By

Raphael Santos

April 12, 2022

Updated

February 13, 2024

Source: Frame Stock Footage/Shutterstock

The public agenda to combat the climate crisis and the engagement of private investors can accelerate new technological breakthroughs

The beginning of the century brought massive hype with the dawn of clean technologies and their promises. If we track its start in the media and public discussion, it would have begun with the launch of Al Gore's book, "An Inconvenient Truth". This was followed by a remarkable succession of investments in energy companies — with some reaching maturity and others not surviving beyond the hype.

The fact is that many valuations were overvalued, resulting in a cleantech bubble that left a bad experience among venture investors. But now, clean technologies are experiencing a renaissance.

Cleantech 2.0 or Climate Tech

Cleantech 1.0 experienced its boom between 2006 and 2011 when it saw a total of USD$25 billion dollars flowing by venture capital funds in its market.

Many of the cleantech companies of the time presented innovative solutions but were still nascent. Many of these startups ended up requiring much more investment and R&D time, which eliminated the possibilities of short-term returns and caught investors off-guard.

What has been called Cleantech 2.0, or climate tech, emerged around 2018, after the Paris Agreement (2015), as environmental issues became a priority for the public.

Source: Frame Stock Footage/Shutterstock

Source: Frame Stock Footage/Shutterstock

The difference caused by the names, Cleantech 2.0 or climate tech, is still confusing. While some leaders follow the premise that climate tech is simply an evolution of the old Cleantech 1.0 market, others prefer to treat this emerging sector as something entirely new.

In this article, we will treat both terms as synonyms to avoid going deeper into this controversial terminology. But just for you to know, the two names are commonly used to categorize technologies prepared to help us decarbonize the global economy by 2050.

Today we are witnessing another optimistic cycle in the cleantech sector. While it certainly requires caution, there are various new factors to encourage our hope in this current market.

Why is the Cleantech 2.0 scenario better?

A typical question: Why is Cleantech 2.0 more promising than its predecessor technology? What are the signs that indicate this change of winds? Continue reading our article to find out more.

Renewable energy sources are cheaper

Clean technologies have become cheaper. The average price of energy utilities is dropping. One good example is solar panels; their cost has declined by 71% over the last ten years. And we can consider that as a strong reason for the total capital invested in climate tech achieving its maxim in 2021.

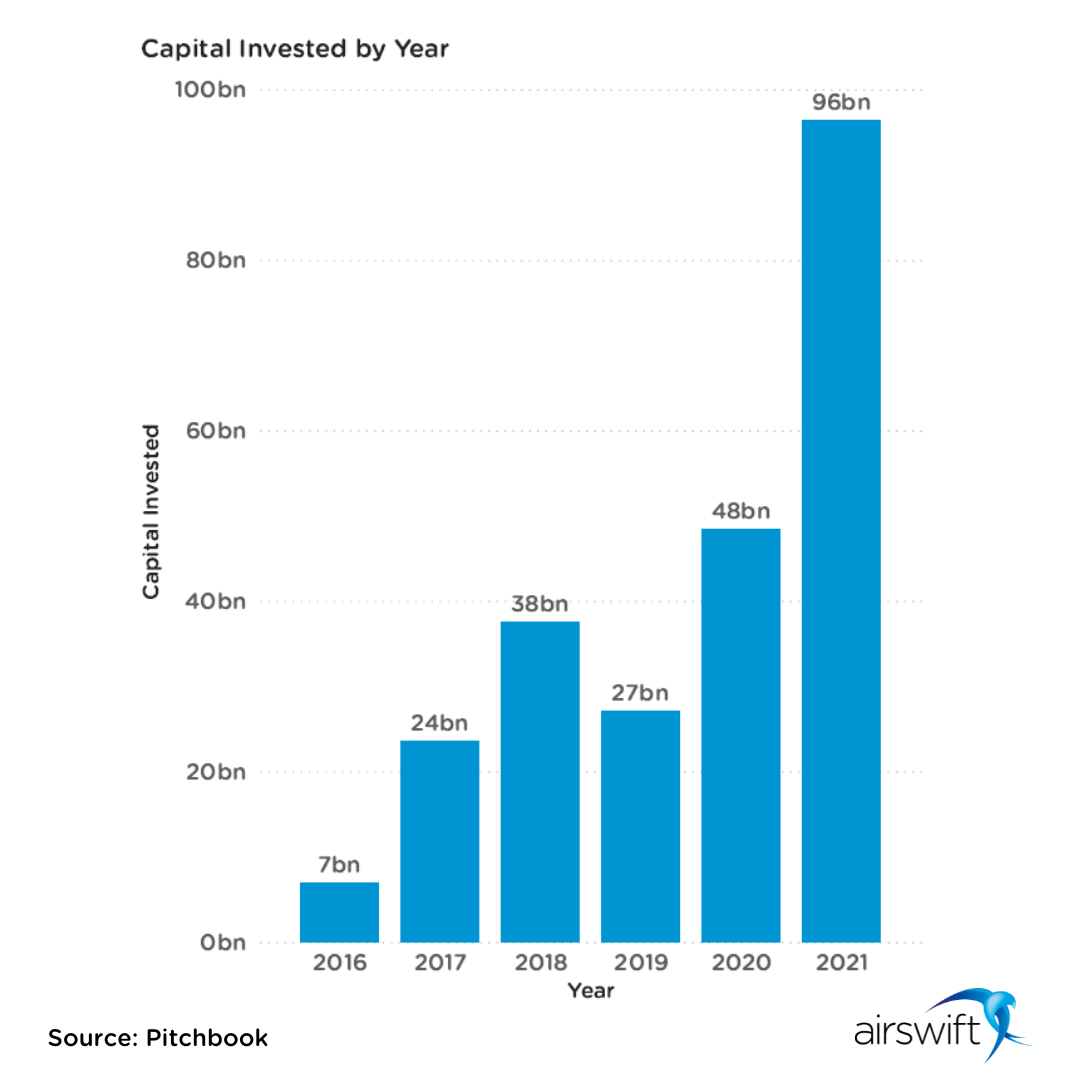

According to Pitchbook’s Institutional Research Team, the climate tech sector (which encompasses this second wave of Cleantech startups) has shown an impressive investment performance last year.

In 2019, due to the pandemic, funding retreated. However, as we can see in the chart, venture capital funds returned to action in the following years. One hypothesis that we can rise is the positive perspective caused by vaccines in that meantime.

The public agenda has progressed

The Paris Agreement

The historic Paris agreement is responsible for increasing the joint efforts of countries toward the goal of a net-zero economy by 2050.

Other commitments to net-zero that are worth mentioning include the "Fit for 55" package. For example, the European Union's answer to the climate crisis is ambitioning to reduce carbon emissions by 55% by 2030.

COP26

And also, we have the compromises projected at the 2021 UN Climate Change Conference (COP26). The final proposal was signed by a group of countries representing 70% of the global economy. In all, over 40 governments have committed to accelerating investments in clean energy and facilitating partnerships between the private and public sectors. The Breakthrough Agenda set goals for 2030 in the following sectors:

- Power

- Road transport

- Steel

- Hydrogen

- Agriculture

These particular junctions between public and private financing will be a watershed moment in the scaling up of new green technologies.

Talent migration

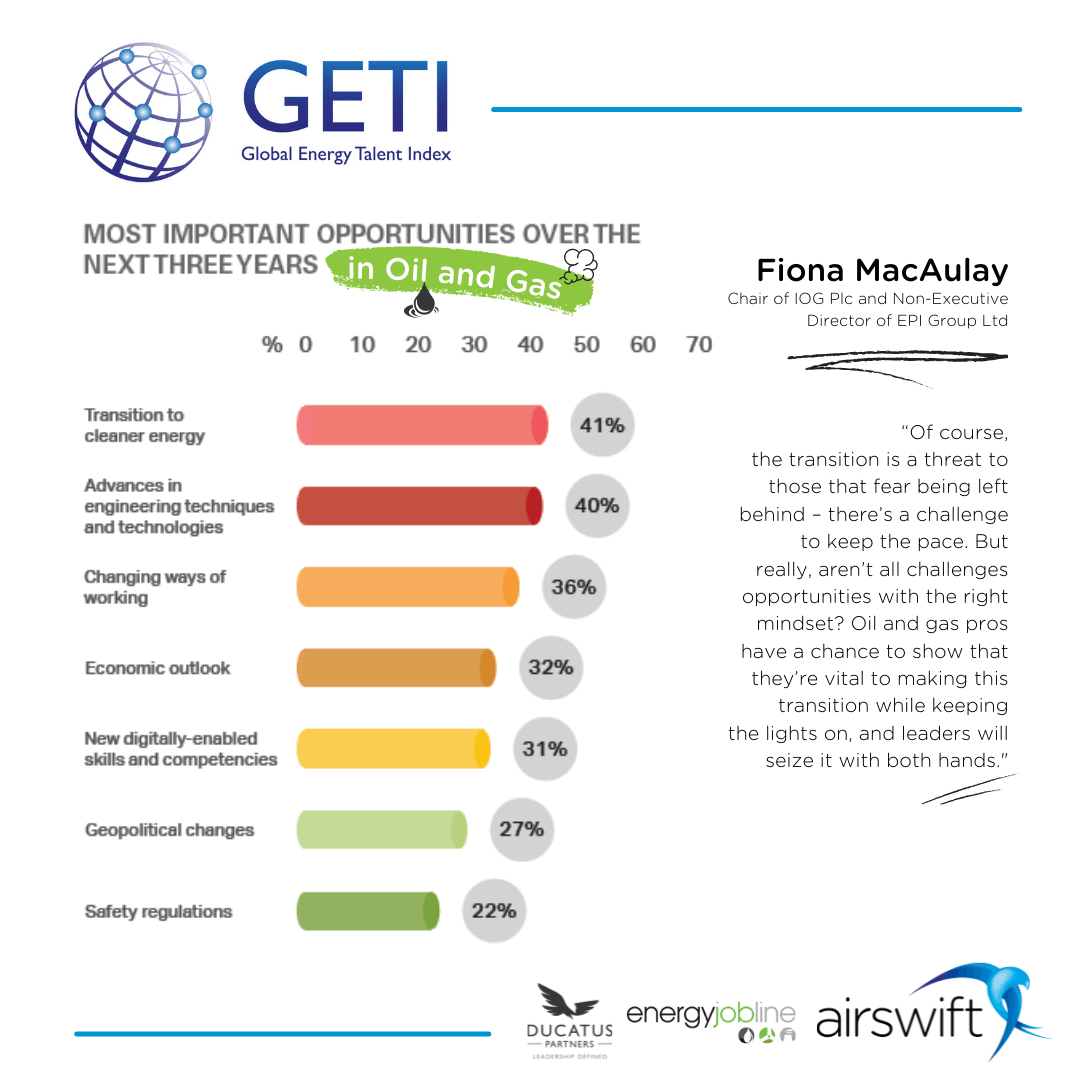

The Global Energy Talent Index (GETI) 2022, launched by Airswift, spotlights the latest trends in the energy industry, and the energy transition takes centre stage. Within the Oil and Gas sector, the transition to cleaner energy is seen as the most important opportunity over the next three years.

Other sectors like Renewables and Nuclear also listed the energy transition in the 1st position. Petrochemicals had in 3rd, while Power in 2nd. The GETI report listened to almost 10,000 energy professionals of 144 different nationalities spanning 161 countries.

The consensus around clean energy as one of the main opportunities in the short-term shows where investments will be going on and, consequently, the migration of skilled workers.

The green economy is becoming ubiquitous and plans to set its decarbonization mindset throughout different sectors in the entire global industry. There's plenty of room for talent, and the high demand doesn't show signs of slowing down. Whether in business or research, business leaders all want a slice of the Cleantech 2.0 pie.

The Glasgow Financial Alliance for Net Zero (GFANZ)

The GFANZ consortium is an alliance made up of private stakeholders who have over USD$130 trillion in assets and are committed to helping achieve the Paris Agreement's goals. With that in mind, more and more investments are expected from these investors to reduce the world's temperature levels.

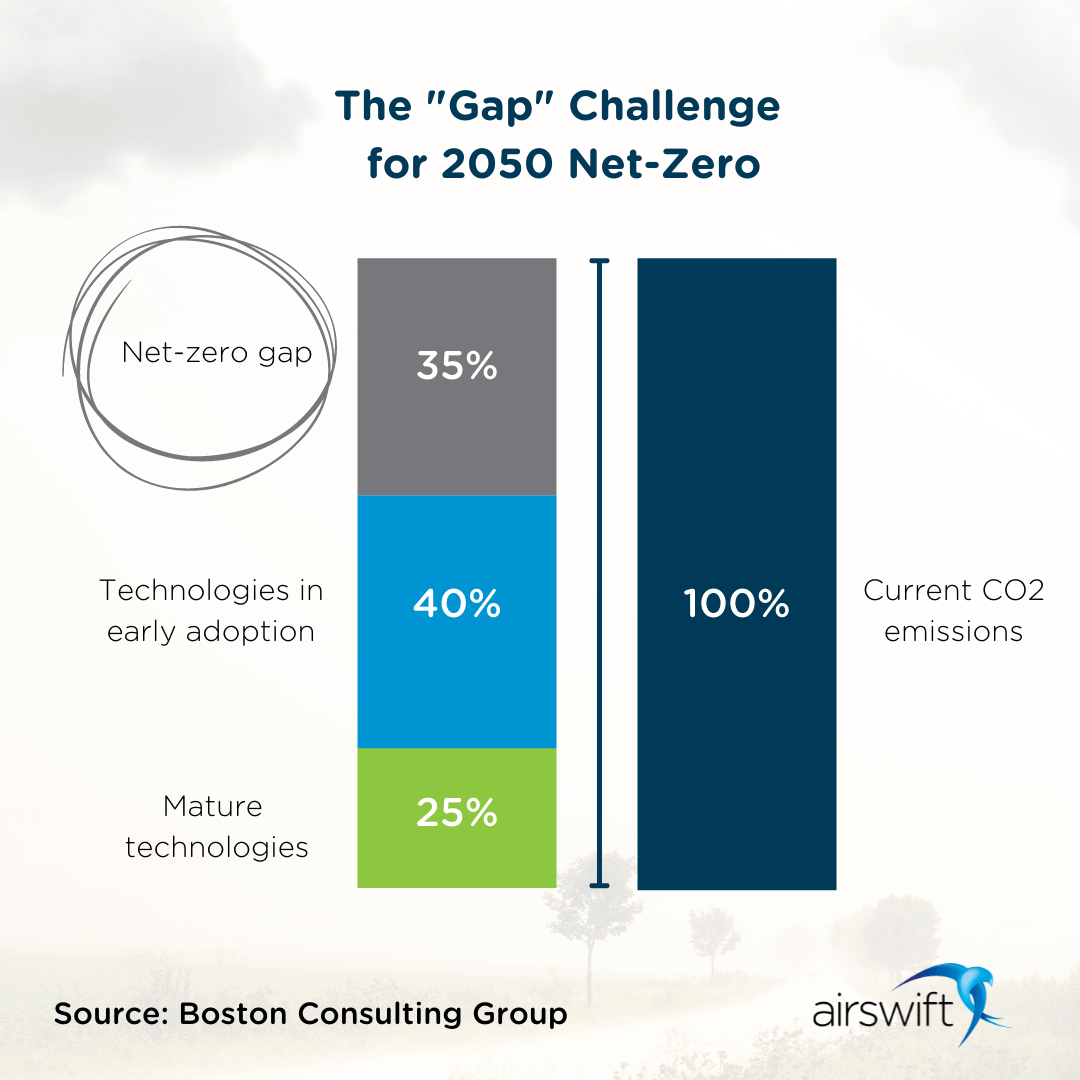

GFANZ also advocates for more public-private partnerships to accelerate this net-zero economy transition. This blended form of capital is again essential for innovative solutions to eliminate the dependence on fossil fuels. And while many clean technologies existing can help us achieve the Paris Agreement goal, there is a current tech gap of 35% making this accomplishment difficult.

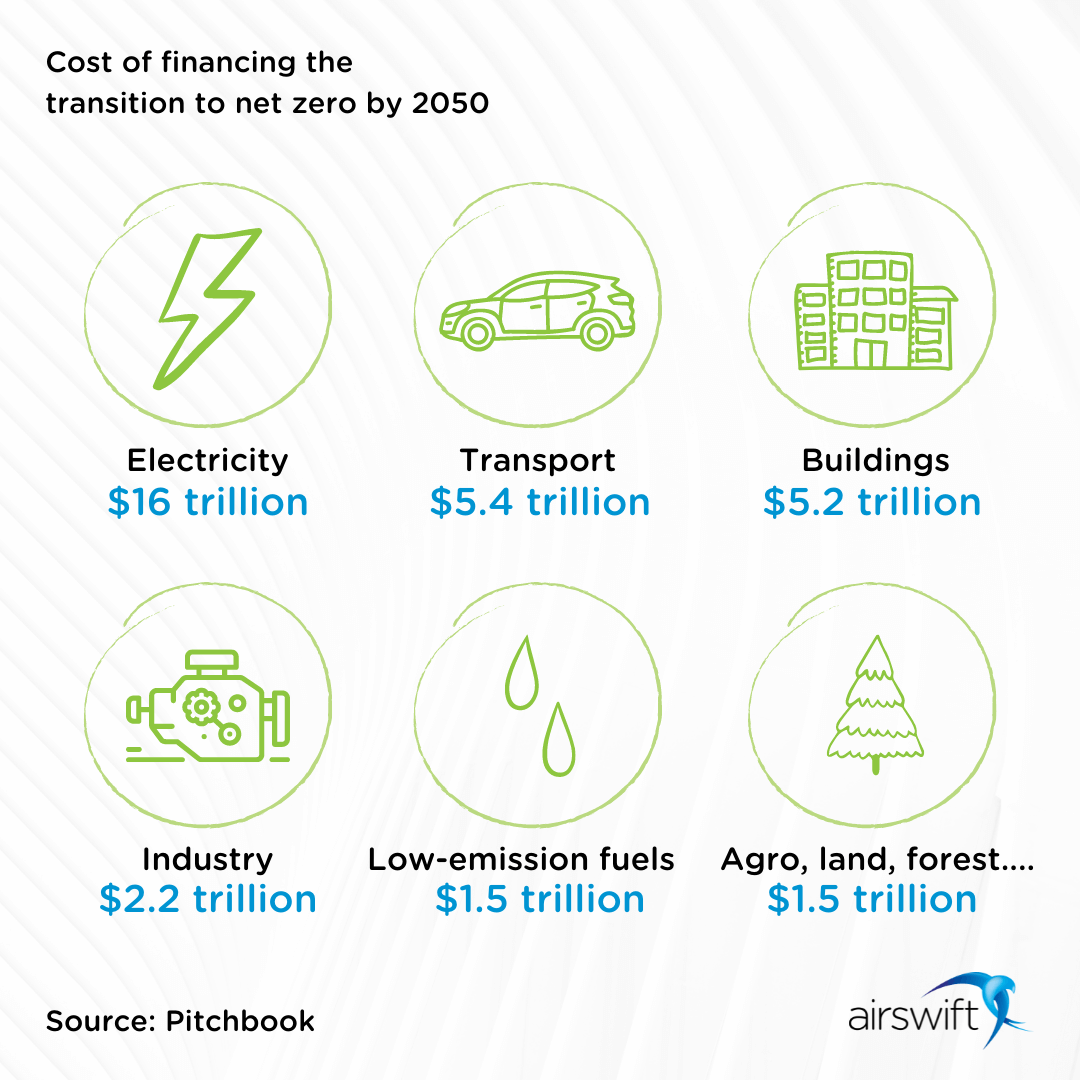

Cleantech investments need to keep increasing so we can change the numbers and reach the net-zero plan. There's a tremendous opportunity at hand we're talking about between USD$100 and USD$150 trillion to decarbonize the planet in the estimated period.

Let's check some of the promising technologies on the radar of investors below.

Promising Cleantech 2.0 technologies

As highlighted above, the Breakthrough Agenda established at COP26 foresees that the alliance between public and private capital is fundamental to making clean technologies more accessible by 2030.

So, it is crucial that the following investments must be to scale new technologies.

Grid and PV power in southern world countries

Existing power grids are outdated and carbon intensive, so that's why Cleantech 2.0 will need investments in grid integration focusing on the following technologies:

- Long-duration storage

- Advanced controls

- Software and communication

- Vehicle-to-grid integration

- Building-to-grid integration

- Next-generation nuclear

- High-efficiency materials

Africa, Central and South America are the regions that will most benefit from this improvement in solar panels, smart grid networks and more. It's a big opportunity to establish and expand cleantech startups in those continents.

Clean Industry

Investors are seeking to clean up industry processes in potential markets. Here, the Asian market is the one that will largely receive funding to reduce its carbon emissions. See the following promising technologies:

- Green steel

- Alternative protein — both lab-raised and alternative

source protein - Industrial electrification

- Green hydrogen

- Chemical electrification

The main focus of these investments tends to be on activities that are more difficult to undergo decarbonization, such as manufacturing. For instance, carbon emissions from steel represent almost 9% globally, which needs to lead to investments in a more sustainable alternative.

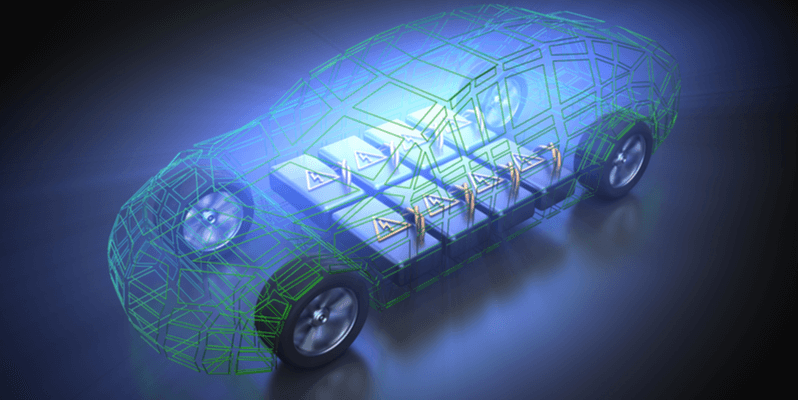

Battery and energy storage

Long-storage duration is another challenge faced by the cleantech sector. Electric transportation represented 48% of the total investment in the sector last year. Below are the clean technologies to drive energy savings:

- Battery tech

- Battery control software

- Long-duration energy storage

- Offshore wind grid connectivity

Decarbonized transport is the area that promises to go ahead with a massive increase in investment. Projections already speak of three times more capital being injected into the segment, from USD$390 billion per year (the early 2020s) to USD$1.2 trillion (2030s). And twenty years from now, the numbers could reach ten times more than what is currently being invested.

Source: Frame Stock Footage/Shutterstock

Source: Frame Stock Footage/Shutterstock

The built environment

Building efficiency is the word here. Investments to decarbonize buildings (retrofits, cooling appliances) can increase fourfold, from USD$190 billion to USD$710 billion per year (2020 - 2040).

These are the innovation initiatives ready to be funded:

- Efficient building systems—especially heating and cooling

- AI reforestation data analysis

- Bioengineering

The UAE is one of the countries in the world with consistent investments in sustainable buildings. For instance, you have projects like Masdar City, fully designed to follow the best clean energy practices. Initiatives by the local government, such as the Projects of the 50, will for sure accelerate the cleantech industry in the Middle East.

Download the GETI report to learn more about energy transition

The transition to a more sustainable activity, where clean energy is vital to the business, has already become the issue of our time. The current moment is seen as a paradigm shift, the passage of an era, and everything we’ve seen until now paints a hopeful picture of why Cleantech 2.0 will carry us to net-zero in 2050.

Going into the direction of renewable energy sources is the only direction for the survival of businesses and humanity against the climate crisis.

You will need as much information as possible to plan and make the best decision. Here at Airswift, we work closely with engineering and technology industries to provide unwavering support across various levels, ranging from global mobility services to recruitment and consulting. We currently have more than 60 offices worldwide and employ more than 9,000 contractors.

Our recent edition of the 2022 GETI report takes a comprehensive look at talent trends in the global energy sector. Download the report below to find out all about the next steps to take as we collectively navigate the energy transition.