Globally renowned oil and gas recruitment services

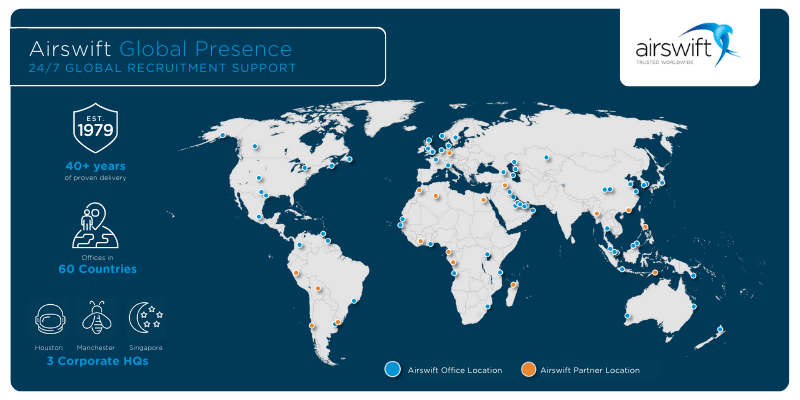

For over 40 years, Airswift has partnered with leading exploration and production companies within the oil and gas industry.

Our focus is on sourcing and providing the talent and services that deliver efficiency and innovation in safety-focused environments.

Airswift provides workforce solutions to onshore, offshore, natural gas, upstream, midstream and downstream clients in the energy sector.

Would you like to find out how Airswift can support your oil & gas project?

Why choose Airswift?

Airswift is the staffing agency of choice for world-leading businesses.

We manage 60 offices worldwide, 1,000 employees and 9,000 contractors. Our global reach and pool of available talent is unmatched in the industry.

Our connected infrastructure ensures unique project insights and agile talent acquisition. Whatever the project, we can help find and mobilise the best onshore and offshore talent.

Our Services in Oil & Gas

Talent Acquisition

We provide permanent recruitment and contractor management services for oil and gas companies.

Our talent acquisition offerings include:

- Retained search and headhunter services. Our dedicated recruiters work to find the best candidates for specialised roles within the oil and gas industry. By leveraging our industry expertise and extensive network, we identify the right candidates.

- Contingent staffing and contractor management. We provide our clients with the flexibility to scale their workforce up or down without the administrative burden of managing contractors. We take care of all the logistics, including payroll, compliance, and benefits, so that you can focus on your core business.

- Direct hire and permanent recruitment. For clients who need to fill a critical role within their organisation, our team work with you to understand your unique requirements and identify candidates who meet those criteria. We handle everything from sourcing and screening to negotiating offers and onboarding.

- Board and executive search. Find the best leaders for your organisation. We strive to understand your strategic goals, values and culture before identifying the right candidates.

Global Employment and Mobility

For enterprises in the oil and gas sector aiming to extend their footprint on a global scale, swift and precise talent acquisition is paramount for the success of international projects.

We deliver an extensive range of Global Employment and Mobility solutions, specifically tailored to support oil and gas companies in recruiting internationally and efficiently deploying their workforce across the globe.

Our services encompass global immigration and visa assistance, mobilisation and logistical support, relocation management, as well as payroll and taxation services, ensuring that your team is compliant, well-prepared, and ready to make an immediate impact, irrespective of the location of your oil and gas projects.

Moreover, our Global Employment Outsourcing (GEO) services present a flexible and economical option for oil and gas firms aiming to establish an international presence, all while significantly reducing administrative overhead.

RPO & Managed Solutions

Airswift offers a comprehensive suite of managed solutions for talent management.

Our suite of services spans the entire recruitment cycle, specially optimised for the oil and gas industry, including:

-

Supplier performance evaluation: We assist you in monitoring and evaluating your staffing suppliers' performance, aiming to bolster productivity, diminish compliance risks, and cut down on expenses.

-

On-site assistance: We guarantee that your oil and gas projects are appropriately staffed, ensuring that the right personnel are in place when you need them.

-

Transition management for contingent workers: We facilitate a smooth and efficient transition for incumbent contingent workers to new staffing arrangements.

Furthermore, we provide Recruitment Process Outsourcing (RPO) solutions, uniquely designed to streamline your hiring processes, offering a cost-efficient approach to staffing. Our RPO solutions address the challenges of high recruitment costs and time-consuming hiring processes by delivering a holistic staffing service that includes:

-

Talent sourcing: Utilising our extensive network, we identify and secure the most suitable candidates for your oil and gas projects.

-

Candidate screening: Our rigorous evaluation process ensures that only the most qualified and fitting candidates' profiles are forwarded to you.

-

Onboarding: We manage all facets of the onboarding journey, from conducting reference checks to handling necessary documentation.

-

Talent management: We provide continuous support and talent management services to ensure your staffing requirements are consistently met, optimizing workforce performance in the oil and gas sector.

Consulting

As a leading oil and gas employment company for four decades, Airswift truly understands energy labour markets.

Our consultancy services help oil & gas clients plan their talent pipeline.

Tackling the talent gap is one of the biggest challenges of the energy transition. As the world races to build a more sustainable future, the demand for skilled professionals is skyrocketing – but supply isn't keeping up.

Our vast network of qualified candidates spans the globe, with expertise in energy, construction, technology and engineering.

Through our industry-leading workforce consulting we can help you with :

- Talent mapping

- Salary and market rate benchmarking

- Identification and delivery of cost savings

- Skills assessment

- Strategic workforce planning

- Performance and risk management advice

Technical recruitment expertise guaranteed

Airswift delivers top-notch energy professionals, essential equipment, and premier services for necessary projects, ensuring compliance and cost-efficiency throughout. Safety is paramount; we ensure every team member is well-trained for safe field operations. Our local supervisors uphold excellent contractor relations, optimising operations across diverse sites, including:

- Onshore and Offshore Oil and Gas

- Refineries & Production Facilities

- Liquefied Natural Gas Production

- Pipelines

- Floating Production Storage and Offloading Vessels (FPSO)

- Fabrication Yards

Oil and gas disciplines we recruit for

- Chemicals

- Commissioning

- Construction

- Data Systems

- Design

- Drilling

- Engineering

- Facilities Management

- HSSE

- Land Management

- Logistics

- Plant Management

- Procurement

- Project Management

- Quality

- Terminal Management

- Turnaround/Shutdown

Testimonials

BP

Contractor

Chevron

Client

Oilsearch

Client

Project Highlights

Our team has collaborated with globally renowned oil and gas companies, assisting them in sourcing the exceptional talent necessary to foster innovation and propel expansion.

Here are some of the major projects we've been involved in:

- Airswift was appointed staffing provider for the duration of an FLNG project for a large supermajor within Asia Pacific. In addition to staffing, Airswift provided full mobilisation support and consulting services.

- Sole labour supplier to a West African LNG project. This included full global employment services for 250+ gas professionals in technical and non-technical disciplines.

- Largest provider of technical expertise to an LNG project in Asia Pacific. We opened a local office in Port Moresby to provide staffing, training workshops, global employment services and consulting support.

- Supplier of permanent, fixed-term and contract technical personnel for all phases of a global LNG project. This included engineering professionals in Australia, United Kingdom, South Korea, Malaysia and Thailand.

- Provided all safety, construction and engineering personnel to a multi-billion-dollar downstream project in Texas. The project is split into two parts, an ethylene cracker installation and a polyethylene expansion.

- Exclusively staffed contingent workers for three large Canadian pipeline projects over four years and onboarded pre-identified and recruited candidates.

- Delivered a fully compliant on-boarding process for 2,000+ workers and third-party contractors on a refinery mobilization project in Indiana. This resulted in an incident free transition with zero disruption to business and 100 percent transfer rate. There was $1.4m initial cost savings through rate benchmarking. Throughout the duration of the contract, the client made total savings of $4m.

- Supplied all contingent workers and managed all onboarding compliance requirements for a turnaround project in Texas. A team of 30 turnaround specialists was provided to effectively support the project resulting in $400,000 of savings.

Ichthys

The Ichthys project is one of the largest LNG projects, taking gas from the Ichthys Field in the Browse Basin offshore of Western Australia. Airswift has supported various clients throughout the project in Australia, Indonesia, Singapore and South Korea.

Airswift assembled a dedicated delivery team, consisting of a global account manager and discipline-specific recruitment consultants, who successfully completed all staffing and project requirements within target, which involved the construction, commissioning and start-up of the FPSO and CPF across two yards in South Korea. Our Service teams provided full global mobility services, including logistics, immigration, visa and work permit support, local payroll and destination services.

Kaombo FPSO

The Kaombo development is located off the coast of Angola and is the first project on ultra-deep offshore Block 32. In 2017, Airswift supported teams on the first FPSO vessel's voyage from Singapore and in Angola for the offshore hook-up and commissioning (HUC), providing recruitment, logistics, PPE, visa and work permits, verification of offshore certification, and 24/7 contractor support.

At peak, Airswift supported over 500 contractors for engineering, construction and commissioning across multiple global locations, including Singapore, Indonesia, Malaysia, Angola, Netherlands, France, Norway and the United Kingdom.

You may also be interested in these case studies

Case Study: Tyra Gas

Our client needed to identify a company who could serve as a "one-stop shop", providing Global Employment and Mobility across seven locations.

Case Study: Rovuma LNG

Airswift maximizes local content development through best in class recruitment services for our clients and major LNG projects in Mozambique.

Case Study: Angola LNG

Airswift supplied over 500 technical and 100 non-technical contractors for the Angola LNG processing facilities in Soyo, Angola.

Case Study: Aoka Mizu

Airswift delivered a full suite of Global Mobility services throughout the lifecycle of our client's project across the North Sea and United Arab Emirates.

The Global Energy Talent Index (GETI)

GETI is an annual energy employment trends report focused on oil and gas, renewables, power, nuclear and petrochemicals.

Current Vacancies

Contract

28 Feb 2024

Baku, Azerbaijan

As a Sales Engineer, you will be responsible for promotion and leading sales of ...

Contract

5 Apr 2024

Dar es Salaam, Tanzania

Vacancy Overview Senior Electrical Engineer – Tanzania Brief Job Overview ...

Contract

4 Mar 2024

Houma, Louisiana, United States

Our client, a major Oil and gas company, is looking for an Administrative ...

Contract

1 Mar 2024

Singapore , Singapore

Airswift is seeking to invite an experienced Commissioning Planner to consider ...

Contract

18 Mar 2024

Baku, Azerbaijan

Business Intelligence Analyst ( Nationals Only)

Qualifications & Experience: Education: Higher education degree in business ...

Contract

20 Mar 2024

La Défense, France

FPSO LEAD STATIC AND THERMAL EQUIPMENT ENGINEERING SERVICES

Job Opportunity: FPSO Lead Static and Thermal Equipment Engineer Location: ...

Contract

28 Mar 2024

Houston, Texas, United States

Airswift is looking for a Project Designer Coordinator to work in Houston, TX, ...

Contract

8 Apr 2024

Houston, Texas, United States

Our client, a major Oil & Gas company, is looking for a Project Engineer to ...

Contract

28 Feb 2024

Houston, Texas, United States

Vacancy Overview Lead I&C Engineer – Houston, TX Airswift is an ...

Related Blogs

The top energy industry employment trends for 2024

Airswift is proud to announce the launch of the eighth annual GETI report. Find out what to expect in the report, and how to download a copy.

Top oil and gas employment trends to look out for in 2024

What are the biggest oil and gas employment trends to look for in the coming year? Download the 2024 GETI report to find out.

Video call etiquette: Essential tips from recruitment experts

Discover the best professional video call etiquette tips from recruitment experts to improve communication within your organisation.

Solving the oil and gas skills gap amidst the great crew change

The O&G industry is facing a skills gap as experienced workers retire. Discover how companies are tackling that in the era of the great crew change