By

Nathalia Duarte

November 4, 2025

Updated

February 4, 2026

Wind power has been the largest source of renewable energy in the U.S. since 2019, with more than 153 GW installed. Although the country’s capacity more than doubled from 2014 to 2023, most of the wind energy produced is onshore, with the offshore wind farms slowly rising.

Despite this progress, the industry faces headwinds. Policy shifts and economic pressures have slowed growth, raising concerns about future expansion.

In this article, we examine the US onshore and offshore wind markets, significant projects, and how new policies are transforming the U.S. wind energy landscape.

What is the difference between onshore vs offshore wind?

Onshore wind power is generated by turbines located on land, typically in open, rural areas with unobstructed airflow. Today, U.S. onshore wind generates enough electricity to power over 46 million homes.

Onshore wind advantages:

- Low emissions during construction and operation

- Among the most affordable renewable sources, alongside solar PV

- Faster to build and cheaper to maintain than offshore wind

Onshore wind challenges:

- Fluctuating wind speeds

- Intermittent generation

- Concerns about visual and environmental impact

Offshore wind taps into stronger, steadier sea breezes, making it more efficient than onshore systems. With 80% of Americans living within 200 miles of the coast, offshore farms will be positioned near high-demand areas.

Offshore wind advantages:

- Higher wind speeds and consistency mean fewer turbines for the same output

- Located away from communities, reducing visual impact

- Oceans provide a vast space for large-scale projects

Offshore wind challenges:

- Higher construction and maintenance costs

- Complex repairs

- Limited local ownership

The wind energy market in the USA

The growth of renewables—including wind power—in the U.S. electricity mix has been propelled by declining costs and supportive policies such as the Inflation Reduction Act, which aims to target grid decarbonisation by 2050.

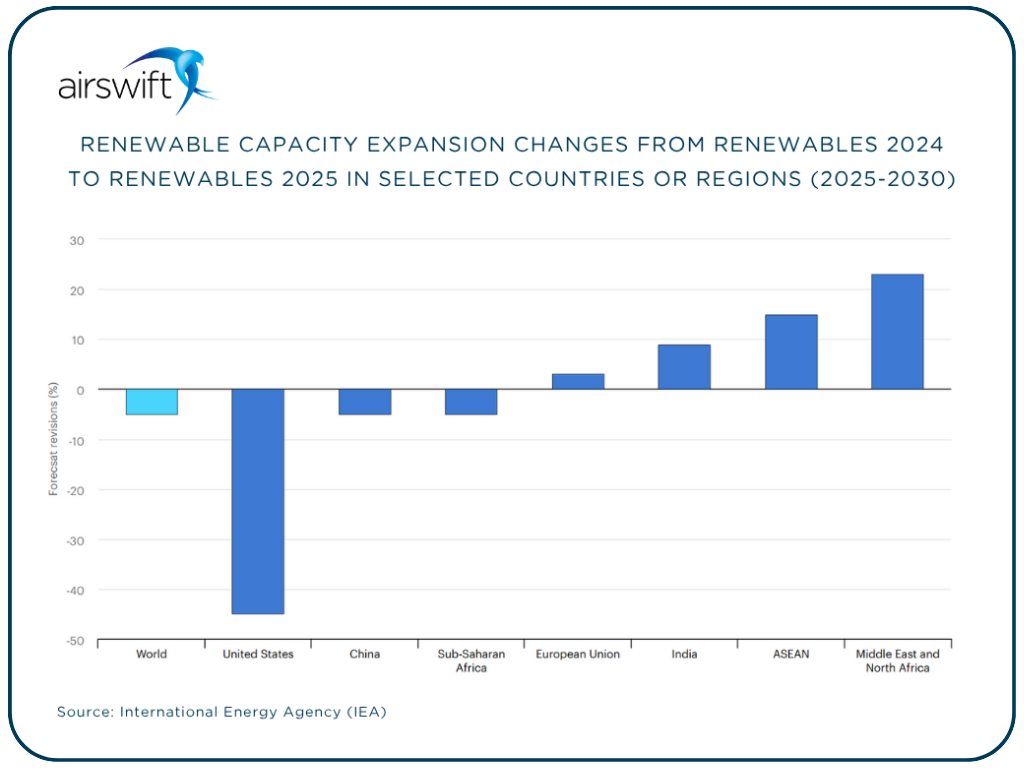

However, the International Energy Agency (IEA) has cut U.S. renewable capacity growth forecasts by 50% for 2025–2030, citing policy changes under the Trump administration. Key factors include the phase-out of federal tax credits, import restrictions, suspension of offshore wind leasing, and stricter permitting for wind and solar projects on federal land.

The U.S. onshore wind energy market grew rapidly from 2000 to 2023

Now the fourth-largest source of U.S. electricity, onshore wind has attracted $330 billion in investment over two decades, including $10 billion in 2023. But 2024 marked the slowest growth in a decade, with only 3.9 GW added.

Offshore wind energy market: small start, big potential

Still in its infancy, offshore wind has just 0.14 GW installed, including 0.1 GW added in 2024. The potential was huge: in 2023, the Department of Energy (DOE) announced a 110 GW target for 2050. Currently, 73 GW are in development across 40+ lease areas. However, political and economic scenarios are very different, and the pace is slowing down.

Five-years outlook predicts 40% decrease in the U.S. wind power gross additions

From 2025 to 2029, the U.S. Wind Energy Monitor projects 33 GW of new onshore capacity, 6.6 GW offshore, and 5.5 GW in repowers, a total of 45.1 GW. This number is down 40% from the previous forecast of 75.8 GW. Supply chain issues, inflation, and rising costs add further pressure to growth.

Wind energy jobs in demand in the USA

The onshore wind sector still employs over 131,000 Americans, including 20,000 manufacturing roles, and supports more than 300,000 jobs nationwide. However, growth has slowed, and future hiring may be impacted by policy uncertainty and project delays.

Offshore wind, once projected to support 56,000 jobs by 2030, is also facing challenges as permitting and investment hurdles create uncertainty.

Wind turbine technicians remain the fastest-growing occupation in the energy sector, with a projected 50% growth through 2034 and an average salary of $62,580 per year. These roles are critical for maintaining and repairing turbines, but technicians may need to pivot to related fields if offshore projects stall.

Five offshore wind projects in the U.S.

There are currently 17 offshore wind projects in the USA, with a total estimated value of $55 billion, set to begin within the next five years.

Here are five of them:

- Vineyard Offshore Wind Farm

- Revolution Offshore Wind Farm

- Coastal Virginia Offshore Wind (CVOW)

- Empire Wind I Offshore Wind Farm

- Sunrise Wind 1 Offshore Wind Farm

1. Vineyard Offshore Wind Farm

The first commercial-scale offshore wind project in the U.S., Vineyard Wind I sits 15 miles off the Massachusetts coast and is scheduled to begin operations in December 2026. Valued at $3.5 billion, it will deliver 800 MW of clean energy, enough to power 400,000 homes and businesses.

Operated by Vineyard Wind (a joint venture between Copenhagen Infrastructure Partners and Avangrid Renewables), the farm features 62 turbines rated at 13 MW each and will create over 1,000 union jobs.

2. Revolution Offshore Wind Farm

Revolution Offshore Wind Farm, the first multi-state offshore wind project in the U.S., spans Massachusetts and Rhode Island and is scheduled to start in 2026. It will generate total output of 704 MW, supplying 304 MW to Connecticut and 400 MW to Rhode Island.

Operated by Ørsted and Skyborn Renewables, the $700 million project includes 65 turbines (11 MW each) and two offshore substations, creating 2,000 direct jobs. After a brief stop-work order in August 2025, construction resumed in September following a federal court decision.

3. Coastal Virginia Offshore Wind (CVOW)

The largest offshore wind project in the U.S., CVOW is a $10.7 billion development located 35 km off Virginia Beach. Operated by Dominion Energy and Stonepeak Infrastructure, the 2.6 GW complex will be built in three phases of 880 MW each, with up to 176 turbines powering 660,000 homes.

Construction will support 900 jobs annually, with 1,100 jobs during operations. The project is expected to start in the last quarter of 2026.

4. Empire Wind I Offshore Wind Farm

Empire Wind I, valued at $3 billion, is an 810 MW offshore wind farm 24 km off Long Island, New York. Operated by Equinor, it will feature 54 turbines (15 MW each) and deliver clean energy directly to New York City, powering 500,000 homes.

In April 2025, construction was halted by government order before resuming in May. The first phase created 2,000 jobs, and a second phase will add 1,260 MW with 84 more turbines. The project is expected to start in 2027.

5. Sunrise Wind 1 Offshore Wind Farm

Sunrise Wind 1 is a 924 MW offshore project located in Massachusetts and Rhode Island, 30 miles east of Montauk Point. Operated by Ørsted, it will feature 84 turbines (11 MW each) and two converter substations, delivering clean energy to 600,000 homes.

Construction has already created 800 jobs, and operations are expected to start in the second half of 2027. The original plan aimed to expand the site to 2 GW, but phase 2 is currently on hold.

Five onshore wind projects in the U.S.

The United States has 126 onshore wind projects with total value of $69 billion estimated to start commissioning in the next five years. These include:

- Canisteo Wind Farm

- SunZia Wind Project

- Alle-Catt Wind Farm

- Mount Storm Wind Farm Repowering

- Chokecherry and Sierra Madre Wind Farm

1. Canisteo Wind Farm

Canisteo is a 250 MW onshore wind project in Steuben County, New York, valued at $550 million. It will include 90–130 turbines (2 MW each) and an interconnection facility with a 16 km transmission line. Construction will create 350 jobs, with 11 permanent roles for operations. The farm output will power 69,000 homes annually, and start is expected in early 2026.

2. SunZia Wind Project

SunZia is a 3.5 GW wind park under construction across Lincoln, Torrance, and San Miguel counties in New Mexico. Operated by Pattern Energy Group and valued at $3 billion, it will feature 916 turbines (3.6–4.5 MW each), supplying energy to 1 million homes.

Linked to the SunZia Transmission Project, it will create 2,000 construction jobs and 100 permanent positions. Operations are expected to begin in September 2026.

3. Alle-Catt Wind Farm

A 340 MW onshore wind project spanning 20,000 acres across Allegany, Cattaraugus, and Wyoming counties in New York. Operated by Invenergy, it will feature 76 turbines (4.5 MW each) and power about 134,000 homes annually.

Valued at $454 million, the project will create 11–13 permanent jobs. Operations are expected to start in the last quarter of 2026.

4. Mount Storm Wind Farm Repowering

Clearway Energy Group will upgrade the existing facility in West Virginia to 300 MW capacity, reducing the number of turbines from 132 to 78 (up to 4.3 MW each). Valued at $735 million, the onshore wind farm project includes a long-term PPA with Microsoft, 250 union construction jobs and extends current operations workforce for over 35 years. Operations are planned to start in the third quarter of 2027.

5. Chokecherry and Sierra Madre Wind Farm

This 1,500 MW project by Power Company of Wyoming will cover nearly 2,000 acres in Carbon County. Phase 1 includes 225 turbines (3 MW each), with a total of 500 turbines planned. The $1.3 billion project will employ 1,200 workers during peak construction and over 100 permanent staff, with operations planned to start in December 2027.How can Airswift help?

Airswift supports the global energy transition by connecting top staff to major renewable energy projects with our Talent Acquisition solutions. With 60+ offices worldwide, 1,000 employees, and 9,000 contractors, we provide skilled professionals for every stage of the project lifecycle, from engineering and fabrication to commissioning and operations.

If you need expert talent to drive your renewable energy initiatives, get in touch with us today.