By

Diyaa Mani

September 20, 2024

Updated

October 29, 2024

Employment trends and job market analysis

Australia is an optimal destination for businesses that want to expand globally. With a predominantly English-speaking population, it has an open economy that ranks 12th in the world by GDP and strong trade links.

It also sits in close proximity to powerhouse markets in the Asia Pacific region and has a rich spread of natural resources such as timber, petroleum, and natural gas. All of this has historically attracted healthy foreign investment and is supported by a well-educated workforce population of 27,100,000.

Since 2020, the Australian mining industry has experienced interesting recruitment trends influenced by various factors such as technology, commodity prices, and project development fluctuations.

Strong demand is expected for professionals with expertise in coal (especially metallurgical coal), iron ore, gold, copper, and other hard rock commodities, particularly in remote locations. Leadership and specialised technical professionals are in short supply but highly sought after. The growing role of technology and innovation drives demand for professionals with a proven track record in implementing technology within the industry.

While there is a positive outlook for recruitment, staffing needs vary widely among organisations, with some seeking international candidates to fill skill shortages.

Our guide below provides a comprehensive overview for hiring employees in Australia.

| Capital | Canberra |

| Languages spoken | English |

| Population size | 27.10 million |

| Payroll frequency | Monthly and bi-monthly |

| Currency | Australian Dollar (AUD) |

| GST | 10% |

Taxes and payroll

Employer contributions

Payroll tax

Payroll tax in Australia is levied on the wages paid to employees in Australia by the employer. As it is not a federal tax, the pay rates and threshold amounts vary from state to state. The table below summarises the current pay rates and thresholds for all the states and territories within Australia:

|

STATE/TERRITORY |

THRESHOLD |

PAY RATE |

|---|---|---|

|

New South Wales |

AUD 1200,000 |

5.45% |

|

Victoria |

AUD 900,000 (from 1 July 2024) |

4.85% |

|

Queensland |

AUD 1,300,000 |

4.75% to 4.95% |

|

South Australia |

AUD 1,500,000 |

0 to 4.95% |

|

Western Australia |

AUD 1,000,000 |

5.5% to 6.5% |

|

Tasmania |

AUD 1,250,000 |

4% to 6.1% |

|

Australian Capital Territory |

AUD 2,000,000 |

6.85% |

|

Northern Territory |

AUD 1,500,000 |

5.5% |

An Employer of Record can help manage payroll tax compliance by calculating, withholding, and remitting payroll taxes to the appropriate state and territory authorities.

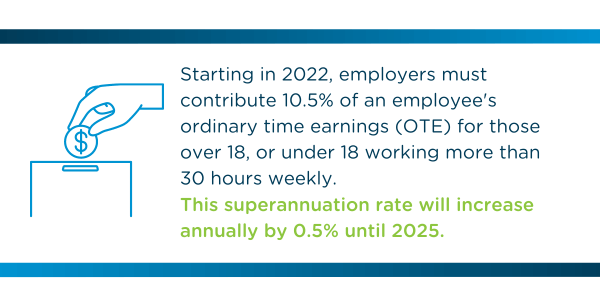

Superannuation

Superannuation (commonly called "Super") is a mandatory retirement savings system in Australia. Employers are required by law to contribute a percentage of an employee’s ordinary time earnings (OTE) into a Super fund. As of 2024, the contribution rate is 11%, meaning employers must set aside 11% of an employee's earnings for their Super.

Superannuation (commonly called "Super") is a mandatory retirement savings system in Australia. Employers are required by law to contribute a percentage of an employee’s ordinary time earnings (OTE) into a Super fund. As of 2024, the contribution rate is 11%, meaning employers must set aside 11% of an employee's earnings for their Super.

This applies to employees over 18, or those under 18 who work more than 30 hours per week.The contribution rate will increase by 0.5% each year until it reaches 12% by 2025. This system ensures employees build retirement savings throughout their working lives.

Also referred to as Super, this is s a retirement pension benefits fund for all employees in Australia. As of 2024, employers contribute 11% of an employee’s ordinary time earnings (OTE) if they are over 18 years of age or under 18 years of age but work more than 30 hours weekly. Superannuation is set to go up by 0.5% each year until 2025.

Employee taxes

Personal income tax

The amount of income tax paid by employees in Australia depends on how much they earn. For residents in Australia, the initial AUD 18,200 they earn is exempted from tax. Upon completing their tax file number (TFN) declaration, an employee can claim a tax-free threshold.

The amount of income tax paid by employees in Australia depends on how much they earn. For residents in Australia, the initial AUD 18,200 they earn is exempted from tax. Upon completing their tax file number (TFN) declaration, an employee can claim a tax-free threshold.

The table below illustrates the complete list of tax rates Australian residents must pay in AUD:

|

INCOME |

TAX RATE |

|---|---|

|

AUD18,200 and below |

Exempted |

|

AUD 18,201 to AUD 45,000 |

19 cents for each AUD 1 over AUD 45,000 |

|

AUD 45,001% to AUD 120,000 |

AUD 5,092 plus 32.5 cents for each AUD 1 over AUD 45,000 |

|

AUD 120,001 to AUD 180,000 |

AUD 29,667 plus 37 cents for each AUD 1 over AUD 120,000 |

|

AUD 180,001 and over |

AUD 51,667 plus 45 cents for each AUD 1 over AUD 180,000 |

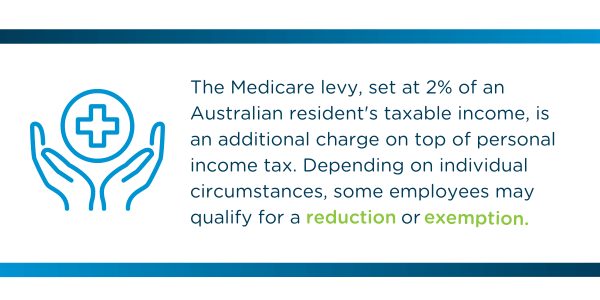

Medicare

Medicare is a national insurance scheme that provides free or subsidised healthcare for Australians. The Medicare levy consists of 2% of an Australian resident’s taxable income and must be paid in addition to their personal income tax. Some employees can get a reduction or exemption depending on their personal circumstances.

Medicare is a national insurance scheme that provides free or subsidised healthcare for Australians. The Medicare levy consists of 2% of an Australian resident’s taxable income and must be paid in addition to their personal income tax. Some employees can get a reduction or exemption depending on their personal circumstances.

Labor laws

Expanding a business to Australia requires a good understanding of the country's labour laws to ensure compliance and successful operations. Here are some key labor laws and regulations to be aware of:

Fair Work Act 2009

This is the primary legislation governing employment and workplace relations in Australia. It covers various aspects of employment, including minimum wage, working hours, leave entitlements, and unfair dismissal.

National Employment Standards (NES)

Part of the Fair Work Act, the NES sets out 10 minimum employment entitlements for most employees, including maximum weekly working hours, annual leave, personal/carer's leave, compassionate leave, public holidays, and more.

Employment contracts

Written employment contracts are essential and should clearly outline terms and conditions of employment, including job responsibilities, remuneration, working hours, leave entitlements, and notice periods for termination.

Unfair dismissal and termination

The Fair Work Act provides protection against unfair dismissal for eligible employees. Employers need to follow fair and valid procedures when terminating employees and must have a valid reason for the termination.

Anti-discrimination laws

Australia has strict laws against workplace discrimination based on factors such as race, gender, age, disability, sexual orientation, and more.

Health and safety

Employers have a legal obligation to provide a safe and healthy work environment for employees. The Work Health and Safety Act 2011 outlines the requirements for workplace health and safety.

Workplace bullying and harassment

Employers are responsible for preventing and addressing workplace bullying and harassment. Adequate policies and procedures must be in place to address such issues.

Enterprise agreements

Some businesses operate under enterprise agreements negotiated between employers and employees or their representatives. These agreements can set out terms and conditions of employment that might differ from the standard.

Minimum wage

The minimum wage in Australia is currently set at AUD 24.10 per hour (AUD 915.90 per week). This figure was revised on 1st July 2024. The average salary in Australia is AUD 68,900 and AUD 35.30 per hour.

Working hours

Employees can work a maximum of 38 hours in a work week, with working days typically lasting 8 hours. Time worked outside the spread of ordinary hours can attract overtime rates.

Employee benefits

Australia has one of the most comprehensive benefits schemes and therefore, there are many laws in place designed to uphold its integrity. Regulations tend to vary by state making it crucial for employers to understand both the federal and state laws that govern the location a company operates in.

Mandatory benefits

Apart from Medicare and Superannuation, Australian employees are also entitled to:

Workers’ compensation insurance

This is designed to protect workers during work-related injuries. Premiums make up a percentage of the employee’s pay and are based on factors such as claim history, industry, and remuneration. Employers are expected to purchase this form of insurance for employees in each state and territory in which they are based.

Flexible work

Under Australia’s Fair Work Act, some employees have a legal right to request for flexible work arrangements once they have provided an employer with a continuous 12 months of work.

Supplementary benefits

Offering employees benefits beyond the status quo shows that your company is invested in their well-being. Supplementary benefits should be designed to reflect the current state of your employees' needs and provide them with additional support for their everyday living expenses.

For example, the Australian Taxation Office (ATO) has recently made it possible for eligible employees to claim work from home expenses when filing their tax returns.

These deductions include:

- Electricity expenses on heating, cooling and lighting

- Decline in value of home office furnishings

- Cleaning

- Personal phone

- Internet

- Computer consumables and stationery

Some other common forms of supplementary benefits in Australia include:

- Group insurance

- Life and disability insurance

- Health insurance

- Childcare centres and subsidies

- Education advancement opportunities

- Employee assistance programs (EAPs)

- Commuter allowance

- Stock options

- Fitness centre memberships

Types of leave

Annual leave

Full-time employees in Australia are entitled to four weeks of paid annual leave per year. Shiftworkers can get up to five weeks of annual leave per year.

Public holidays

Public holidays in Australia vary by state, however Australians celebrate 7 national public holidays comprising of:

- New Year’s Day

- Australia Day

- Good Friday

- Easter Monday

- Anzac Day

- Christmas Day

- Boxing Day

Personal leave

Sick and carer’s leave come under the same entitlement in Australia. According to the National Employment Standards, the yearly entitlement is based on an employee's hours of work and is 10 days for full-time employees and pro-rata for part-time employees.

Sick leave is accumulated during each year of employment and begins from an employee's first day of work. It is based on their ordinary hours of work and any balance at the end of the year is carried forward to the next.

Sick and carer's leave accumulates when an employee is on:

- Paid leave such as annual leave and sick and carer's leave

- Community service leave including jury duty

- Long service leave

Sick and carer's leave doesn’t accumulate when the employee is on:

- Unpaid annual leave

- Unpaid sick or carer's leave

- Unpaid parental leave

- Unpaid family and domestic violence leave

Parental leave

Parental leave in Australia is provided by the Federal Government. Its entitlements include:

Parental leave in Australia is provided by the Federal Government. Its entitlements include:

- Maternity leave

- Paternity and partner leave

- Adoption leave

- Special maternity leave

- A safe job and no safe job leave

All employees are entitled to up to 12 months of unpaid parental leave. Employees who are the primary caregivers of a newborn or newly adopted child from the 1st of July 2024 can apply for 22 weeks of paid parental leave (PLP) by applying to Australia’s federal government parental leave pay scheme.

The PLP payment system is managed by Services Australia.

Compassionate and bereavement leave

Employees are entitled to up to two days of compassionate leaver at any time when:

- A member of their immediate family or household dies, or contracts or develops a life-threatening illness or injury

- A baby in their immediate family or household is stillborn

- They have a miscarriage

- Their current spouse or de facto partner has a miscarriage

Family and domestic violence leave

Full-time, part-time, and casual employees in Australia are entitled to 10 days of paid family and domestic violence leave per year. This entitlement comes from the National Employment Standards (NES).

Full-time, part-time, and casual employees in Australia are entitled to 10 days of paid family and domestic violence leave per year. This entitlement comes from the National Employment Standards (NES).

Long service leave

Long service leave is granted to employees who have provided a long period of continuous service to an employee.

Long service leave entitlement is determined by each state or territory’s jurisdiction that is centered around:

- How long an employee has to work to qualify for long service leave

- How much leave the employee receives

|

STATE/TERRITORY |

LONG SERVICE LEAVE ENTITLEMENTS |

|---|---|

|

New South Wales |

Employees are entitled to two months (8.6667 weeks) of long service leave upon completing 10 years of continuous service after the initial 10, employees are entitled to a further month of long service leave. |

|

Victoria |

Employees are entitled to an amount of long service leave on ordinary pay equal to 1/60th of the period of continuous employment after completing a minimum of 7 years’ continuous service with their employer. |

|

Queensland |

Employees are entitled to eight and two-thirds weeks of leave after a period of 10 years’ of continuous employment. Beyond 10 years, they are entitled to an additional 4.333 weeks of leave for each additional five years of continuous service. |

|

South Australia |

Employees are entitled to 12 weeks of long service leave upon 10 years of continuous employment. They are entitled to an additional 1.3 weeks of long service leave for each full year of service after the initial 10 years. |

|

Western Australia |

Employees are entitled to eight and two-thirds of leave after 10 years of continuous employment. They are entitled to an additional 1.3 weeks of long service leave for each full year of service after the initial 10 years. |

|

Tasmania |

Employees are entitled to eight and two-thirds weeks of long service leave upon the completion of 10 years of continuous service. They are entitled to four and one-third weeks for each additional five years of service after the initial 10 years. |

|

Australian Capital Territory |

Employees are entitled to just over six weeks of leave upon completion of seven years of continuous service. For each subsequent year of service, employees accrue a further one-fifth of a month of long service leave. |

|

Northern Territory |

Employees are entitled to 13 weeks of leave upon completion of 10 years of continuous employment. They are entitled to an extra 1.3 weeks of long service leave for each additional year of service following the initial 10 years which can only be taken after an additional five years’ service. |

Community service leave

An employee is eligible for community service leave while they are engaged in activities such as volunteer emergency management or jury duty. There is no limit on the amount of community service leave an employee can take.

A voluntary emergency management activity is described as any of the following:

- It involves dealing with an emergency or natural disaster

- The employee engages in the activity on a voluntary basis

- The employee was either requested to engage in an activity, or it would be reasonable to expect that such a request would have been made if circumstances had permitted, and

- The employee is a member of or has a member-like association with a recognised emergency management body.

Attracting talent

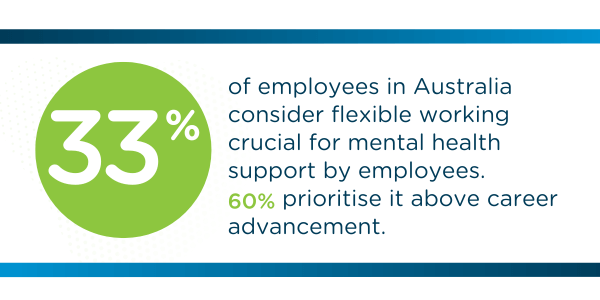

The pandemic forced employees around the world to reevaluate their perspective on work and for many, they realised that their jobs were depriving them of the work-life balance that work from home arrangements suddenly familiarised them with.

According to Lifeworks’ Mental Health Index, 33% of employees in Australia believe that flexible working is one of the most important things a company can do to support their mental health. 60% of the employees surveyed, even prioritise it over career progression.

To attract local talent in Australia, employees need to up their game and rethink their employee value proposition so that it reflects the needs of an evolving workforce. It’s time for organisations to act and provide their employees with experiences and resources that go beyond a transactional exchange.

Attractive remuneration and reward schemes

This includes salary and other financial incentives such as bonuses, extra allowances, and employee stock options. According to PWCs Future of Work survey, this ranked as the most desired EVP amongst Australian workers.

With more attention being paid to gender and race-related wage gaps in the workplace, there is a growing call for pay transparency in order to achieve pay equity. Now more than ever, it is important for companies to clearly communicate their compensation packages and ensure that what they’re offering is equally distributed and that variances are justifiable.

Wellbeing in the workplace

Employees today expect a lot more from the companies they work for and the ones that respond in kind will stand to retain and attract a happier, more committed workforce.

Now is the time for businesses to review their efforts in providing employees with the resources they need to prioritise their wellbeing. This includes enabling more flexibility surrounding how and where work is done, creating safe, judgement-free spaces for employees to speak openly, offering access to support systems and programs for mental health needs.

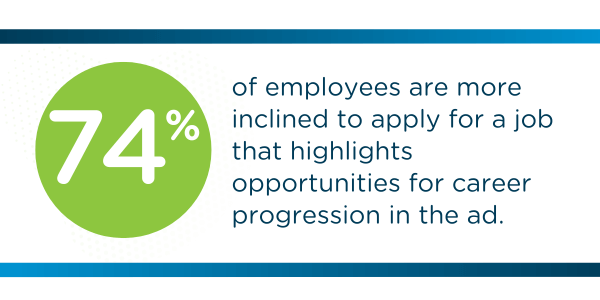

Personal and professional development

Creating opportunities and clear pathways for employees to grow in their career. 74% of employees say that they are more likely to apply to a job if the ad promotes career progression. It’s important for employees to feel that they have direction and a clear sense of where their job is taking them.

Creating opportunities and clear pathways for employees to grow in their career. 74% of employees say that they are more likely to apply to a job if the ad promotes career progression. It’s important for employees to feel that they have direction and a clear sense of where their job is taking them.

Companies that equip them with the resources to do so, such as mentorship programs, leadership training, and upskilling opportunities will be able to retain and draw in workers who are enthusiastic and goal oriented.

Employee rights

In addition to the key labour laws mentioned earlier, employees in Australia have various rights and entitlements that are protected under the Fair Work Act and other relevant legislation. Here are some important employee rights in Australia:

Protection against unfair dismissal

Eligible employees have the right to protection against unfair dismissal. Employers must have a valid reason for termination and follow a fair process.

Protection against workplace discrimination

Employees are protected against discrimination based on factors such as race, gender, age, disability, sexual orientation, and more. Discrimination can occur during recruitment, employment, and termination.

Minimum wage

As mentioned above, employees have the right to be paid at least the minimum wage as determined by the Fair Work Commission. This ensures that workers receive a fair wage for their work.

Working hours and breaks

Employees have the right to reasonable working hours and breaks during their shifts. The Fair Work Act sets out guidelines for maximum weekly working hours and rest breaks.

Superannuation

Employees have the right to employer contributions to their superannuation (retirement savings) fund. Employers are required to make regular superannuation contributions on behalf of their employees.

Access to fair work information

Employees have the right to access information about their rights and entitlements under the Fair Work Act, including through the Fair Work Ombudsman's resources.

Privacy

Employees have the right to privacy in the workplace, including the protection of their personal information.

Access to collective bargaining

Employees have the right to engage in collective bargaining through unions or other representative bodies to negotiate terms and conditions of employment.

It's important to note that these rights may vary based on an employee's specific circumstances, including their employment status (contract vs. permanent roles) and the terms outlined in their employment contract.

Hiring best practices

Hiring employees in Australia requires careful planning and adherence to legal and ethical standards. Here are some best practices to consider:

Understand employment laws

Familiarise yourself with Australia's employment laws, including the Fair Work Act, National Employment Standards, and industry-specific regulations. This knowledge will help you create fair and compliant employment contracts and practices.

Clear job descriptions

Develop clear and accurate job descriptions outlining the roles, responsibilities, and expectations for each position. This helps applicants understand the requirements and allows you to select candidates who best match your needs. These job postings can also help you to attract passive candidates who might not be actively looking for a new role, but are open to new opportunities.

Fair and transparent recruitment

Conduct a fair and transparent recruitment process. Advertise job vacancies widely, use objective criteria for shortlisting candidates, and ensure that your hiring decisions are based on merit. It's also important to conduct reference checks during the interview process to get a feel for the type of environment that candidates are used to working in.

Equal opportunity and diversity

Promote equal opportunity and diversity in your hiring process. Avoid any discriminatory practices and provide accommodations for candidates with disabilities or special needs.

Check visa and work rights

If hiring non-Australian citizens, ensure that they have the appropriate visa and work rights to be employed in the country.

Employment contracts

Provide written employment contracts to all employees, clearly outlining terms and conditions, including pay, working hours, leave entitlements, and notice periods. Make sure both parties understand and agree to the terms.

Minimum wage compliance

Ensure that your employees are paid at least the minimum wage set by the Fair Work Commission for their industry and position.

Fair remuneration

Offer competitive salaries and benefits that align with industry standards and reflect the responsibilities of the role.

Employee onboarding

Develop a comprehensive onboarding process for new employees. This should include introducing them to company policies, procedures, workplace culture, and their team.

Probation periods

Consider implementing a probation period for new hires. This allows both parties to assess whether the role and company are a good fit before making a long-term commitment.

Training and development

Provide opportunities for training and professional development. This can help improve employee skills and job satisfaction.

Health and safety

Prioritize workplace health and safety. Provide necessary training, equipment, and resources to ensure a safe working environment.

Employee engagement

Foster employee engagement by promoting open communication, recognising achievements, and involving employees in decision-making where appropriate.

Performance reviews

Conduct regular performance reviews to provide feedback, set goals, and address any concerns. This helps employees understand their progress and areas for improvement.

Flexible work options

Consider offering flexible work arrangements, such as remote work or flexible hours, to accommodate employees' needs and promote work-life balance.

By following these best practices, you can build a strong team of employees who contribute positively to your company's growth and success while maintaining compliance with Australian employment laws.

What does the ideal onboarding process look like?

When expanding your business to Australia and onboarding new employees, it's crucial to establish a thoughtful and comprehensive process that sets the tone for a positive work experience. The onboarding process should blend logistical orientation with cultural integration, ensuring that new hires are equipped to contribute effectively and feel a sense of belonging from day one.

Begin by creating a warm welcome for new employees. Arrange a personalised orientation session where you introduce them to the company's history, values, and mission. Highlight your company's achievements and goals to demonstrate your commitment to the local market.

Provide clear guidance on practical matters. Explain company policies, benefits, and expectations for performance and conduct. Offer written materials that detail important information, including employment contracts, code of conduct, and details about compensation, working hours, and leave policies. Ensure your new team members are familiar with health and safety procedures and understand their employee rights.

Introduce new hires to their teams and key colleagues. Foster connections through informal meet-and-greet sessions, team lunches, or virtual coffee breaks. Encourage open communication and provide mentorship to help new employees integrate smoothly into the company culture. Address any questions they may have, helping them feel valued and understood.

Offer training and resources that align with the employees' roles and responsibilities. Provide access to online learning platforms or specialised training sessions that empower them to excel in their positions.

Regularly check in with new employees during their initial months. Schedule follow-up meetings to gauge their progress, address any concerns, and provide additional support. This demonstrates your commitment to their growth and well-being within the organisation.

Termination of employment

Whether an employee chooses to leave a company or the employer decides to dismiss them, termination can occur for a variety of reasons.

Upon termination, the employee is typically expected to provide the employee with a written notice addressing their last day of employment (with some exceptions).

The notice can be given by:

- Delivering it in person to the employee

- Leaving it at the employee's last known address

- Sending it by pre-paid post to the employee’s last known address

- If the employee agrees, sending it electronically by email or text message

Alternatively, an employer can choose to let the employee work through their notice period, pay it out to them (known as pay in lieu of notice, or provide the employee with a combination of the two.

If the employer pays out the notice, they must pay the employee the full amount they would have received if they had worked through the notice period. This includes:

- Incentive-based payments and bonuses

- Loadings

- Monetary allowances

- Overtime

- Penalty rates

- Any other separately identifiable amounts

The employment period also will end on the date that payment in lieu of notice is made.

The employee will stay employed for any part of the notice period that isn't paid out.

Notice during probation periods

If employment is terminated during an employee's probation period, they are entitled to receive or be paid out notice based on their length of service.

Ending apprenticeships and traineeships

Terminating apprentice or trainee employees requires extra steps to end a contract. Employers must contact their state or territory training authority for information related to ending either of these.

Serious misconduct

The employer is not entitled to provide any termination notice if an employee is terminated due to serious misconduct. They must, however, pay the employee any outstanding entitlements such as annual leave and in some cases, long service leave. The latter depends on the state or territory laws that govern the entitlement.

Examples of serious misconduct include:

- Causing serious and imminent risk to the health and safety of another person or to the reputation or profits of their employer's business

- Theft, fraud, assault, sexual harassment

- Refusing to carry out a lawful and reasonable instruction that is part of the job

What are my options for hiring?

If you’ve got your sights set on remote hiring in Australia, a company like Airswift can help you get started. Our Employer of Record service is designed to ensure that you stay compliant across a range of local requirements including payroll, tax, working hours, and termination procedures.

Our in-country teams have the expertise needed to protect your business from unnecessary risk, freeing up headspace for you to focus on all the other exciting prospects of growing your business internationally.

To hire contractors and employees in Australia, some of the options you can explore with Airswift include:

Talent acquisition

Australia boasts a diverse and highly educated workforce, and our goal is to source and deliver the talent you need across a wide range of industries by leveraging our expertise and access to employee networks across the region.

Whether you’re looking to hire locally for an urgent project or need to cover a staffing shortage in your company, we believe that there is always a contractor for your business ‘needs. Our contract hire services are catered to businesses that need temporary hires to fulfil a variety of requirements.

For businesses with plans to hire candidates that can grow with the company, our professional search services give you access to highly skilled jobseekers that are ready to work. From shortlisting the candidates to screening and onboarding them, we take care of all the administrative processes for you.

Employer of record

Hire employees without setting up a local entity. Working with an Employer of Record in Australia lets you do this and get up and running in as little as 72 hours. Once your Australian employee has been greenlit, we take care of everything ranging from onboarding and benefits management, to tax filings and time off.

Although the information provided has been produced from sources believed to be reliable, Airswift makes no warranties, whether express or implied, regarding the accuracy, adequacy, completeness, legality, or reliability of any information herein. Accordingly, there shall be no liability attached to the use of the information herein, howsoever arising. For the latest information and specific queries regarding particular cases, please contact our team.