Adoption leave

The length of adoption leave for a single adoptive parent is 70 calendar days, and for two adoptive parents, it is 80. The adoption leave can start up to seven calendar days before the adoption date and must be taken within the first year after the adoption. The employee is entitled to receive their average salary based on the six months before taking adoption leave.

The employee must provide documentation of the adoption, such as an adoption certificate, to their employer. Employers must grant adoption leave to eligible employees and cannot terminate their employment during this time.

Employers should also ensure that they comply with all relevant laws and regulations regarding adoption leave.

Other leave

Employees are entitled to up to five days of unpaid leave for family circumstances such as the death of a close relative. The employment contract or collective bargaining agreement may provide additional types of leave.

If an employee is studying at an educational institution, they can receive study leave to prepare for exams, lab work and diploma work to undergo training programmes for the military. Agreements, collective labour contacts and training contracts will determine payment for this type of leave.

Background checks in Kazakhstan

In Kazakhstan, background checks play an important role in the hiring process. Employers must conduct mandatory criminal record checks as part of the background check procedure. This involves verifying the criminal history of potential employees to ensure they meet the necessary legal requirements and do not pose any risks to the organization.

However, there are currently no specific mandatory requirements for verifying education or employment history in Kazakhstan. While employers can conduct checks on these aspects, it is not a legal requirement. This means that employers have the discretion to decide whether they want to verify potential candidates' educational qualifications or previous work experience.

It's important to note that background check practices can vary among different industries and employers in Kazakhstan. Some employers may conduct more comprehensive background checks, including education and employment verification, to ensure they hire qualified and trustworthy individuals. It's advisable for employers to establish their own internal policies and procedures regarding background checks, taking into account industry best practices and legal considerations.

To ensure compliance with local laws and regulations, it is recommended that employers in Kazakhstan consult with legal experts or local authorities for the most accurate and up-to-date information regarding background checks and any specific requirements or guidelines that may apply.

Source: Shutterstock

Attracting talent in Kazakhstan

There are several things employers in Kazakhstan can do to attract and retain talent:

Offer competitive salaries and benefits

One of the most effective ways to attract talent is to offer competitive salaries and benefits. This can include health insurance, extra paid time off, additional retirement plans and other important employee perks. It can help to survey other employees to see how your benefits packages can align with their values and goals.

Provide opportunities for growth and development

Employees are often attracted to companies that offer opportunities for growth and development. This includes training programs, mentorship opportunities and career advancement paths.

Emphasise work-life balance

Many employees are pushing for a better work-life balance in today's job market. Employers can attract talent by offering flexible work arrangements, such as remote work options or flexible schedules for those unable to work from home.

Build a positive company culture

A positive company culture can be a major draw for employees. Employers can create a positive culture by emphasising teamwork, open communication, and employee recognition programs.

Overall, attracting talent in Kazakhstan requires a strategic approach considering employees' unique needs and preferences. Employers can attract and retain top talent in the market by offering competitive salaries and benefits, providing opportunities for growth and development, emphasising work-life balance, and building a positive company culture.

Termination of employment in Kazakhstan

Employers can terminate a fixed-term contract on the following grounds: business, personal or worker misconduct. In any of these cases, the employer must provide notice and a written explanation for the employment termination.

If the reason is a worker’s misconduct, the employer must provide a warning and give the employee a chance to explain their actions.

Upon employee request, the employer must provide a termination letter or employment certificate including the dates of employment, job nature, recommendation and salary details. Employers must provide this letter within five working days from the requested date.

Severance pay

There are no provisions in the law regarding severance pay in Kazakhstan.

Probationary period

Probation periods must be established in the employment contract and should not exceed three months.

Notice period

Kazakhstan's standard notice period for terminating an employment contract is one month. This means that either the employer or the employee can terminate the contract by giving at least one month’s written notice to the other party.

However, there are some exceptions to this standard notice period, depending on the type of contract and the employee's length of service. For example, if the employee has worked for the company for less than six months, the notice period may be reduced to two weeks.

In some cases, an employer may be required to provide a longer notice period under the Kazakh Labor Code, such as in cases of mass layoffs or if the company is being liquidated. Additionally, the employment contract terms may also specify a longer notice period, so it's important to check the contract for any relevant provisions.

Source: Shutterstock

What are my options for hiring in Kazakhstan?

If you want to expand your business to Kazakhstan, a company like Airswift can help you get started. We offer employment solutions designed to ensure you stay compliant across all local legal requirements, including tax, payroll, termination procedures and working hour obligations.

Our in-country teams have the expertise and knowledge necessary to save your organisation from unnecessary risk, freeing up your time to focus on the other prospects of international business growth.

Some of the options businesses can explore include:

Talent acquisition

We understand that hiring and expanding globally is a complex process and an Employer of Record can help you hire employees without setting up a local entity. Working with an Employer of Record in Kazakhstan allows you to get up and running in as little as 72 hours. Once your employee has been given the green light, we will take care of everything from onboarding and benefits management to tax filings and annual leave allowance.

Talent acquisition

Airswift can source and deliver the talent you need across various industries by leveraging our expertise and employee networks in Kazakhstan.

If you would like to hire for an urgent project or need to cover a staffing shortage, we are committed to finding a contractor to suit your needs. Our contract hire services are catered to organisations that need temporary hires to fulfil various requirements.

Finally, if you’re looking to hire candidates that can grow with your company, we have professional search services that provide access to highly skilled job seekers who are ready for work. We also handle all the administrative processes, from shortlisting candidates to screening and onboarding them.

Employer of record

We understand that hiring and expanding globally is a complex process and an Employer of Record can help you hire employees without setting up a local entity. Working with an Employer of Record in Kazakhstan allows you to get up and running in as little as 72 hours. Once your employee has been given the green light, we will take care of everything from onboarding and benefits management to tax filings and annual leave allowance.

Speak to an expert

*Although the information provided has been produced from sources believed to be reliable, no warranty, express or implied, is made regarding the accuracy, adequacy, completeness, legality or reliability of any information. For the latest information and specific queries regarding particular cases, please contact our team.

Table of Contents

Speak to an expert

Want to speak to an expert about hiring employees in Kazakhstan?

Get in touch